By Ashley Silver

Government Technology

(TNS)

Civic tech nonprofit Code for America is broadening its tax filing simplification process to two more states—eliminating filing fees for more than 700,000 residents.

Starting in January, residents of Maryland and North Carolina will be able to file their state taxes online for free using Code for America’s FileYourStateTaxes tool. Integrated with the IRS’s Direct File program, it expands on the federal service, which currently only offers no-cost filing for federal returns.

Maryland and North Carolina will join several other states participating in the online initiative, following the success of pilot programs in Arizona and New York. The IRS first introduced the Direct File program in early 2024 as a pilot across 12 states, offering taxpayers a way to submit their federal income tax returns directly to the government for free. Four states developed a personalized companion tool using the pilot, allowing their residents to file state returns. During the 2024 tax season, Code for America partnered with two of those four states—Arizona and New York—to implement FileYourStateTaxes.

Gabriel Zucker, program director of tax policy and partnerships at Code for America, emphasized the significance of expanding the FileYourStateTaxes resource to states like Maryland and North Carolina.

“With FileYourStateTaxes, we’re aiming to provide a seamless solution for states who may not otherwise have tech solutions available to join Direct File quickly, and we’re working to test and prove the Direct File model in a wide range of contexts—different kinds of tax codes, different geographies, different technical backgrounds and different political contexts,” Zucker said. “We’re hoping to announce additional partnerships soon so that we can serve taxpayers across the country, proving Direct File can work in any state.”

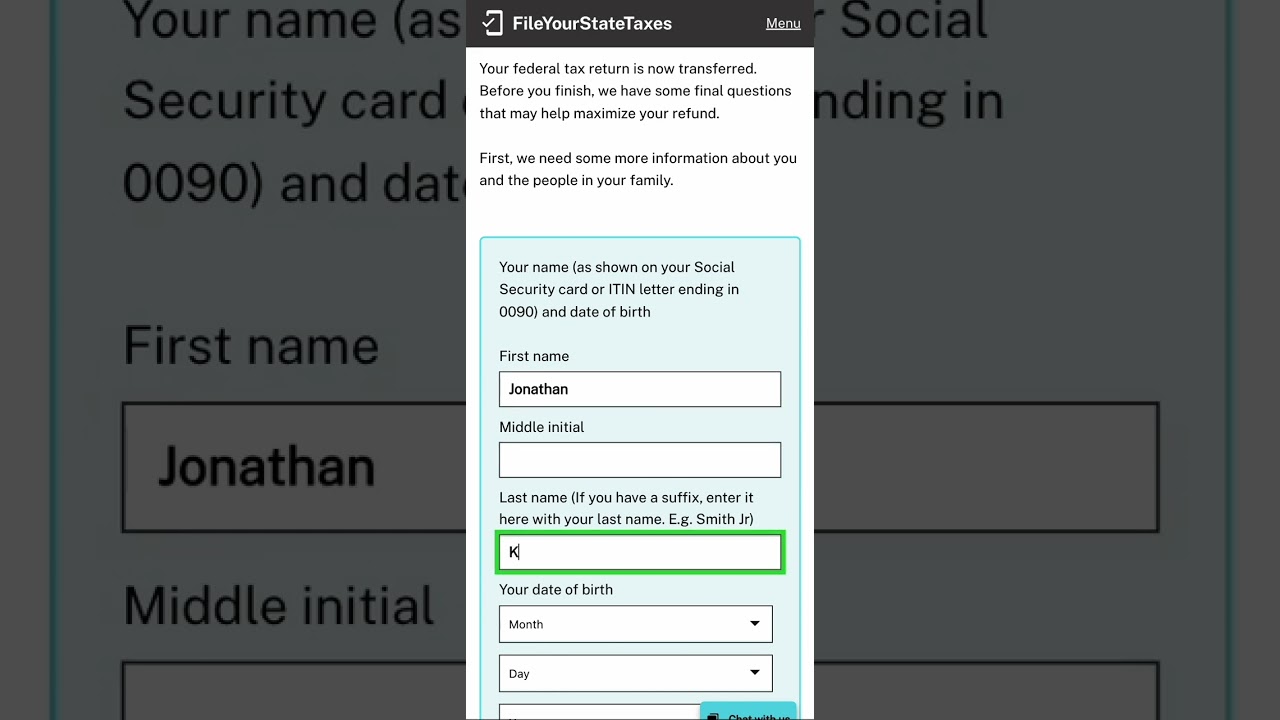

One of the key components of FileYourStateTaxes is its focus on the user experience. The tool virtually eliminates unnecessary steps for residents by pulling data directly from the IRS Direct File.

“In this system, we do everything we can with the data imported from Direct File to automate the vast majority of the state return behind the scenes, and we don’t show taxpayers any questions or information they don’t need to file the state return,” Zucker said. “We’re constantly on the lookout for any product choices that might trip up a taxpayer or unnecessarily slow them down and always looking for ways to make the product clearer.”

Code for America is making accessibility a priority with the system; and as with Direct File, the state tax filing tool offers support in English and Spanish, with live chat assistance available.

For Maryland, the partnership with Code for America is part of a broader modernization effort within its Office of the Comptroller. Brooke E. Lierman, the comptroller for the state, highlighted the importance of embracing a more comprehensive government process for tax filing.

“Our agency is in the midst of a once-in-a-generation modernization plan, and offering Direct File is a key part of that plan,” she said. “Simplifying the filing process with the addition of Direct File and our agency’s new Maryland Tax Connect system brings a new level of transparency by reducing costs and processing time associated with paper filings.”

Lierman said Code for America was a natural partner for building the tools needed to offer Direct File in Maryland, given its extensive experience creating similar platforms for other states during the 2024 Direct File pilot.

The FileYourStateTaxes initiative specifically aims to increase access to tax benefits for working families who have previously faced barriers to filing. In the absence of a free national online filing tool, Zucker said, many families have struggled to claim their benefits due to costly filing fees or complex tax requirements.

The new system being integrated into the current Direct File tool mends these issues, he said, by providing a front door for “tens of millions of families, helping them claim federal and state tax credits that they might otherwise miss.”

The nonprofit Economic Security Project estimates Direct File could deliver $355 million of value a year to Maryland, with a significant portion coming from unclaimed federal tax credits, according to the state comptroller’s office.

Code for America has incorporated feedback it has received on the e-file system; one example is the need for transparency on the data shared in the system. In response, the organization is working on updates to offer more insight for those interested in the finer details of their returns. Code for America is also interested in further simplifying the tax filing process in coming years by using IRS data to pre-populate tax forms. The success of this work could pave the way for future collaborations between civic tech organizations and government agencies.

“Direct File has succeeded by doing the basics right and following the standard civic tech playbook: Start small and iterate—don’t try to launch all of the tax programs in all states for all taxpayers at once,” Zucker said. “Stay ruthlessly focused on the needs of the user, use plain language, use industry-standard accessibility measures, and test the product with its intended user base.”

_______

(c)2024 Government Technology. Visit Government Technology at www.govtech.com. Distributed by Tribune Content Agency LLC.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs