A new report published Wednesday by the Association of Chartered Certified Accountants (ACCA) says accounting professionals are taking the lead in shaping artificial intelligence and data strategies across businesses.

Based on interviews and a survey of more than 900 accounting leaders who are already using AI, the report, The Smart Alliance: Accounting Expertise Meets Machine Intelligence, found 56% of practitioners said they had an advisory role in adopting AI, and 20% said they were the strategic owners.

The report revealed that business is investing in AI, with mid- to large-sized organizations committing the greatest sums to AI implementation over the most recent financial year. Among organizations with revenues exceeding $1 billion, more than one-quarter invested over $500,000 in AI projects in the past year alone.

“The survey revealed that three-quarters of all respondents are expecting to increase their AI investments in the coming year. This surge in commitment is not merely about keeping pace with technological trends; it reflects a growing recognition of AI’s potential to drive real business value in the accounting sphere,” Alistair Brisbourne, head of technology research at the ACCA who authored the report, said in a statement.

The findings confirm that AI is a tool to enhance the skills of accounting professionals rather than replace them, according to the report.

“The future of AI in accounting or auditing isn’t only about new technologies; it’s about reimagining the roles of finance professionals by focusing on analysis and interpretation, strategy, and high-level decision-making. It’s also part of the evolution of the finance function (and roles) toward becoming more value-adding and autonomous,” the ACCA report states.

Fundamentally, AI is a data transformation, the report says. “AI is essentially about leveraging data in innovative and powerful ways to enhance decision-making and streamline processes” through the application of tools such as machine learning, computer vision, natural language processing, and generative AI.

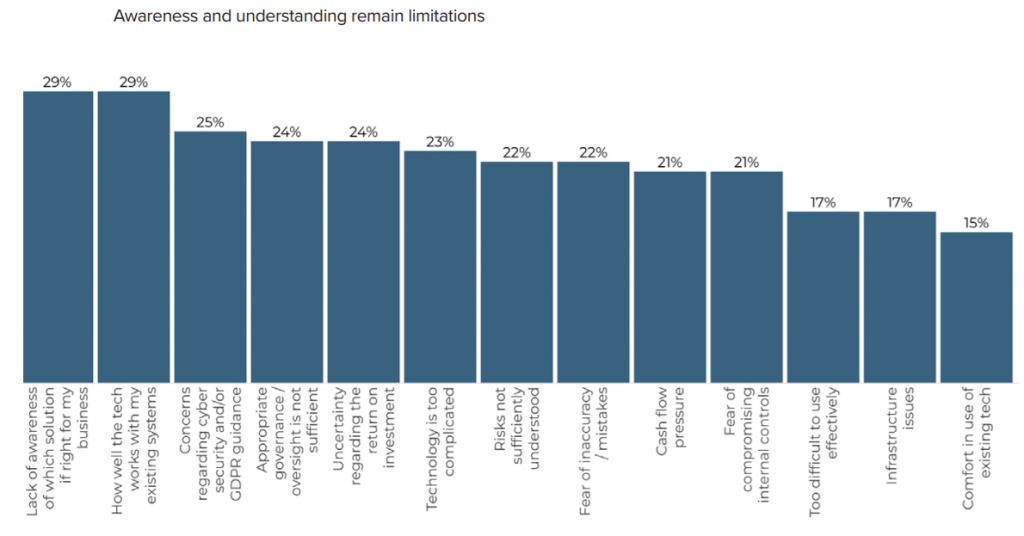

The report provides insights into strategic approaches, challenges, the risks—including ethical questions—and the outlook for AI in the profession. The survey reveals a widespread acceptance that the finance function can be improved by AI, contradicting the stereotype of a conservative profession.

However, the survey also found AI adoption is not uniform: more than 40% of large firms are using AI for data analysis and reporting, but fewer than 30% of sole practitioners and small or medium-sized practices have done so.

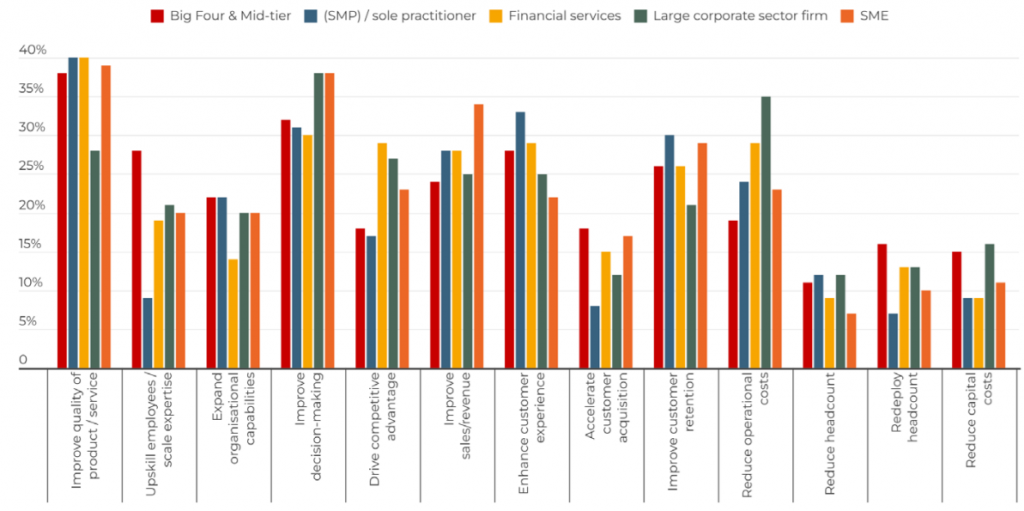

The survey also reveals different sectors are focusing on different uses with organizations pursuing several outcomes through AI initiatives, including improving the quality of products and services, boosting efficiency of existing processes, upskilling employees, expanding organizational capabilities, enhancing decision-making, driving competitive advantage, and reducing operational costs.

As data becomes central to organizational success, accounting professionals are well-placed to foster cross-functional collaboration, bridge the gap between organizational strategy and day-to-day operations, and ensure AI initiatives align with business objectives, the report says.

“The future of AI in accounting appears both exciting and transformative,” Brisbourne said. “Our survey data, coupled with insights from industry leaders, paints a picture of a profession on the cusp of significant change—driven by advancing AI technologies and evolving business needs.”

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs