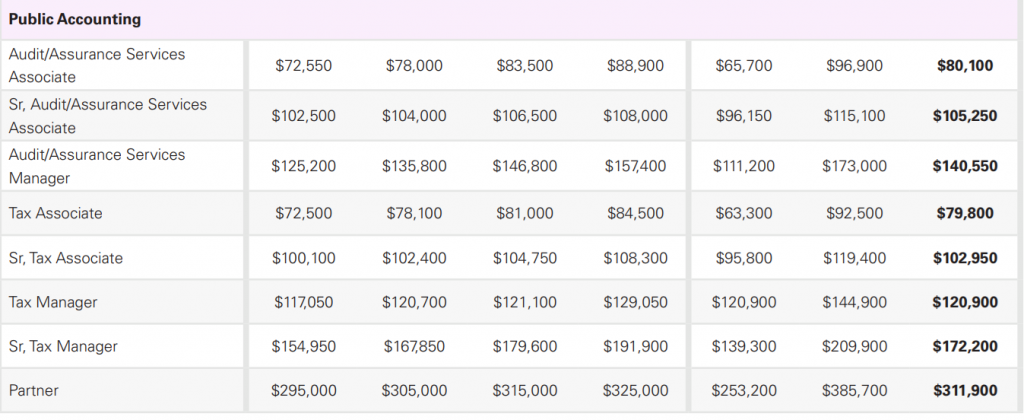

Average public accounting salaries in audit/assurance are expected to range from $80,000 for an associate to $140,550 for a manager in 2025, while the average salaries for roles in tax are projected to range from $79,800 for an associate to $172,200 for a senior manager next year, according to LHH Recruitment Solutions.

The global talent solutions provider recently released its 2025 Salary Guide, which includes pay expectations for a variety of positions in accounting and finance.

Looking at wage data across all industries for next year, LHH called the economic recovery since the COVID-19 recession “quite historic” and real wages—wages adjusted for cost of living—are higher than before the pandemic and increasing at a rate similar to pre-pandemic growth.

But it’s not all sunshine and rainbows: “While the numbers may look great on paper, they don’t necessarily translate to how people feel about the job market, wage growth, and the economy as a whole,” LHH says. “In fact, despite a mostly slow and steady recovery, a new economic phenomenon has emerged: the ‘vibecession.’ In a ‘vibecession,’ despite positive indicators, people may still feel pessimistic.”

While the vibes about the economy and job market might not be real positive for some professionals right now, the silver lining is base salary expectations for public accounting roles in 2025 look to be higher than in LHH’s outlook for 2024.

Unlike last year when LHH provided salary data for 11 public accounting roles in three categories based on experience (low, medium, high), this year the staffing firm provided projected base salary ranges for eight positions by firm size (small, medium, large, enterprise), as well as minimum, maximum, and average base salaries. (Average base salaries are in bold.)

Here are LHH’s salary prognostications for public accounting next year:

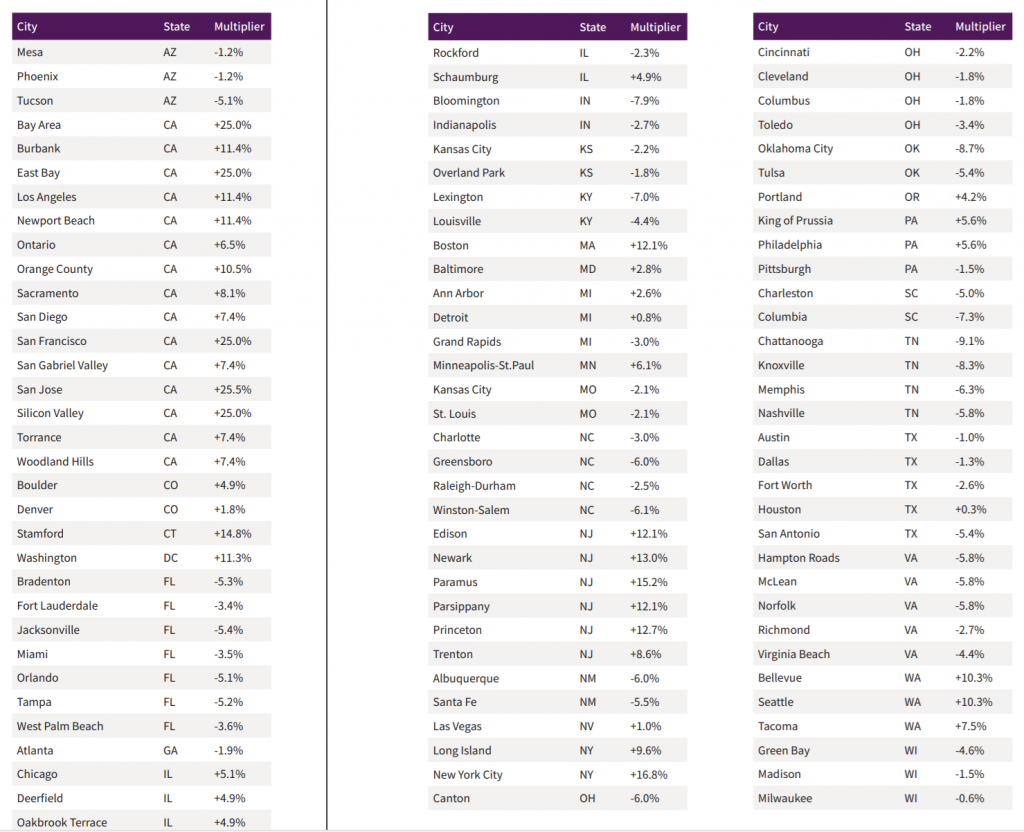

The salaries presented in this guide are based on national averages, but each market is different. In the salary guide, LHH provided variances for key markets throughout the U.S. so accounting professionals can calculate the most accurate salary ranges for their specific job market.

Here is the formula to calculate local salaries:

National Salary x (100% + Local Multiplier) = Market-Specific Salary

According to LHH, digital transformation is creating opportunities for accountants with certain skills and threats for others. Fifty-six percent of accountants surveyed in LHH’s “Global Workforce of the Future” report said their roles are at risk of disruption by digitization, automation, and artificial intelligence. However, 62% of those same professionals in accounting said they are relatively confident their current skills are transferable to other roles within their profession, and another 57% said their current skills are transferable to other industries.

“For those ambitious accountants and bookkeepers and their employers, we recommend a heavy focus on reskilling and upskilling opportunities,” LHH says. “Even with the prevalence of automation in the field, these professionals will need to provide oversight for new technologies, as well as analysis of ever-expanding quantities of data for better business insights.”

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Accounting, Firm Management, Human Resources, Payroll, Staffing