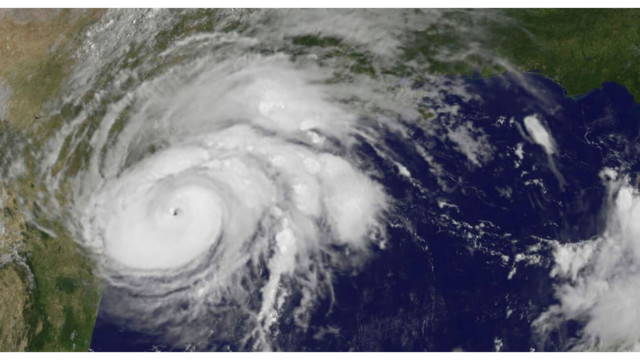

As residents across the southeast continue to pull their lives back together following the devastating destruction of Hurricanes Helene and Milton, the personal financial planning experts at the American Institute of CPAs are offering tips to help with financial well-being and planning for the future.

“Victims have a lot of things to sort through following a major disaster, including getting their financial house in order,” says Dan Snyder, director, Public Accounting (Personal Financial Planning) for the AICPA. “Those affected by recent hurricanes should explore and take advantage of any sources of benefit they can to help them on the road to recovery.”

Sources of cash in a disaster

- Research special disaster relief funds. These may be available from federal, state and local governments and are generally income-tax free.

- Consider using your savings and then, possibly a line of credit as a cash option – these are the most accessible.

- Talk to your homeowner’s insurance agent – you may be able to get an advance to any claims you file.

- If you receive your Social Security payments via a physical check and have not received your regularly scheduled payment because of severe weather, call your local Social Security Field office.

- Consider cashing out an insurance policy. A whole life or universal life insurance policy might have a cash value you can withdraw or use to get a loan from the insurance company (term insurance has no cash value). Keep in mind that the insurance company may charge you a fee. A portion of the cash value may be taxable if the amount received is a partial surrender of the policy and is greater than the cumulative premiums paid.

- If you have an emergency savings account with your employer, reach out to your employer to request a distribution.

- Consider tapping into a retirement fund. Ask your employer about the rules for borrowing against your plan. Keep in mind that if a disaster leaves you disabled, you can withdraw money from the retirement plan without penalty, but you will have to pay income tax.

- You also may be able to borrow up to 50 percent of your retirement plan assets up to $50,000. You will have to pay it back, but won’t pay taxes if it is fully repaid. While these are the general guidelines, these rules can differ with each plan.

- For federal disaster areas declared after January 25, 2021, participants can withdraw up to $22,000 without at 10% early withdrawal penalty and may repay such withdrawal within three years to avoid income tax. In addition, such participants can take a loan from a defined contribution plan up to the lesser of $100,000 or 100% of the balance and can delay repayment for one year.

- Read more about the implication of taking a loan from your retirement plan here.

Money Management

- Gather a list of your financial accounts, account numbers and contact information for each company.

- Call the businesses to which you owe money. Ask for their help in working out a manageable repayment plan. It may be hard to make these calls, but most creditors will work with you, especially when you are heavily impacted in a disaster area.

- Consider using a debt counselor. You may benefit from a not-for-profit debt counseling service, such as Consumer Credit Counseling Service (CCCS). Call 800.388.2227 or visit the National Foundation for Credit Counseling website at nfcc.org.

- Consider bankruptcy only as a last resort. If you find yourself in this situation, call a lawyer or legal aid clinic before acting.

Documenting Lost Items Checklist

- If you do not have an accurate home inventory, you will need to create one.

- Estimate the fair market value of damaged or destroyed items. Search online for item values. Determine the current value of vehicles. Consult a car dealer or search online.

- Get a copy of the escrow papers for your home. Consult your real estate agent, title company, escrow company or the bank that handled the purchase or refinance.

- Determine the value of any home improvements you’ve made. Contact lenders or contractors to get estimates.

- File Form 4506, “Request for Copy or Transcript of Tax Form,” with the IRS. Obtain previous federal income tax returns (a small fee may be charged for this service). If someone else prepared your tax returns, contact that person to request copies.

Filing an Insurance Claim

- Plan to file a claim even if your home or property is not covered for the type of disaster that occurred – consequential damages may be covered.

- Save receipts for additional living expenses. Many homeowners’ policies cover additional living expenses such as housing and food costs, temporary residence, additional costs for transportation to and from work and school, and storage expenses.

- Make temporary repairs that are “reasonable and necessary” (if it is safe to do so). For example, cover holes in the roof, walls, doors and windows with plastic or boards to help prevent further weather-related damage.

- Save receipts for any materials purchased. These are reimbursable when confirmed that they are reasonable and necessary.

- Make an accurate list of the damage. Check your damages list against any inventory you may have made before the disaster occurred or make a pre-disaster inventory from memory. If you are unsure of the market value of damaged property, look online. If possible, photograph or video record the damage. Surviving photographs or videos taken in and around your home also may help.

- Collect all available receipts, canceled checks, credit card statements and invoices. Use these to prove the value of lost possessions, including big-ticket items. Request archived copies of monthly statements from your bank and credit card providers to help remember purchases. File claims as quickly as possible.

Hiring a contractor

- Get estimates from several licensed, bonded, reputable contractors.

- Make periodic payments. For example, pay 20 percent down to start work, and make additional payments as work progresses.

- Don’t make a final payment until the job is finished to your satisfaction.

Consumer Fraud · Federal Bureau of Investigation website · Securities and Exchange Commission (SEC) website· Financial Industry Regulatory Authority Inc. (FINRA) website· Consumer Financial Protection Bureau website · Online state and county databases, as well as the Better Business Bureau (bbb.org), are also good places to start.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs