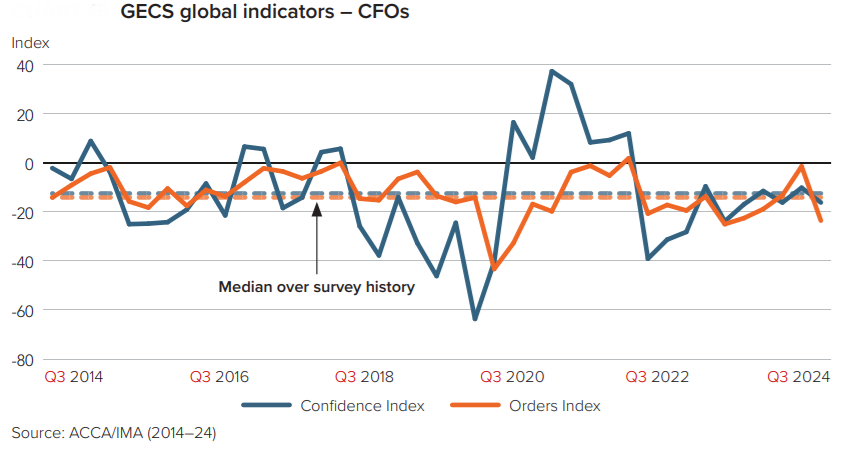

Confidence in the global economy among accountants and finance professionals declined moderately in the third quarter and is now at its lowest since Q4 2023 and slightly below its historical average, according to the latest Global Economic Conditions Survey from the Association of Chartered Certified Accountants (ACCA) and the Institute of Management Accountants (IMA).

In addition, CFOs’ confidence also fell, and in particular, there was a sharp deterioration in their assessment of new orders.

“The global economy has been quite resilient so far in 2024, but the latest survey of accountants points to some easing in growth at the current juncture,” the ACCA/IMA survey report says. “On a positive note, the increased policy stimulus should boost the Chinese economy over the coming months and quarters, and the move to rate cuts by the U.S. Federal Reserve, and many other central banks, will increasingly support global activity. That said, geopolitical risks are very elevated, with the conflict in the Middle East escalating. In addition to potentially weighing on confidence, any further spike in oil prices would clearly be problematic for central banks and consumers. Meanwhile, significant uncertainty about the upcoming U.S. election could increase corporate caution.”

According to the survey, confidence improved in North America, although it recouped less than half of its previous fall. By contrast, there was a marked decline in confidence in Asia Pacific. Concerns about the continued weakness of the Chinese economy likely weighed on sentiment, with the survey being completed before the authorities announced a pivot to a more aggressive policy stimulus. Confidence also fell quite a bit in Western Europe, driven by a sharp decline in U.K. confidence, amid concerns about tax rises in the upcoming budget.

The proportion of respondents reporting increased operating costs remains elevated by historical standards in most regions, suggesting central banks need to proceed quite cautiously with monetary easing, particularly given ongoing geopolitical developments, the survey report says. On an encouraging note, the share of global respondents reporting problems accessing finance moved lower again amid policy easing by central banks.

The survey also asked accountants to rank their top three risk priorities, and for the second quarter running, regulatory change was top for respondents in financial services, while the economy remained first for those in the corporate sector. Both public-sector entities and small and medium-sized practices put cybersecurity as their biggest concern. But for the first time, climate change claimed a top three spot, with the public sector placing it third. Another first-ever was by region, with Western Europe ranking talent scarcity and retention first.

“While the increase in confidence in North America is welcome, the key indicators are consistent with some slowing in the U.S. economy and significant caution on behalf of businesses,” Alain Mulder, senior director of Europe operations and global special projects at IMA, said in a statement. “But with the job market showing resilience and the Federal Reserve beginning its rate-cutting cycle, the most likely scenario for the U.S. economy still looks to be a soft landing.”

Fieldwork for the 2024 Q3 survey took place between Sept. 3 and Sept. 19, gathering 697 responses: 476 from ACCA members and 221 from IMA members.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs