By Ryan Vlastelica

Bloomberg News

(TNS)

Intuit Inc. and H&R Block Inc. shares fell on Tuesday, after the Washington Post reported that the leaders of President-elect Donald Trump’s “Department of Government Efficiency” discussed creating a new way for Americans to file their taxes.

H&R Block fell as much as 8.7%, dropping to its lowest since August, while Intuit slid as much as 6.8%, erasing much of an advance that had come in the wake of the election.

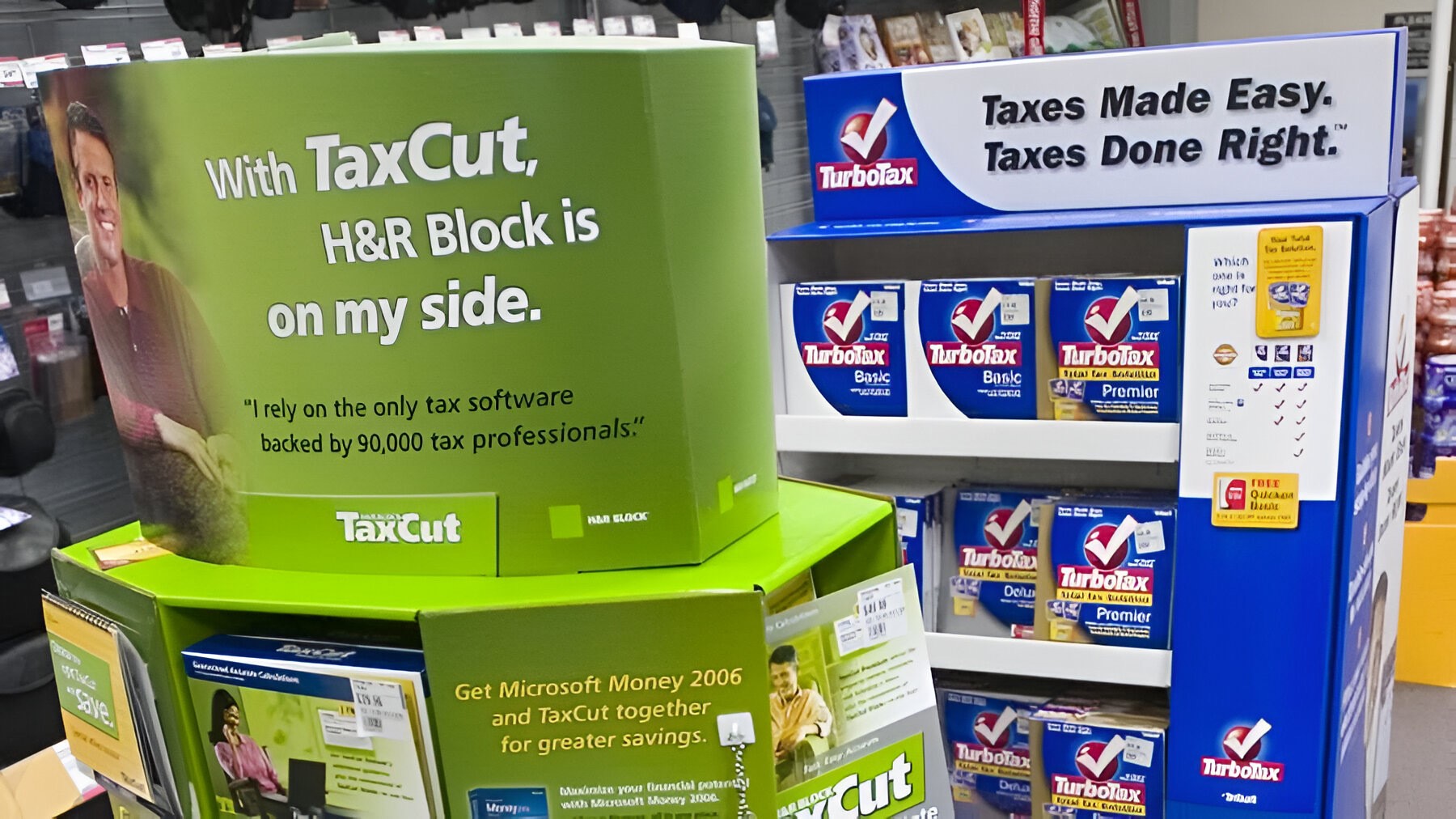

Intuit, the maker of TurboTax, and H&R Block dominate the US tax preparation industry, earning billions of dollars a year providing digital and in-person services. The DOGE discussions follow the rollout of a pilot program from the IRS for taxpayers to file their returns for free online as part of the Biden administration’s Inflation Reduction Act.

Jefferies wrote that the selloff in Intuit was “unwarranted,” as an app is “unlikely to be a high priority in a long list of initiatives” to reduce government waste, while the IRS pilot program “had little success.”

However, KeyBanc Capital Markets wrote that given investor debate around growth in Intuit’s consumer segment, such headlines would continue to weigh on the stock.

The Washington Post report, which cited people familiar with the conversations, said that a “DOGE” panel discussed creating a mobile app for Americans to file their taxes for free. A post from “DOGE” said that the tax code had gotten too complex and “must be simplified.”

Separately, Bloomberg Intelligence wrote that an IRS entry into the tax-prep industry “could, in theory, threaten revenue for H&R Block, Jackson Hewitt and Intuit,” with almost a third of Intuit’s sales at risk. However, analyst Andrew Silverman believes the “Direct File” tool “won’t successfully compete,” as the IRS “can’t devote the resources to it and is ill-equipped to create or maintain the software necessary to appeal to taxpayers.”

_______

©2024 Bloomberg L.P. Visit bloomberg.com. Distributed by Tribune Content Agency LLC.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs