Intuit, the financial technology platform that makes Intuit TurboTax, Credit Karma, QuickBooks, and Mailchimp, has launched Intuit Assist for QuickBooks, a generative AI (GenAI)-powered financial assistant that transforms how businesses run and grow their business.

Available to QuickBooks Online customers in the U.S., Intuit Assist is delivering seamless, connected ‘done-for-you’ experiences, enabled by AI with access to AI-powered human experts. Intuit’s AI-driven expert platform is embedded in the company’s products, including QuickBooks, TurboTax, Credit Karma, and Mailchimp.

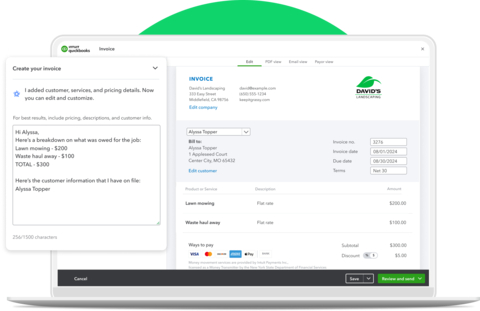

Intuit Assist is bringing these experiences to life by delivering personalized, intelligent recommendations and streamlined tools to help small and mid-market businesses generate estimates, invoices, bills, and payment reminders at the click of a button. These accounting transactions are done for them, all without the need to manually enter data or do the work. These features, coupled with powerful and actionable insights, allow business owners to stay in control while reducing the amount of work needed to get paid and convert prospects, giving them the confidence to make smart financial decisions to grow their business, all on one platform.

“With Intuit Assist, customers can leverage connected tools and services to manage and keep a business growing. It’s a game changer that empowers business owners to work like they have a larger team behind them, with a holistic view of their business,” said Dave Talach, Senior Vice President, Product, Intuit QuickBooks. “These AI-powered automations, coupled with our trusted experts and key solutions across Intuit’s platform, provide done-for-you experiences that will help customers grow their business while dramatically reducing manual work.”

Most small businesses spend time manually entering data, creating estimates and invoices, and paying bills, often lacking a connected solution that can do it all in one place. On average, businesses use 10 different digital solutions to manage their operations, and because they aren’t connected, business owners waste time transferring data from one app to another, without a simple way to see a holistic view of their business on a single platform. Intuit Assist helps tackle these challenges, providing a connected, intuitive solution that gives them a clear, up-to-date picture of their finances. Intuit Assist allows customers to delegate daily administrative tasks like creating invoices and estimates and auto-matching expenses, freeing up time to focus on other tasks like driving growth. Intuit Assist also helps accomplish one of the most important goals for growing businesses — getting paid faster — with AI-generated invoice reminders for overdue invoices helping businesses get paid 45% faster, an average of 5 days sooner.1

Kim Cross, owner of Zhi Bath & Body and an Intuit Assist for QuickBooks beta customer, says Intuit Assist is saving her valuable time so she can focus on her core mission. “I got into business because I wanted to help people with sensitive skin get access to the products that would help them love their skin naturally. But I found that I was spending the majority of my time doing manual, administrative tasks that didn’t allow me to do what I got in business to do — help people, develop new products, and find new ways to grow,” she said. “When I started using QuickBooks Online, I loved how it automatically generated reports for me and helped me track my goals and growth, but the addition of Intuit Assist has truly made an impact on the time and effort I have to spend completing manual tasks like creating estimates and invoices. I have a note-taking process I do to help with customer invoicing in QuickBooks, but now that workflow is significantly more streamlined thanks to Intuit Assist. Just last week, I was able to take a photo of notes from a meeting with a potential client, which Intuit Assist then translated into an estimate that I reviewed quickly and sent off for approval. It was so easy and with a click of a button, I was able to translate that estimate into a sale.”

From the QuickBooks home page, customers can access a new Business Feed offering a dynamic and proactive view of their business, highlighting the work that Intuit Assist has done for them to review. From auto-generated invoices and reminders to spotting potential cash flow shortages in real-time with suggested actions, customers can stay on top of their finances and gain better insights to make informed decisions. Customers can leverage the power of Intuit Assist to:

- Turn conversations and documents into estimates, invoices or bills: Business owners communicate with their customers and capture updates in various places — from email, to electronic documents to notes on paper. Intuit Assist can automatically turn these conversations into estimates or invoices, eliminating much of the manual work. By simply forwarding an email from a customer or uploading a photo of a handwritten note or document in the QuickBooks app, Intuit Assist can auto-generate an estimate or invoice for business owners to easily review, send, and close deals with clients faster. Similarly, with the Intuit Assist powered email-to-bill feature, business owners can forward emails, drag and drop files, or scan a QR code to upload images, and Intuit Assist will enter the details into a bill form so they can schedule payment and ensure bills are always paid on time.

- Generate invoice reminders for a faster way to more money: Overdue invoices are 10% more likely to be paid in full with Intuit Assist, as it detects past due invoices and automatically drafts personalized invoice reminders.2 These messages are uniquely generated based on the client history and invoice status, to ensure the reminder has the right tone based on each situation, allowing the business owner to simply review, send, and get paid an average of 5 days sooner.

- Seamlessly move from getting paid to automating books, with accuracy: Intuit Assist does the work of extracting details from receipts and auto-populating them in QuickBooks by expense category, payment account, and vendor, making the receipt capture tool even more seamless. Additionally, Intuit Assist can automatically match transactions made through other products across the QuickBooks ecosystem, such as invoices paid using QuickBooks Payments or bills paid via QuickBooks Bill Pay, to the corresponding bank transaction to help customers be confident in the accuracy of their books with minimal oversight.

- Connect with an expert**: Intuit Assist helps to streamline the setup process for customers who are new to QuickBooks, showing them how to connect with a live human expert who can walk them through the platform and help customize it for their business needs. These live experts can also help customers to personalize their Chart of Accounts and guide them through monthly categorization, providing further bookkeeping guidance to ensure they’re set up for success.

Intuit Assist for QuickBooks Online is now available to customers in the U.S. online on web desktop and mobile web.

How Intuit is harnessing the power of data and AI for customers

For more than a decade, Intuit’s robust data and AI capabilities have been foundational to the company’s success as a fintech industry leader and technology innovator. Introduced in September 2023, Intuit Assist — our generative AI-powered assistant — provides personalized, intelligent recommendations that help customers make smart financial decisions with less work and complete confidence. Built with Intuit’s proprietary GenOS, Intuit Assist is embedded across our platform and products — including Intuit TurboTax, Credit Karma, QuickBooks, and Mailchimp — delivering new benefits in all-new ways to improve customers’ financial lives.

Also developed using its proprietary GenOS, Intuit’s new agentic AI systems will do the hard work on behalf of consumers and businesses, complemented by personalized AI-driven insights and recommendations, with a seamless path to AI-powered human tax and bookkeeping experts whenever needed. Intuit is bringing together the best of human expertise and the company’s AI capabilities to accelerate delivery of agentic AI experiences across its AI-driven expert platform.

A strong commitment to responsible AI and data stewardship

Intuit’s AI-driven expert platform and products are built in keeping with the company’s commitment to data privacy, security, and responsible AI governance. Intuit safeguards customer data and protects privacy using industry-leading technology and practices, and adheres to responsible AI principles that guide how the company operates and scales its AI-driven expert platform with its customers’ best interests in mind. Intuit is also a member of the U.S. Artificial Intelligence Safety Institute Consortium, established by the National Institute of Standards and Technology (NIST).

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs