By Richard Corn, CPA.

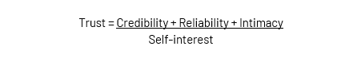

The ‘trust equation,’ outlined in The Trusted Advisor by David Maister, Charles Green, and Robert Galford, is a formula that quantifies trust in professional relationships: take a person’s credibility, reliability, and intimacy and divides it by their self-interest.

This can be applied to multiple industries, including accounting. The Accountant Trust Quotient represents a unique and irreplaceable aspect of the client-accountant relationship. Credibility and reliability are key factors for building trust in accounting, and in this case intimacy refers to the depth and tenure of the relationship with any particular client. This is honed through an accountant’s role as a trusted advisor for clients as they navigate challenges and achieve success.

Accountants have overwhelmingly earned this trusted status. According to BILL’s 2024 Accounting Firm Hireability Index, 89% of SMBs consider their accountants a trusted advisor.

As AI and evolving technologies gain prominence, accountants find themselves at a critical juncture. Beyond maintaining trust in their firm, accountants must also help clients build trust in technology. Accountants can serve as the bridge between clients and AI-driven solutions, validating data and ensuring that technology being considered is trustworthy.

Keep reading to learn about strategies for cultivating and leveraging the trusting relationship between accountants and clients in an increasingly digital landscape.

Examining the Accountant-Client Relationship

During my time as an accountant, I was spending all day replying to client emails only to work on actual accounting services all night. That is when I realized I needed to take a step back and evaluate my accountant-client relationship process holistically.

A strong relationship between accountants and their clients is built on two equally important fundamentals: accurate measurement and unwavering transparency.

Accurate measurement is a key component of financial reporting, tax compliance, and audit accuracy. This attention to detail enables accountants to spot trends, uncover new opportunities, and identify potential risks—each crucial for client success.

Transparency involves both ethical standards and effective communication. Accountants need to carefully balance client confidentiality with being open about processes. Clear, regular communication is essential, and should involve proactive updates, explanations of complex concepts, and prompt responses to inquiries.

Establishing a clear and predictable communication cadence will help you spend less time chasing emails and more time providing clients with valuable insights. In practice, this could mean having a strong client onboarding process that includes establishing expectations for weekly, monthly, and quarterly communications. This helps clients understand when they will be hearing from you and which communication channels are best for different types of questions they may have. If your processes don’t include a communications playbook, this is your call to create one.

With this bedrock in place, accountants can then focus on the other pillars that help to build long-term trust with clients: quality of service, demonstrating industry expertise, and a personalized approach to each client’s needs. Accountants also need to navigate difficult conversations, manage expectations, and deliver sensitive information tactfully.

Accountants who use these fundamentals as a north star are not only able to strengthen individual client relationships but also elevate their role in an increasingly complex financial landscape.

What this Means for Accountants

Today’s accountants need to be adaptable and keep up with rapidly changing regulations, growing cybersecurity risks, and heightened data privacy concerns. As accountants increasingly serve as strategic business advisors, clients expect timely financial insights and analysis.

This requires the skill to translate raw numbers and complex financial data into actionable insights. However, accountants encounter challenges with this due to complex regulations, vast data volumes, and the risk of human error. As the industry evolves, technology can play an increasingly important role in overcoming these challenges.

The impact of emerging technologies, particularly AI, is reshaping accounting. AI is automating routine tasks, freeing up time for accountants to focus on high-value services and enhance their role as strategic advisors. AI solutions can also improve audit quality by providing advanced risk assessment capabilities and enhancing data analysis for more accurate forecasting.

To succeed in a tech-enabled landscape, accountants need to understand how to leverage AI and other technologies to improve their services. Technology adoption is certainly top of mind for clients: 79% of respondents to BILL’s Accounting Firm Hireability Index said they would leave or stop referring their accounting firm if they don’t stay up-to-date on the latest technologies.

This goes beyond just being tech-savvy – accountants must not only explain these technologies to clients, but help to educate them to build a solid, foundational understanding. This includes realistic expectations about capabilities and limitations, as well as basic security best practices, like staying up to date on the strongest authentication methods when managing financial data online (hint: it’s not text message-based two-factor authentication).

Bringing this Trust to AI

Increased tech proficiency, combined with financial expertise, positions accountants as trusted advisors in an increasingly digital business world. As AI becomes increasingly prevalent, professionals face the critical task of extending their Accountant Trust Quotient to encompass new technologies.

This starts with client education, which is essential for building trust in new technology, especially AI. Accountants must clearly explain how AI integrates into accounting processes and be prepared to address concerns while managing expectations. It’s crucial to emphasize that while AI tools streamline workflows, human oversight remains in place.

Accountants play a crucial role in decision-making by blending AI-generated results and professional judgment while analyzing data through the lens of each client’s unique needs. This oversight includes data validation, which involves implementing robust data checks before AI processes data and regularly auditing AI systems for accuracy and reliability.

When discussing AI implementation, accountants should focus on how it is enhancing effectiveness for their firms, rather than merely improving efficiency. If processes are more efficient – and therefore taking less time – clients may expect to see a decrease in their billing rates. But when the conversation focuses on how AI is helping firms level up the services they are already providing, it can be viewed as a valuable enhancement rather than a time-saving tool.

Being able to demonstrate and articulate how AI is enhancing day-to-day work can go a long way toward accountants helping clients understand the profound impact AI tools can have on their own companies.

The Future of Trust in Accounting

The future of accounting will be defined by a blend of human expertise and artificial intelligence. Accountants who can effectively bridge this gap, leveraging technology to enhance their services while maintaining the personal touch that builds lasting client relationships, will be the leaders in the field.

In this new era, the Accountant Trust Quotient will become the key differentiator, setting exceptional professionals apart. By cultivating trust in both their human judgment and their technological tools, accountants will continue to play a crucial role in guiding businesses through the complexities of the modern financial world.

====

Richard Corn, CPA, is Director of Product Management at BILL.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Firm Management