The last year has been a whirlwind, but at least we didn’t have a major global pandemic, and the folks in Washington, D.C. were able to just barely avert a government shutdown. That said, there were still major news events and ongoing trends that are significantly shaping the profession, including how professionals practice, how firms operate, and your business and individual clients.

Here are our picks for the Top News Items Affecting the Profession in 2024:

The 2024 election likely had the most impact on the day-to-day lives of taxpayers and accounting and tax professionals, or will in 2025 when returning President-Elect Donald Trump is inaugurated in January. He has promised sweeping reforms to government and taxes, immigration and global tariffs that could impact many industries. Additionally, his advisory panel DOGE, being led by Elon Musk and Vivek Ramaswamy, could further influence the actions of Trump and leaders in Congress.

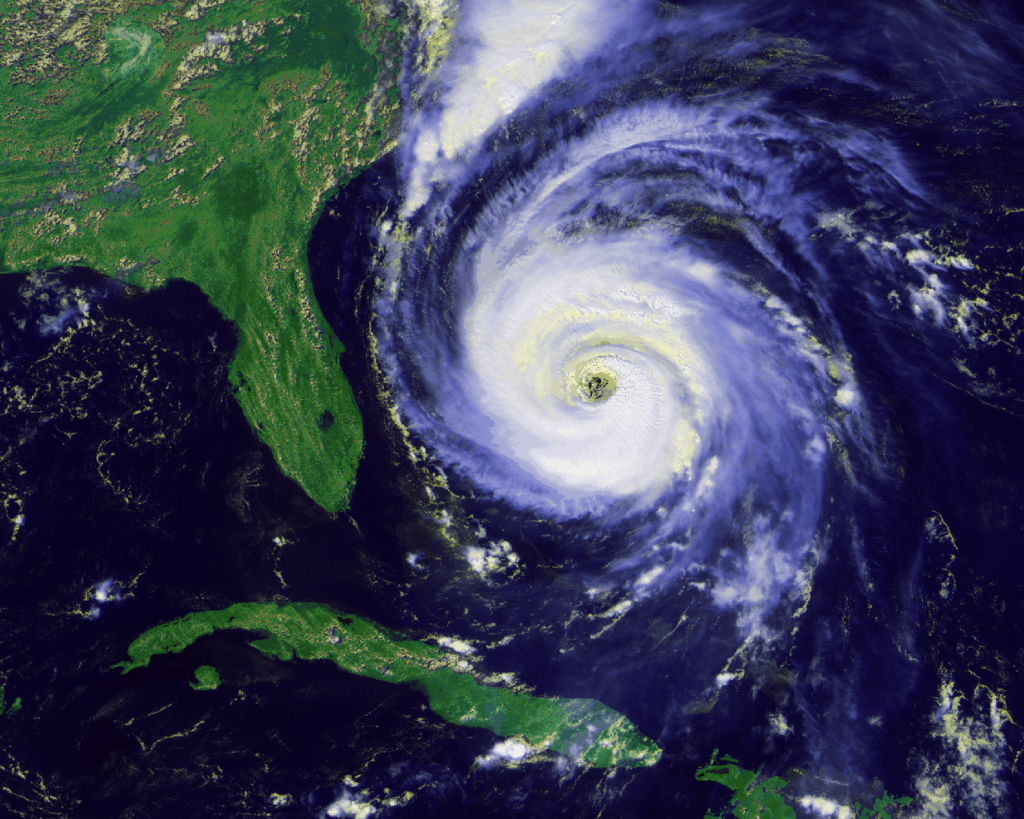

The U.S. east coast was hit by several tropical storms and hurricanes in 2024, most notably Category 4 Helene, and Category 3 Milton, both of which cause devastation across Florida, Georgia, the Carolinas and parts of Virginia. Small businesses (and entire towns and counties) experienced weeks or longer of disruption and lack of services. Many residents in these states received IRS and state level hurricane tax relief via automatic extensions of business and individual filing dates.

UPDATE: On Dec. 27, 2024, the BOI was once again put on hold by a federal court. —

In a move it says will help reduce fraud, the U.S. Department of the Treasury wants most LLCs, corporations and partnerships to start filing additional disclosures as to who their stakeholders are. The AICPA and most other business groups have opposed the measure, and earlier in the year, a federal judge placed an injunction on the rule, preventing it from moving forward. However … just before the end of 2024, a federal appeals court lifted that injunction, meaning the filing requirement is back in place.

Social Security Fairness Act Passes

The House of Representatives waited until the closing weeks of the year to finally make a change to Social Security that some legislators have been working on for decades, and that millions of retirees thought was unfair treatment. The Social Security Fairness Act removed two provisions that reduced SSI benefits for workers who also receive other forms of retirement pensions, such as teachers, police, firefighters or state workers. The new act removed the Windfall Elimination Provision and the Government Pension Offset, which were created “more than 40 years ago in response to an increase in retirees who hadn’t fully paid into Social Security and to more dual-income couples retiring.”

The Accounting Talent Pipeline Still Has a Shortage

Fewer college students are pursuing accounting degrees, and less of those who do are choosing to invest the additional time and expense of the additional credit hour requirements, and the Unified CPA Exam. As a result, the AICPA and state societies are rethinking how to attract these young graduates, including reducing credit hours to sit for the exam, providing other incentives, and enabling non-traditional degreed staff to handle some functions ordinarily performed by junior CPAs.

Private Equity in Accounting Firms Continues Movement

Private equity interest in accounting firms is reaching down from the top levels into even mid-sized firms. These investors see the opportunity to profit by reshaping the modern practice into more profitable models, but how will the resulting sell-off of partner equity affect junior and mid-level staff who had aspired to equity partner roles some day? If there is no such opportunity, will the talent pipeline suffer further? And what will be the result on client service?

When Covid struck, many businesses and firms shifted to a more remote (or even completely remote) workforce. More than three years later, some are rethinking this dynamic, and are wanting staff to return at least for a hybrid model, with individuals working from a traditional office at least a couple of days a week. Some larger employers are wanting a full return to the office, while others are finding benefit in the hybrid model, or are continuing to find success with remote staff.

Covid-Era ERC Claims Are Still an Issue

The Employee Retention Credit was created in 2020 as an economic assist to encourage businesses struggling due to Covid. Unfortunately, it was widely misunderstood and frequently misused/abused. This led to many businesses filing false or fraudulent claims, some of which they had been duped into filing because of unscrupulous and predatory organizations. Even into 2024, ERC claims continue to be an issue, with the IRS offering some forms of amnesty or deadline extensions to correct erroneous filings.

====

Did we miss a big article or theme that you think is affecting the profession? What’s been your firm’s biggest challenge in 2024? Tell us about it in the comments below.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Accounting, Firm Management, Taxes