The Securities and Exchange Commission (SEC) on Jan. 2 gave the green light to a rule amendment adopted by the Public Company Accounting Oversight Board (PCAOB) in November that allows the audit regulator to target for deregistration firms that don’t file annual reports and have neglected to pay their annual fees for two straight years.

“I’m pleased to support this rule because it helps the PCAOB maintain an accurate public record of registered firms,” SEC Chair Gary Gensler said in a statement.

Under the new rules, the PCAOB can address situations in which a registered firm has ceased to exist, is nonoperational, or no longer wishes to remain registered, as demonstrated by its failures to file annual reports via PCAOB Form 2 and pay annual fees for at least two consecutive reporting years. If a firm is found to be delinquent, a formal process to withdraw their registration would begin.

“If a firm isn’t filing statutory annual reports or paying their dues, it’s logical to presume the firm is inactive. Thus, it’s appropriate not to let such firms market themselves to the public as being registered with the PCAOB,” said Gensler, who added, “I’m glad to see, though, that the new standard includes a 60-day waiting period before finalizing a firm’s withdrawal.”

As of Aug. 31, 2024, 80 of the 1,544 public accounting firms registered with the PCAOB haven’t filed annual reports and haven’t paid annual fees for both the 2022 and 2023 reporting years, the PCAOB said in November. None of the 80 firms have issued an audit report for any public company issuer between Jan. 1, 2021, and Aug. 31, 2024, Gensler noted.

“Under the new standard, the PCAOB would now have an effective way to remove firms from registration that have ceased to exist, are nonoperational, or have demonstrated through inaction that they no longer wish to remain registered,” he said.

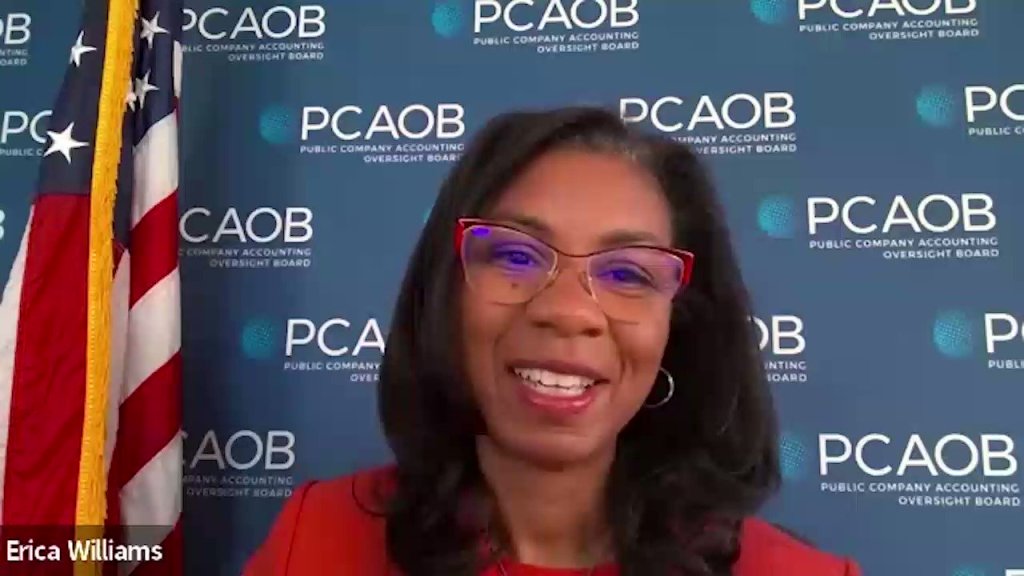

PCAOB Chair Erica Williams said in a statement Thursday that the amendment approved by the SEC “will not only make PCAOB registration information more useful for investors, audit committees, and other stakeholders, it will also help our organization use its staff time and resources more efficiently and effectively.”

With the SEC’s approval, the amended rule will take effect initially for annual reports and annual fees that are due in 2025, meaning that a registered firm that doesn’t file an annual report and doesn’t pay an annual fee for both the 2025 and 2026 reporting years could be deemed withdrawn from registration under Rule 2107(h) beginning in fall 2026, according to the PCAOB.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs