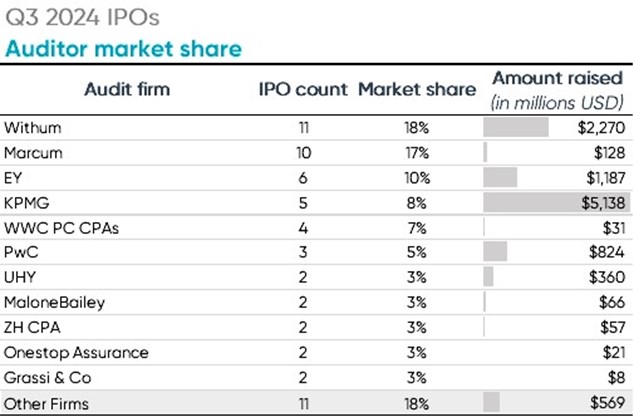

After tying Big Four firm PwC for the lead in the second quarter of 2024, top 25 accounting firm Withum was alone at the top of the initial public offering (IPO) auditor market share standings in Q3 with 11 audit clients that went public—all through special-purpose acquisition companies (SPACs)—according to a recent analysis from Ideagen Audit Analytics.

Overall, 22 different firms audited the 60 newly listed companies in Q3 2024, which raised a combined total of $10.7 billion. Marcum, who trailed just behind PwC and Withum in Q2 with seven new clients, increased their IPO client total in Q3 to audit 10 newly listed companies, representing 17% of all IPOs.

Marcum was acquired by fellow top 15 accounting firm CBIZ in a deal that was completed on Nov. 1, 2024. CBIZ acquired the non-attest business of Marcum, while Kansas City, MO-based CBIZ CPAs (formerly Mayer Hoffman McCann), the national independent CPA firm with which CBIZ has had an administrative service agreement for more than 25 years, acquired Marcum’s attest business.

In Q3, Big Four accounting firm KPMG ranked No. 1 in terms of gross proceeds despite only auditing five new public companies. KPMG’s five clients raised a total of $5.14 billion in gross proceeds, with Lineage Inc.—an operator of cold storage warehouses that was the largest IPO of the quarter in terms of proceeds—accounting for $4.44 billion of the total, according to Audit Analytics.

Traditional IPOs comprised the majority of deals in the third quarter, representing 70% of all new IPOs. There were 42 traditional IPOs and 18 SPAC IPOs in Q3. Compared to Q2, SPAC IPOs nearly doubled while traditional IPOs decreased by 5%.

Seven firms audited the 18 SPAC IPOs of Q3. As previously mentioned, Withum audited 11 of the 18 SPACs in Q3, which raised a combined total of $2.27 billion in proceeds. Far behind Withum in second was UHY, which audited two SPACs with total gross proceeds of $360 million. Marcum and four other firms each audited one SPAC in Q3.

Compared to Q3 of 2023, total IPOs increased by 16, or 36%, while total IPO proceeds increased by 16% in Q3 2024, according to Audit Analytics.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Accounting, Auditing