The Treasury Department and the IRS on Jan. 8 released the final rules and procedural guidance for the Clean Electricity Low-Income Communities Bonus Credit Amount Program under Section 48E(h) of the tax code, which was established by the Inflation Reduction Act.

The 48E(h) program expands the 48(e) bonus credit and promotes cost-saving clean energy investments in low-income communities, on Indian land, or as part of affordable housing developments and aims to benefit low-income households.

A Treasury analysis of the first year of the 48(e) program showed that the program received more than 54,000 applications from 48 states, the District of Columbia, and four territories.

Approved applications are expected to generate $3.5 billion in investments in low-income communities and on Indian lands, and are estimated to generate $270 million in offset energy costs annually, the Treasury Department said in a media release. During the second year of the 48(e) program, the program received more than 57,000 applications totaling over 1.9 gigawatts of clean energy generation. Approved applications are expected to generate approximately $4 billion in public and private investment into communities and almost $350 million in offset energy costs annually, Treasury said.

The 48E(h) bonus credit increases the 48E Clean Electricity Investment Tax Credit for applicable energy facilities with maximum net output of less than 5 megawatts by 10% or 20%.

A 10% increase is available to applicable facilities that are located in low-income communities or on Indian land. A 20% increase is available to applicable facilities that are part of a qualified low-income residential building project or a qualified low-income economic benefit project, according to the IRS.

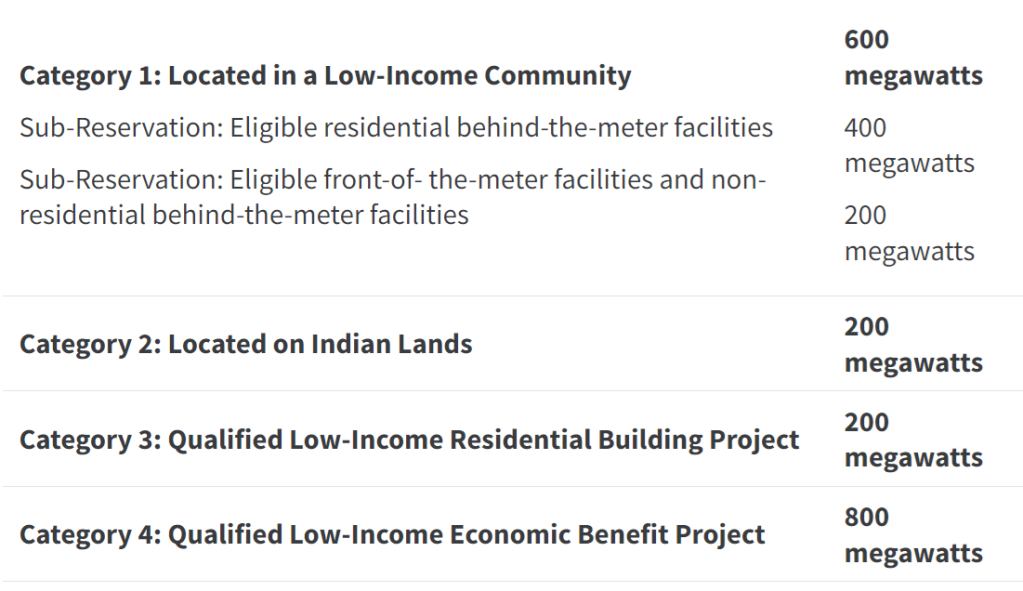

The program’s annual capacity limitation of 1.8 gigawatts is divided across each facility category for the 2025 program year, plus any carried over unallocated capacity limitation from the 2024 program year. For the 2025 program year, the capacity limitation is distributed across the four categories as follows:

For the 2025 program year, approximately 174,243 kilowatts (DC) were carried over from previous program years and distributed evenly between the four categories, Treasury said.

The rules released last Wednesday highlight the expanded list of program-eligible technologies beyond wind and solar to zero-emissions technologies like hydropower and geothermal. The full set of program-eligible facilities and how that list will be updated in the future is defined in the Section 48E Clean Electricity Investment Credit final regulations, which Treasury and the IRS released on Jan. 7. The allocated credit provides a 10 or 20 percentage-point boost on top of the 30% 48E investment tax credit, assuming prevailing wage and apprenticeship requirements are met.

The 48E(h) program will allocate bonuses to 1.8 gigawatts of clean electricity generation serving low-income communities each year from 2025 through at least 2032. For the 2025 program year, the application period will open at 9 a.m. ET on Jan. 16, 2025, and closes at 11:59 p.m. ET on Aug. 1, 2025. For the 2026 program year and subsequent program years, the application period will open the first Monday of February at 9 a.m. ET and closes the first Friday of August at 11:59 p.m. ET.

The final rules make key changes from the 48(e) program, including changes due to the statutory transition to the 48E Clean Electricity Investment Credit, as well as the incorporation of feedback received through public comment and lessons learned from previous program years, Treasury said. Select changes include:

- Expanding eligibility of investment technologies: The final rules highlight the list of eligible facilities defined in the updated 48E Clean Electricity Investment Tax Credit regulations from solar and wind to also include facilities that utilize zero-emission technologies like hydropower, marine and hydrokinetic, geothermal, and nuclear.

- Expanding impact for low-income households: The final rules clarify eligibility requirements for key categories, including expanding the list of housing programs that are eligible to participate as a qualified low-income residential building project and clarifying the financial value that certain projects must provide to low-income households.

- Creating opportunities for small businesses: The final rules provide a pathway for emerging clean energy businesses to receive priority in applying for the program.

“Expanding the Clean Electricity Low-Income Communities Bonus Credit will help lower energy costs in communities that have been overlooked and left out for too long and empower developers to work alongside communities to provide tailored solutions to meet their energy and economic needs,” U.S. Deputy Secretary of the Treasury Wally Adeyemo said in a statement. “The final rules announced today will help ensure that all Americans benefit from the growth of the clean energy economy.”

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs