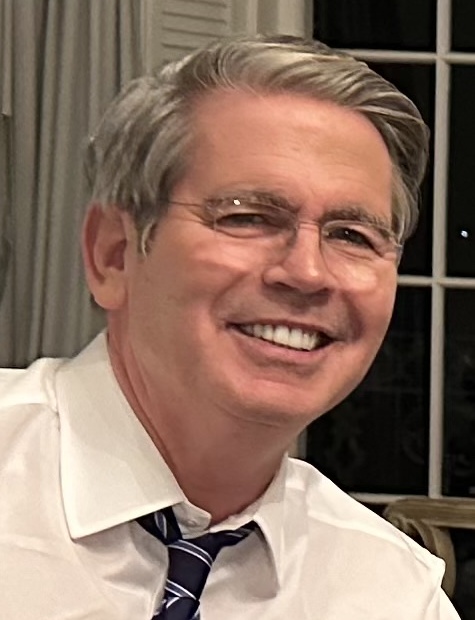

On Monday and Tuesday, President Donald Trump’s nominee to lead the Treasury Department, Scott Bessent, faced heated accusations from several members of the Senate Finance Committee, including accusations that the billionaire had avoided paying nearly $2 million in taxes over the past several years.

In a memo to Bessent, Senators Elizabeth Warren, Ron Wyden, and Shelden Whitehouse, cited news reports from various sources, writing that:

“These reports indicate that Senate Finance Committee staff reviews of your tax returns in advance of your nomination hearing revealed that you used loopholes and write offs — in direct conflict with Treasury Department policy and U.S. Tax Court rulings — to avoid paying nearly $2 million in taxes.” Memo from Senate Finance Committee members to Bessent.

The memo further suggested that a “cloud of tax avoidance” would prevent him from effectively acting as Treasury Secretary, which oversees the IRS and other U.S. financial regulatory bodies.

The members recommended Bessent take four steps to restore the confidence of the Senate and the U.S. public that he is being forthright and is qualified for the position:

- (1) release your tax returns to provide public confidence that you are following tax laws;

- (2) voluntarily submit to an IRS audit of your last five years of tax returns, and any returns filed while you are Treasury Secretary;

- (3) recuse yourself from any Treasury Department discussions related to the issues raised by your tax returns; and

- (4) commit to supporting ongoing enforcement efforts against wealthy tax cheats.

The Senators also claimed that Bessent, “… avoided paying nearly $1 million in Medicare taxes on your hedge fund earnings over the course of three years by reporting on your tax returns that you were a “limited partner” in the hedge fund you founded, the Key Square Group.” Furthermore, they asserted that he improperly claimed almost $2 million in losses from a publishing firm he founded, resulting in a reduction of tax liability of $800,000.

Additionally, the Senators added concerns about improper use of bad debt deductions, and potential evasion of state and local tax deductions.

The memo concluded with a request that he submit to a voluntary IRS audit of his previous five years of taxes, as well as ongoing audits during his tenure, if confirmed, as Treasury Secretary.

After the hearing, the Finance Committee voted mostly along party lines to advance Bessent’s nomination to the Senate for a full vote on confirmation.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Accounting, Income Taxes