By Erik Bascome

Staten Island Advance, N.Y.

(TNS)

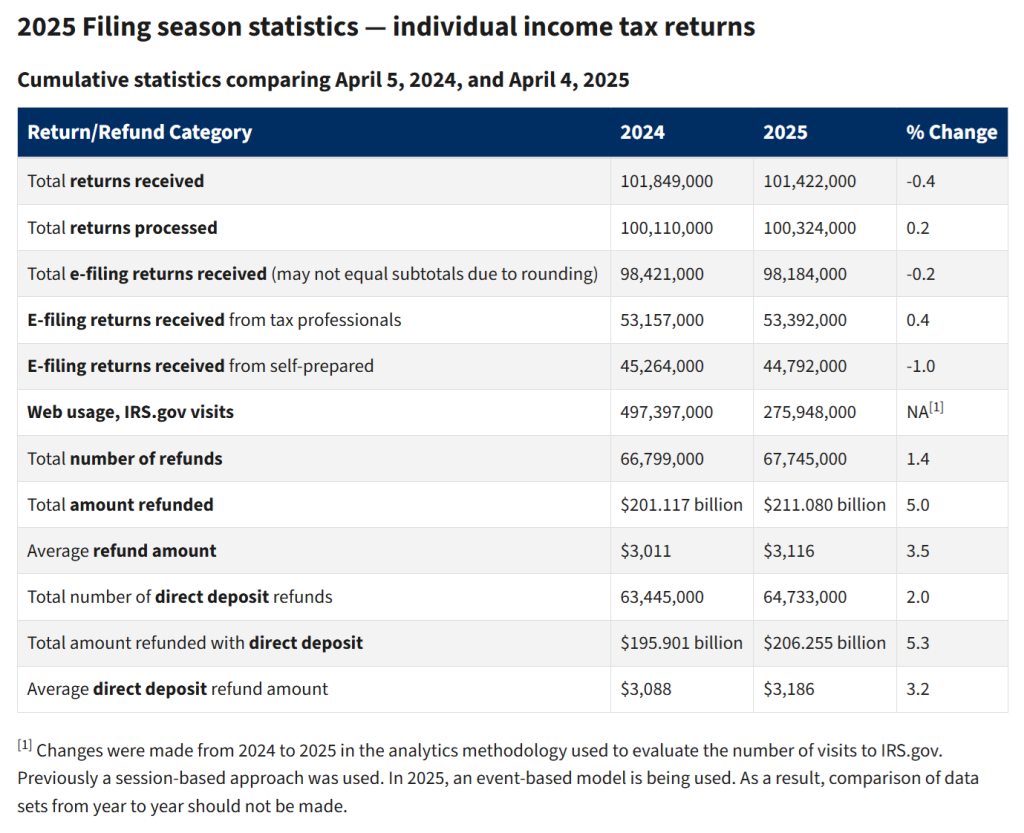

More than 67 million Americans have already received their annual tax refunds from the Internal Revenue Service (IRS), with the average refund totaling thousands of dollars.

Through April 4—the latest date currently available—the agency has issued 67,745,000 refunds, roughly 1.4% more than the 66,799,000 that had been issued by that time last year.

In total, the agency has issued roughly $211.1 billion in refunds, up 5% from the $201.1 billion issued at that time in 2024.

- Related article: What is the Average Tax Refund Amount in Your State?

The average refund amount through April 4 was $3,116, roughly 3.5% higher than the average refund of $3,011 at that time last year.

Through Feb. 14, the average had been just $2,169 but has increased dramatically now that the IRS has begun issuing refunds to taxpayers who claimed the Earned Income Tax Credit or Additional Child Tax Credit, the refundable portion of the Child Tax Credit.

Due to the Protecting Americans from Tax Hikes Act, or PATH Act, which took effect during the 2017 filing season, the IRS legally cannot issue refunds or credits to anyone who claimed an Earned Income Tax Credit or Additional Child Tax Credit before Feb. 15.

The policy was implemented “to help prevent revenue loss due to identity theft and refund fraud related to fabricated wages and withholdings,” according to the IRS.

Tracking your refund

If you’re one of the millions of Americans who have already sent in their tax returns, there are online portals that will allow you to monitor the status of your refund.

For federal taxes, residents can use the IRS “Where’s My Refund” tool or the IRS2Go mobile app to see when their refunds have been received, processed and sent.

Refund status will appear roughly 24 hours after you e-file a current-year return, three or four days after you e-file a prior-year return, or four weeks after you file a paper return.

To access the information, which is updated overnight each day, residents must provide their Social Security or individual taxpayer ID number, filing status and exact refund amount on their return.

Once refunds are sent, those using direct deposit should receive their refund within five days, while those expecting checks in the mail may have to wait several weeks.

Editor’s note: Here are the latest tax filing season statistics from the IRS:

_______

© 2025 Staten Island Advance, N.Y. Visit www.silive.com. Distributed by Tribune Content Agency LLC.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs