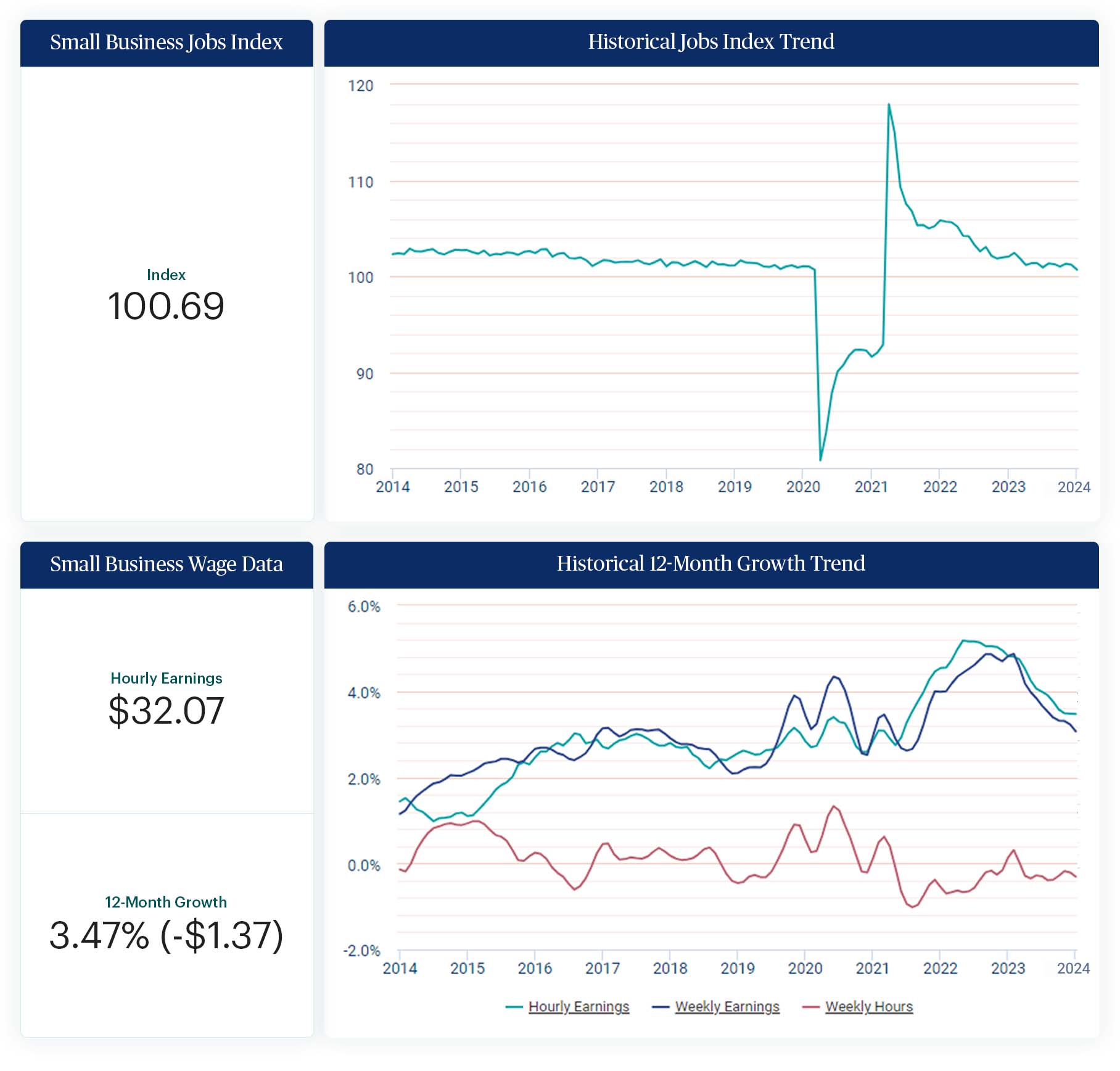

According to the Paychex Small Business Employment Watch, January marks the 34th consecutive month of job growth for U.S. small businesses. Wage growth for workers continues to stabilize in the new year with hourly earnings growth remaining essentially unchanged since November at 3.47%.

“As we begin 2024, job growth in small businesses is continuing at a steady pace,” says John Gibson, Paychex president and CEO. “Nationally, wage growth remains stable despite 65 minimum wage changes taking effect in various states and localities on January 1. Small and medium-sized businesses remain resilient in the face of many challenges, including a tight labor market for qualified workers, the cost of and access to capital, rising employer regulations, and cost of providing benefits to attract and retain employees.”

“Several macroeconomic data sources point to a strong close to 2023,” adds Gibson. “Gross domestic product (GDP) increased 3.3% in the fourth quarter while the annual unemployment rate hit its lowest point since 1969, signaling federal policymakers have managed to bring down inflation and secure a ‘soft landing’ without major repercussions for workers or the economy. Policymakers need to address the cost and access to growth capital for small businesses, as well as the long term-issues impacting the labor market — including the participation rate and the quality of the workforce — to support the continued growth of small businesses, which drives the U.S. economy.”

Jobs Index Highlights

- At 100.69, the national index indicates continued job growth but at a slower pace.

- With indexes above 100, all regions continue to report positive job growth in January. The South (101.12) leads the pace of regional job growth in January and has ranked first among regions for 16 of the last 17 months.

- Leading the South, Tennessee (102.19), Texas (102.06), and Virginia (102.01) are all reporting index levels above 102 in January.

- Ranked first among top U.S. metros in January, Dallas jumped 1.60 percentage points to 103.30 and has now increased its job growth rate for three-straight months.

- Education and Health Services (101.91) leads industries for small business job growth to start 2024. Indicating strong, sustained job growth, this sector’s jobs index was above 102 for 33 consecutive months leading up to January 2024.

Wage Data Highlights

- At 3.47%, hourly earnings growth has stabilized and is essentially unchanged over the past three months (3.48% in December 2023, 3.49% in November 2023).

- At 4.03%, the West leads regional hourly earnings growth for the eighth consecutive month. The South (3.33%) has the lowest hourly earnings growth rate among regions.

- Washington’s 5.17% hourly earnings growth in January is the highest among states for the sixth consecutive month.

- Seattle reports 5.27% hourly earnings growth in January, the fifth consecutive month over five percent, and ranked first among top U.S. metros.

- Construction has the strongest weekly hours worked among sectors for January, up 0.32% since December. Leisure and Hospitality also experienced strong one-month hourly earnings growth (5.10%).

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs