Chances are you have clients—or would like to have clients in various niches—who are one-person shops. They have no staff, and are taking full advantage of the gig economy to work for themselves and pursuing their passions.

Welcome to QuickBooks Solopreneur. You neither have to have a small accounting practice, nor be in a medium or even a larger practice to want to work with one-person clients. And let’s face it, they could really use your help in getting their finances not only organized, but tax ready as well. In fact, if you have any sole proprietors who file Schedule Cs, QuickBooks Solopreneur is right sized to support their business.

According to the Intuit QuickBooks Entrepreneurship in 2024 Report, as more people take the leap to work for themselves, solopreneurs are increasing in numbers. Nearly a quarter of U.S. consumers said they plan to start a new business in 2024, and two-thirds believe that starting a business is a better path to building personal wealth, even when compared to buying a house.

“Many solopreneurs are at that critical phase where they need to better understand their business to chart a path to financial stability,” said Michael Hitchcock, vice president, Accounting and Tax, QuickBooks. “QuickBooks Solopreneur is designed specifically for one-person businesses who crave simplicity and don’t yet require an advanced accounting solution. It enables them to get a holistic view of their finances, manage daily operations, and be ready for tax time so they can grow on their own terms.”

Your clients who are sole proprietors already wear many hats to run their businesses, including “bookkeeper,” where they need to separate personal and business transactions, track cash flow, and pay business taxes — all from various bank accounts and financial apps. QuickBooks Solopreneur can help them do that.

Features of QuickBooks Solopreneur

There are a number of key features in QuickBooks Solopreneur, including the following:

Get set up for success in no time. Getting started with QuickBooks Solopreneur is easy, no matter how clients previously tracked their business finances. Data import is fast and simple, and even if clients are keeping their finances on a spreadsheet, for example, Solopreneur will import this data and provide bank account connections for instant business insights.

Track profitability. Your clients started their business because they were passionate about their work, not necessarily because they understand financial reports and terms. QuickBooks Solopreneur makes it easy to track income and expenses, run reports, and get a clear view of business performance. Easy-to-understand reports and dashboards help your clients see exactly where their business stands at a glance, so they can make informed, data-backed decisions.

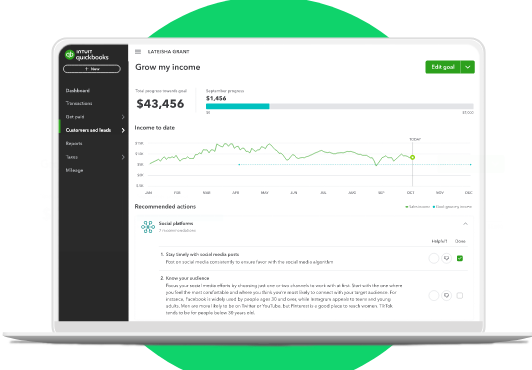

Create actionable business goals and track your progress. QuickBooks Solopreneur sets realistic customer and revenue growth goals with target dates, and tracks the progress right on a dashboard. Clients will always know exactly where they are in their journey, and what they need to do to get ahead or stay on track.

Separate business and personal expenses. Accountants are well aware this is a problem with many small businesses. Keeping personal expenses separate from business expenses is important for many reasons, including accurately tracking business performance, filing business taxes, and maximizing deductions. QuickBooks Solopreneur automatically categorizes and separates business and personal expenses for easy review; sorting bank and credit card transactions is effortless.

Invoice and accept payments. Small businesses struggle to get invoices paid on time. Professional, easy-to-pay invoicing can make all the difference. With QuickBooks Solopreneur, they can create professional, custom, pay-enabled invoices that can be sent from any device. They can track invoice status, send payment reminders, and accept optional tips, all in one place.

Automatic mileage tracking. Accountants also know that getting small businesses to accurately track their mileage is a hurdle for many clients. QuickBooks Solopreneur tracks mileage automatically via a phone’s GPS, then categorizes trips with just a swipe.

Calculate sales tax. Calculating sales tax correctly is also one of the toughest things to do without making mistakes. Even for the most-savvy solopreneur, it’s tricky to keep track of what’s taxable, which rate to use, and what to do with the sales tax they collect. And because almost every state has its own sales tax rate—as well as some cities—miscalculations can easily happen. QuickBooks Solopreneur eliminates this burden of calculating sales tax whenever it’s applied, and also tracks rate changes.

Create estimates. QuickBooks Solopreneur also customizes professional estimates, accepts mobile signatures, and shows the status of estimates, all in one place. When the job begins, clients can convert their estimates into invoices.

Present Your Clients With Options

Regardless of which version of QuickBooks you offer your clients, they are looking to you as their advisor to help them realize more revenue, get organized, and grow their business. QuickBooks Solopreneur is a wise choice for one-person business owners who want to keep it simple, yet have the power to keep their books, file taxes, and look to the future.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs