By Joseph Morton, The Dallas Morning News (TNS)

A Texan was the first person to use a new, free electronic tax return filing system, and thousands have followed suit since, but millions more are eligible.

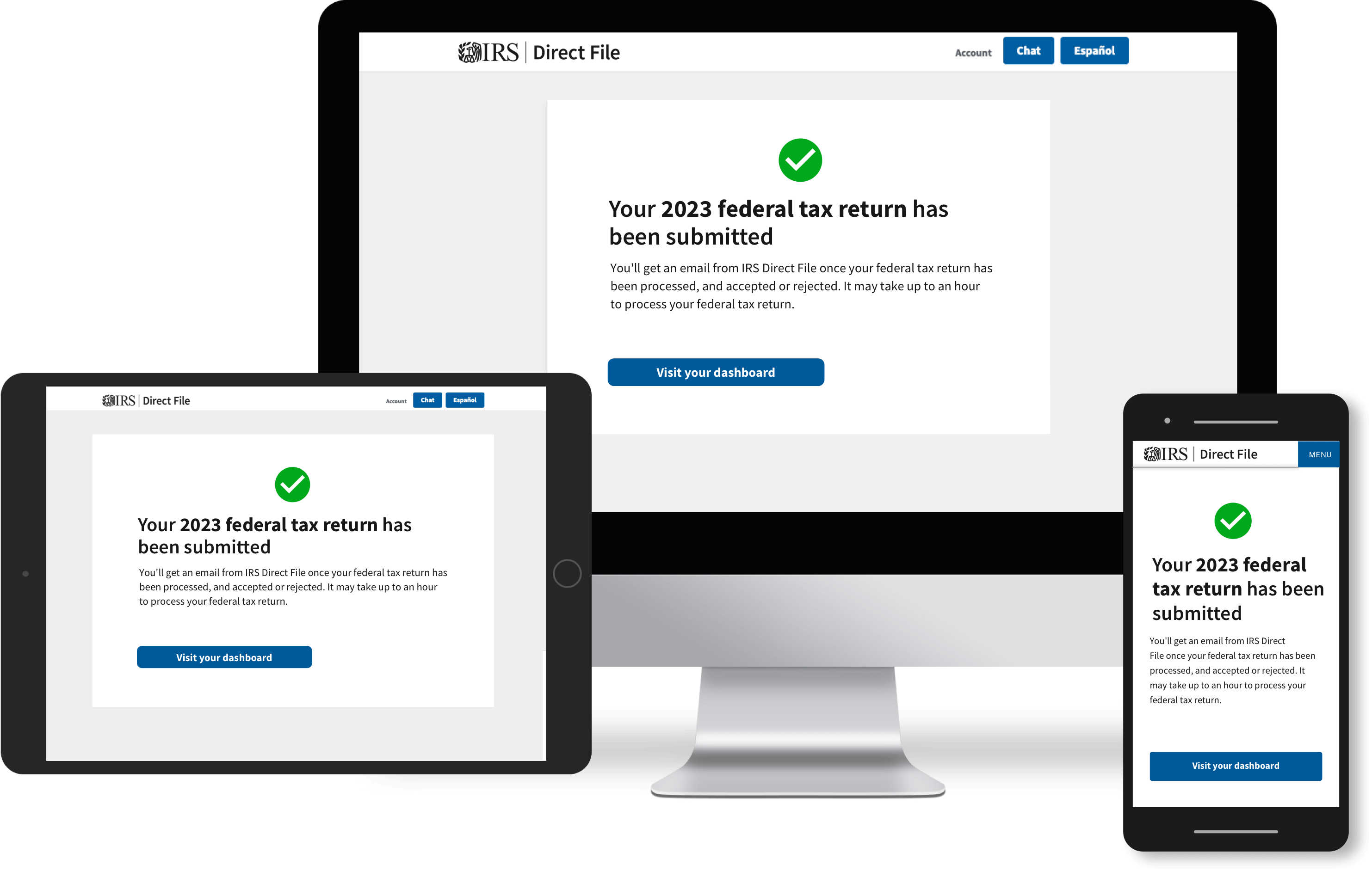

The IRS launched the pilot program known as Direct File in a dozen states this year, including Texas. About 50,000 people in those states have used it so far.

While the exact number of Texas filers in the system was not immediately available, the Treasury Department says the state has the most filers on a per capita basis.

But as April 15 approaches, many more can use it—a total of 3.8 million Texans are eligible.

“We want as many of them as possible to do so because it means that they will save money—because the tool of course is free—and we think they will save time because we think the tool is intuitive and easier to use than many of the other alternative ways of filing taxes,” Deputy Treasury Secretary Wally Adeyemo said in an interview with The Dallas Morning News.

Adeyemo will be in Dallas on Thursday to promote Direct File, as well as the administration’s economic policies more broadly.

Planned events include a “fireside conversation” with Bishop T.D. Jakes, a prominent Dallas megachurch pastor, and faith-based affiliate partners at the International Leadership Conference.

Adeyemo also will participate in a roundtable with faith leaders to discuss ways to improve access to federal assistance programs.

And he will speak at an afternoon event promoting the Direct File pilot program, which he said will help Americans who individually spend about 13 hours and $270 to file their taxes every year.

A total of 19 million taxpayers across the 12 states this year can use the new system, which is intended for filers with relatively simple returns.

It’s not set up for reporting certain types of income, and filers can only take the standard deduction. Filers can go to the IRS website to check their eligibility.

The Biden administration credits the new system to the $80 billion in IRS funding that was included in the Inflation Reduction Act. Republicans have pushed to cut that money, characterizing it as an effort to target everyday Americans.

They have also criticized Direct File.

U.S. Rep. Beth Van Duyne, R-Irving, posted last year on X, formerly Twitter, that “pro-government takeover politicians” want to “supercharge the IRS to go after working families by making the IRS the preparer, filer, and auditor of your taxes.”

“There’s nothing free about ‘free file’ when every taxpayer is stuck footing the bill,” Van Duyne posted.

Administration officials characterize the money as supporting actions against wealthy tax cheats, saying those making more than $400,000 a year are more likely to duck paying what they owe.

They say the money also is being used to improve customer service through tools like the new Direct File.

“The American people should have a free option for filing their taxes like people all over the world do in countries that are similar to the United States,” Adeyemo said.

The new filing system is designed to help filers discover available credits to save additional money.

Adeyemo said once this filing season is over, the agency will review how it went with an eye toward further expanding such tools.

“The last time the IRS dramatically improved its technology was in the 1960s … before we sent a man to the moon, before we had an ATM, before we had the personal computer,” Adeyemo said.

______

©2024 The Dallas Morning News. Visit dallasnews.com. Distributed by Tribune Content Agency LLC.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs