Small businesses want a simpler income tax code with decreased federal spending, and oppose a national sales tax. That’s according to the results of a new survey on taxes and spending conducted by the National Federation of Independent Businesses.

“This survey clearly shows that small business owners believe the tax code is too complicated, too politically motivated, and inconsistent. It is no wonder that more than half of small businesses believe that simplifying the tax code should be a top priority,” said NFIB Tax Counsel Chris Whitcomb.

“As federal lawmakers tackle the complex subject of comprehensive tax revision, this new data will give them needed clarity on the views of the small-business community. With leaders in the House already developing discussion drafts for restructuring, this type of insight into small-business owners’ challenges, needs and mindset will be invaluable,” Whitcomb said.

“By an overwhelming margin, small-business owners indicated that they prefer lower individual tax rates and a simpler tax code,” said study author and NFIB Senior Research Fellow William Dennis.

“They see economic possibility in growing their businesses, not in growing government revenue through tax increases. In fact, their sentiment that spending cuts must take priority is overwhelming, with 81 percent preferring spending cuts to tax increases by at least three dollars in cuts for every dollar in revenues. Virtually no respondent in the survey favored increasing taxes over cutting spending.”

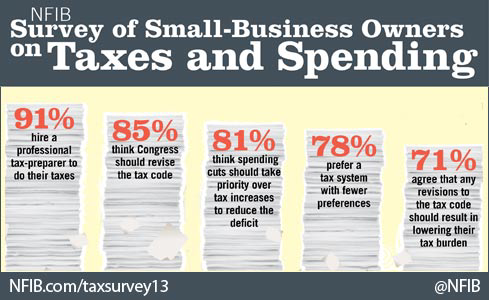

Small business owners overwhelmingly agree that the tax code is too complex and should be overhauled (85 percent).

- Over 90 percent of small business owners surveyed have given up trying to comply with the tax code and instead pay professional tax preparers to prepare their filings.

- More than half (52 percent) of small businesses believe that simplifying the tax code should be a top priority out of all potential revision options.

- Survey respondents noted that the biggest challenges they face in terms of complying with the tax code include a) that tax preferences are inconsistent; (b) continuous changes impact their ability to plan ahead and increase their cost of compliance.

With over 60 percent of NFIB members being very small operations, those with fewer than 10 employees, this presents a disproportionate cost and compliance burden compared to larger companies.

- Although small business owners agree the tax laws should be simpler, a majority (55 percent) do not believe that any changes to the tax code will result in less complexity.

- This reflects a sustained pessimism and lack of confidence in the federal government held among American small businesses, and a clear disconnect between what is promised on the campaign trail and the ability of Washington politicians to live up to their commitments after elections have concluded.

Small businesses overwhelmingly agreed (71 percent) that any ultimate revisions to the tax code should result in lowering their overall tax burden.

- Like most Americans, small business owners would prefer a tax system with fewer tax preferences (78 percent).

- And in some cases, they are willing to accept closing or modifying tax preferences in exchange for lower rates. This is consistent with past sentiments held among business owners about the need for a fair playing field.

Virtually no small businesses surveyed believed tax rates should serve as the only means reduce the national deficit.

- In fact, small business owners overwhelmingly prefer (81 percent) by a ratio of 3 to 1 that spending cuts should take priority over tax increases to reduce the deficit by a ratio of at least 3 to 1.

- NFIB members, like most Americans, believe that the federal government should also have to balance their books just like everyone else.

- A majority of small business owners believe tax reform that eliminates tax preferences and reduces personal income tax rates is the best way to achieve more robust economic growth.

Small business owners have little support or faith in new tax schemes that have been proposed in recent years, such as a national sales tax (Value Added Tax or VAT) or a carbon tax. Even if used to reduce tax rates or replace other taxes, NFIB members are staunchly opposed:

- 67 percent of small businesses familiar with a carbon tax oppose it.

- A national sales tax doesn’t fare much better, with a solid majority (58 percent) of small business owners familiar with the idea in opposition.

The full study can be at www.nfib.com/research-foundation/surveys/tax-survey/.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Income Taxes, Small Business