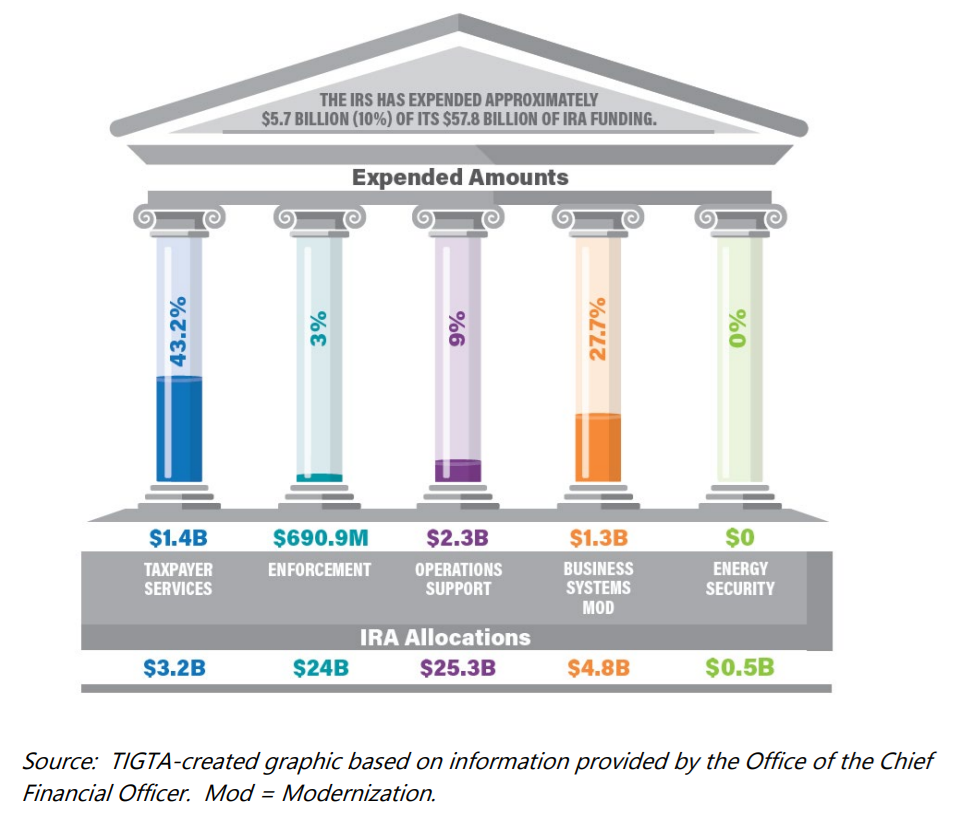

$5.7 billion is how much the IRS has spent, or 10%, of the $57.8 billion the agency will receive from the Inflation Reduction Act, as of March 31, 2024, according to a new report from the Treasury Inspector General for Tax Administration (TIGTA).

TIGTA conducted its review to provide periodic reporting on how the IRS is using and accounting for Inflation Reduction Act funds. The IRS watchdog said it plans to issue this type of report quarterly going forward.

When the Inflation Reduction Act was enacted in August 2022, it allowed for $79.4 billion to go to the IRS over a 10-year period for the agency to rebuild and strengthen taxpayer customer service; add capacity to better evaluate complicated tax returns of high-net-worth individuals, large corporations, and complex partnerships; and update outdated IRS operating systems and technology.

However, that funding has been slashed to $57.8 billion as a result of deals between the Biden administration and Republican lawmakers. Approximately $1.4 billion of that Inflation Reduction Act funding was rescinded as part of debt ceiling negotiations last summer, and another $20.2 billion will be cut and repurposed as part of the agreement in June 2023 between Biden and then-House Speaker Kevin McCarthy to suspend the debt limit and cap federal agency spending.

Of the $5.7 billion the IRS has spent so far, $2.3 billion has been used for operations support, followed by $1.4 billion for taxpayer services, $1.3 billion for business system upgrades, and $690.9 million for enforcement.

In addition to the amounts shown on the graphic above, the IRS spent approximately $11.6 million in FY 2023 for its Direct File tax return system, which is included in the total amount expended, according to TIGTA.

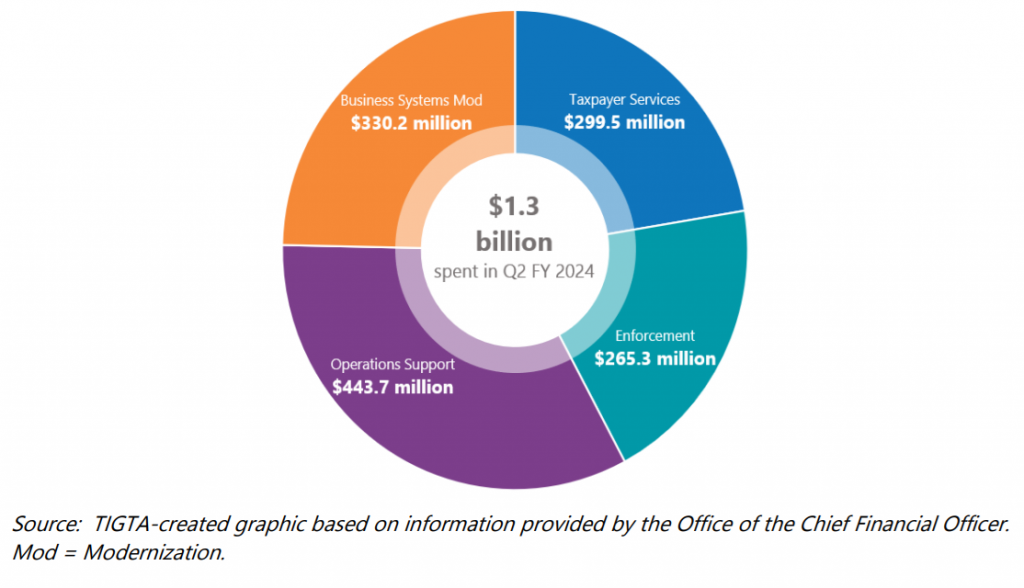

The IRS spent approximately $1.3 billion in Inflation Reduction Act funding in the second quarter of its FY 2024, TIGTA said. The figure below shows expenditures by funding activity during the period Jan. 1, 2024, through March 31, 2024.

IRS officials indicated to TIGTA that $2 billion of the $5.7 billion of Inflation Reduction Act funding expended has been used to supplement its annual appropriation because the amount the IRS received was insufficient to cover normal operating expenses.

As of March 31, the IRS reported that the largest portion of Inflation Reduction Act expenditures was for employee compensation (pay and benefits), totaling approximately $2.5 billion, and contractor advisory and assistance services, totaling approximately $2 billion.

Approximately $680 million of the $2.5 billion the IRS spent on labor occurred in Q2 of 2024, TIGTA said. Most of the labor costs (approximately $1.3 billion) were in taxpayer services, TIGTA reported, including the IRS hiring additional customer service representatives to answer taxpayer telephone calls, as well as employees to staff taxpayer assistance centers.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs