By Darren Root, CPA, CITP, CGMA.

What it takes to be a modern firm means different things to different people. Does it require having connected, collaborative cloud technology in place? A structured, current security plan? Offering a rich client experience? A healthy culture that supports remote work and flex time?

The short answer is yes to all of the above—and more. It also takes intention and commitment to continually evaluate, improve, and elevate firm operations over the long term.

It’s time accounting firms got on the same page about what it means to run a modern firm and how to achieve it. And that’s what we’re here to talk about. Each month, I’ll focus on a key element of The Modern Firm® model—offering a blueprint to help you not only grow your practice…but thrive now and well into the future.

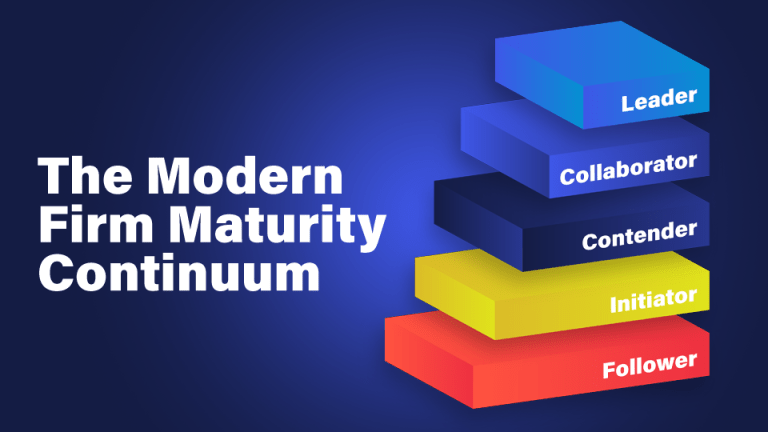

In an era of increasing competition and shifting client expectations, the time is now to modernize. To move up The Modern Firm Maturity Continuum and claim (and maintain) your place as a leader in the profession, take the first step by understanding what it is. From there, you’ll have more clarity on what you need to do to advance.

Start with an honest evaluation

My intent is certainly not to bury the lead, so let’s get right to it. What is this thing called The Modern Firm Maturity Continuum?

In short, the continuum serves as a rubric for grading a firm’s maturity level (in multiple areas of operation). This enables you to thoroughly evaluate your firm, see where you are and, by default, what you need to do to advance. To better understand, consider each level:

Leader: Has a standardized, secure, integrated cloud-based technology stack with seamless, connected access to business client GLs, supporting end-to-end, automated and standardized workflows. Also supports a centralized data strategy that leverages advanced tech and AI to identify client advisory opportunities and serve clients proactively and holistically. Being a Leader is a tall order, which is why only 2% of firms recently surveyed self-identified in this category.

Collaborator: Like Leaders, Collaborators have a standardized, secure, integrated cloud technology stack and uniform workflows in place. They also have clarity around who they want to serve, what they want to sell and how to deliver client services. This group falls short of being a Leader because they’re not actively leveraging AI to holistically serve their ideal client profile (ICP).

Did you know that Leaders and Collaborators earn up to 39% more revenue per employee? That’s a big deal that equates to big bucks. (2024 Accounting Firm Technology Survey)

Contender: Supports a well-defined, connected tech stack—leveraging a secure cloud environment. Also supports uniform workflows; digital documents; and has clarity around who they want to serve, what they want to sell, and how to deliver client services. Contenders have identified their ICP but fall short of the Collaborator group because their ideal clients do not make up the majority of their client base. And while Contenders collaborate with some clients in the cloud, they do not have a dedicated plan to fully connect across all clients.

Initiator: This group has mostly connected software, leveraging a secure cloud environment. Initiators also have some standardized workflows in place and clarity around who they want to serve, what they want to sell and how to deliver client services. However, their client base is largely unintentional—not having identified their ideal clients.

Follower: This group has disconnected software solutions, a blend of paper and digital documents, inconsistent business processes, and handle mostly compliance work— where services are reactive rather than proactive. Followers have yet to clearly define their ICP and report time constraints as a core reason for not strategically managing their firms. This group represents a traditional accounting firm.

Based on these categories, where do you fall? With Leaders and Collaborators reporting higher revenue, striving to reach these levels should be the goal. It’s important to note that 88% of all firms surveyed report that technology positively impacts workplace efficiency and client services[AH1] . So I ask: What’s not to love about being a modern firm?

It pays (literally) to be a leader

For accounting firms, staying relevant in the digital age means embracing change. And that includes adopting advanced solutions. That is, technologies that are connected, secure and cloud-based to support automated, digital workflows—while also supporting ease of collaboration among staff and clients.

Let’s face it; elevating revenue is a key motivator. In fact, Leaders and Collaborators aren’t the only ones earning more (remember, 39% more per employee). Firms who fell into the Contender category reported, on average, 29% more revenue per employee.

As major as it is, elevated revenue is just one tangible benefit. The value of being a modern firm extends well beyond the cash…

Benefits beyond big boosts in revenue

While becoming a modern firm requires more than adoption of advanced apps, technology is central to those at the top of the continuum. As stated above, 88% of all responding firms reported that technology also has a positive impact on workplace efficiency and client services.

This means modern firms are enjoying standardized, automated workflows that super-boost productivity. Connected technology offers exceptional flexibility and the ability to automate routine tasks—eliminating the need for tedious, manual work. Staff love this and the efficiency gains free up team members’ time to support higher-value advisory services. Talk about a win-win.

And all of this leads to elevated client services. Connected technology supports deeper collaboration with clients and more visibility into data and services. It’s important to understand that technological advancements are not merely operational upgrades; they fundamentally improve the way firms interact with their clients and deliver services.

The path forward

The journey along the maturity continuum is a transformative process that requires commitment to continuous improvement and an openness to innovation. For firms, the continuum represents a proven, strategic roadmap to achieve modern status and thrive in the digital era.

The first step is to identify where you fall on The Modern Firm Maturity Continuum. From there, you can start to chart your course and realize all the benefits—beyond those discussed here.

Be sure to come back next month as the continuum conversation continues. For now, take a moment to review all the data from the 2024 Accounting Firm Technology Survey. Here’s to moving upward and onward.

Watch The Modern Firm series of videos and podcasts at https://www.rightworks.com/resources/podcasts/.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs