More than 3.4 million American families claimed $8.4 billion in tax credits to lower the costs of clean energy and energy-efficiency upgrades to their homes during 2023, the Treasury Department and the IRS said on Aug. 7.

The Inflation Reduction Act, signed into law in August 2022, extended and expanded tax credits that allow taxpayers to claim residential and energy-efficient home energy credits.

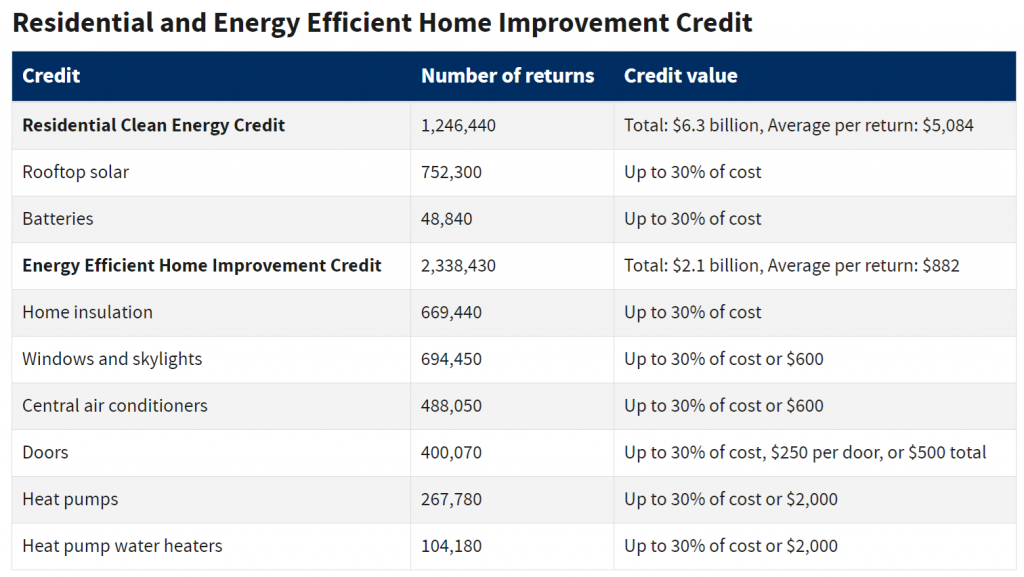

Taxpayers have claimed $6.3 billion in credits for residential clean energy investments on 2023 tax returns filed and processed through May 23, 2024, according to new data from the IRS and an analysis by the Office of Economic Policy. This credit helps families afford investments in solar electricity generation, solar water heating, and battery storage, among others.

In addition, families have claimed $2.1 billion for energy-efficient home improvements—which include heat pumps, efficient air conditioners, insulation, windows, and doors—during the same time span.

These estimates are expected to increase as additional returns are filed and processed, the Treasury Department said.

“The Biden-Harris administration’s top economic priority is lowering costs for American families, and the Inflation Reduction Act is advancing that goal by making home energy upgrades more affordable and cutting monthly utility bills,” Treasury Secretary Janet Yellen said in a statement. “The law has lowered the cost of clean energy upgrades for more than 3.4 million American families, saving them hundreds, if not thousands, of dollars annually on their utility bills for many years to come.”

Deputy Treasury Secretary Wally Adeyemo said he expected even more households to claim the credits this year, especially as more people become familiar with them, the Washington Post reported. Though the credits existed before the Inflation Reduction Act, the law made them more generous and expanded access to credits that had already expired or were set to expire.

In most states, 2 to 3% of individual and family taxpayers claimed a tax credit for at least one form of climate-friendly home improvement in 2023, according to the Washington Post:

The rate was 4 percent in Maine, New Hampshire and Vermont — places where heat pumps have become a popular alternative to costly fuel oil, aided by the states’ own generous rebates and credits for buyers. Oklahoma and West Virginia were the only states with rates below 2 percent.

Though nearly half the households that claimed the credits reported annual income below $100,000, the credit uptake was more common higher up the income scale. More than 1 in every 20 households in income brackets higher than$100,000 claimed the credit, despite the fact that some of the credits limited eligibility for higher-income households.

Sara Baldwin, who leads research on decarbonization at Energy Innovation, told the Washington Post that earlier tax credits show a history of directly spurring people to make climate-friendly purchases.

“We’ve seen a yo-yo up and down in the past suggesting that these tax credits do have a stimulating effect on the market and encouraging more uptake and adoption than would otherwise happen in their absence. I think that’s especially true for individual homeowners, residential customers,” she said.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs