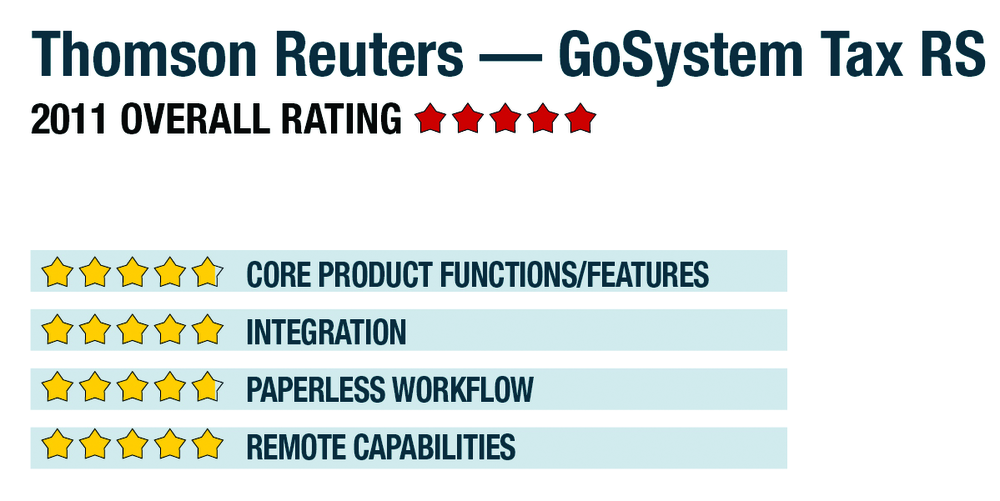

2011 OVERALL RATING 4.75

800-968-8900

CS.ThomsonReuters.com

Please indicate the available delivery methods for your product below:

__x__ On-Premises

__x__ SaaS

_____ Hosted by Vendor

BEST FIRM FIT:

Good fit for top 50 firms, the Fortune 500, and those who need multi-office, multi-department support for the most complex returns. The only purely browser-based application reviewed.

STRENGTHS:

– Designed for the most complex returns, including multi-state, multi-national firms

– Strong integration with GoFileRoom, CheckPoint and other Thomson Reuters tools

– Partial file lock-down available to reduce repetitive reviews on static information for last-minute changes to large returns

– Hosted model means no updates to install & less infrastructure to support

POTENTIAL LIMITATIONS:

– Ability to handle the most complex options may make it too complicated for those who don’t need the functionality

– Requires Internet Explorer 7 or later

– Lack of a locally installed version may not appeal to some users

– Not appropriate for users in rural areas without reliable wired, high-speed Internet options

– One of the most expensive applications reviewed

EXECUTIVE SUMMARY & PRICING:

GoSystem Tax RS is designed for large, multi-office, high-volume tax and accounting firms. The application is especially well suited to those working with the most complex and issue-laden returns, including high net worth individuals, multi-tiered consolidated returns, and taxpayers with compliance requirements in every state and many international jurisdictions. Pricing starts at $2,500 and includes 50 returns and five user accounts. Full pricing is based on the number of returns processed and number of users needed. Custom pricing options are also available.

4.75 – CORE PRODUCT FUNCTIONS/FEATURES

- · Product depth/multi-state

- · Navigation/ease of use

- · Support for special situations

- · Analytical review

- · Electronic filing

5 – INTEGRATION

- · w/in publisher’s own suite

- · w/tax research tools & guidance

- · w/other or external programs

- · w/practice management

- · w/external services

4.75 – PAPERLESS WORKFLOW

- · paperless creation

- · paperless open items

- · paperless review

- · access control for limiting access into returns

- · digital document storage/mgmt.

- · data import/output

4.75 – REMOTE CAPABILITIES

- portal

- remotes access

- 1099 depot

- Outsourced document prep

- Hosting

- Web-based

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs