From the July 2013 issue.

Sales and use tax is one of the three primary areas which legislators use to fund state and local government (the other two major areas are income taxes and property taxes). The concept is relatively simple: if you buy something tangible, you pay a fixed percentage to the local government as a tax.

There are a number of problems: thousands of tax jurisdictions with shifting boundaries, changes in definitions of what is taxable and what is non-taxable, sales of intangible items like computer software and MP3 files, and electronic commerce.

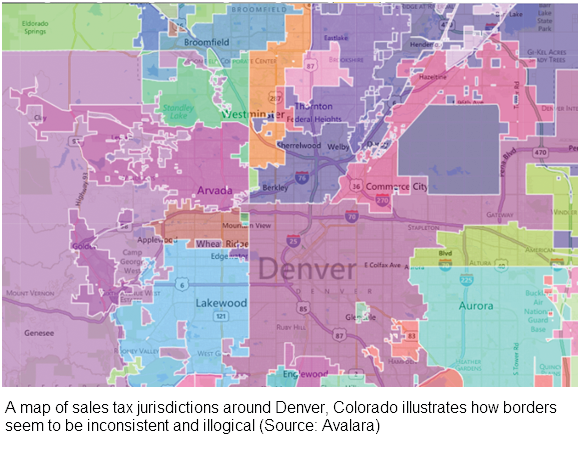

Even a child’s lemonade stand might have to agonize over charging different tax rates for takeout refreshments versus those consumed on the premises. The map of sales and use tax jurisdictions around Denver, Colorado shown below illustrates the challenge of determining where one tax ends and another begins.

As most readers know, online sales are not truly “tax exempt” – the states are prohibited from forcing out of state retailers without a physical presence in a state to collect the tax at the time of sale. While the state still levies the tax on the purchase, the tax cannot be collected economically, and few, if any, states have adequate personnel to audit the millions of citizens who fail to pay use tax.

The National Conference of State Legislators estimates that states lost $23 billion in sales tax revenue payable under existing law due to this problem, often referred to as the “online tax gap”. While this is a significant and growing amount of revenue, the complexity of accomplishing this task is very real.

Some observers estimate that there are over 9,600 sales tax jurisdictions in the United States where online retailers would have to prepare returns, remit taxes, and be subject to audit if this Federal law was changed. Brick and mortar retailers complain that this effectively gives online retailers a price advantage over traditional stores in the amount of the sales tax.

A bill which would change federal law to require retailers with more than $1 million in online sales to collect, report, and remit tax for customers based on where the item will be shipped is pending before Congress. The bill, called the Main Street Fairness Act, passed the Senate in May and is currently pending before the House. Although many legislative observers on both sides of the aisle consider it extremely unlikely that the bill will be approved by the House of Representatives during this Congress, this inequity in our tax system will eventually be addressed.

If the Main Street Fairness Act becomes law, it is likely that the template for charging sales tax will change to follow the principles of the Streamlined Sales Tax. Twenty two states have approved the Streamlined Sales and Use Tax Agreement, which provides a common legal framework for calculating, collecting, reporting, and remitting taxes based on the recipient’s location.

This framework is implemented by using a “Certified Streamlined Sales Tax Service Provider” who is set up to handle this responsibility for a seller. We reviewed three providers of integrated sales tax rate engines, and two of them (Avalara TrustFile and CCH CorpSystem Sales Tax Pro) hold this certification. The third provider, Thomson Reuters ONESOURCE Indirect Tax, reports that they are actively working on this certification for their service.

Our review of sales and use tax compliance solutions is broken down into two segments:

- Sales Tax Preparation Solutions, which are designed to calculate and prepare sales and use tax returns. These applications will generally be used by firms and small businesses who would like to prepare their own sales tax returns.

- Integrated Sales Tax Rate Engines are databases which use address data and geolocation to identify and calculate sales tax rates on transactions entered into a company’s ERP application. These tools require a significant amount of configuration so they can produce accurate tax calculations for each transaction. As a result, these systems are normally limited to midsized or larger organizations with complex tax requirements and difficult tax calculations.

Comparing the solutions is a challenge, as one of the offerings is a tool for filling out forms suitable for any taxpayer, and a different offering in the same review is used almost exclusively by multistate and multinational organizations with billions of dollars in sales.

The solutions we reviewed are:

Sales Tax Preparation

- Bloomberg BNA Sales & Use Tax Forms & Rates

- CFS Tax Software CA & NY Sales Tax Preparer

- Avalara TrustFile Sales & Use Tax

Integrated Sales Tax Rate Engines

- Avalara AvaTax Calc

- CCH CorpSystem Sales Tax SaaS Pro

- Thomson Reuters ONESOURCE Indirect Tax

The challenge for the practitioner is not finding a solution which will meet the needs of a Fortune 500 company, nor is it finding a tool to fill out forms. There will always be tools like this which are either “too big” or “too small” for the needs of small and midsized businesses. The hard part of software selection in this segment is finding the “Goldilocks” solution – that is, the one that is “just right” for the needs of the firm and the client.

One change is that some sources now provide tax rate information by zip code in electronic format for free. TaxRates.com offers tax tables updated quarterly for free which can be imported and set up in accounting software or shopping cart applications. Certain state Departments of Revenue/Equalization also publish lists of rates on their websites.

While “free” is a very appealing word for accounting professionals, we caution users to validate the information obtained from any website for free, as under withholding sales tax (even for a short period of time) can be a very expensive mistake.

Some users are calculating sales tax based on five-digit zip codes instead of 9-digit Zip+4 codes or geospatial location of the subject property. We discourage users from using tables based on five digit zip codes, as multiple jurisdictions frequently exist within a single zip code. Accountants who have to use these tools may want to view the subject property on tax maps or the city/county/state geographic information system (GIS) to validate the borders of the districts in the area before relying on the identified rates and tax jurisdictions.

Even though a comprehensive, free, solution to all sales tax issues is not on the horizon, the tools reviewed are some of the best available to help your clients comply with the thousands of taxes levied on purchase transactions every day.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Sales Tax