While most small businesses expect to be profitable in 2014, less than half of them expect to create new jobs next year, according to a new survey.

The January 2014 SurePayroll Small Business Scorecard and survey shows that there is a mix of optimism and caution heading into the year.

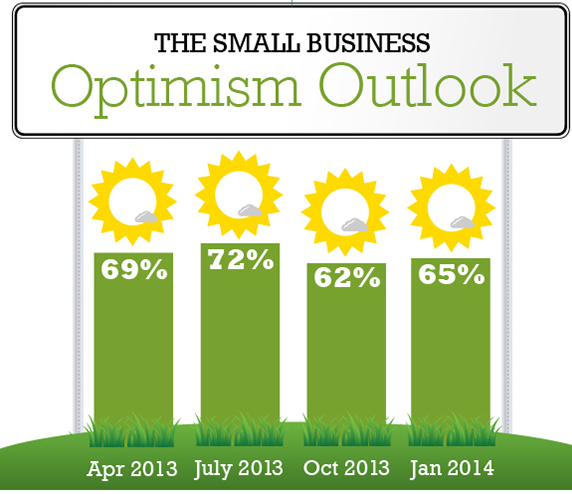

Only 45 percent of the businesses surveyed said they have extra cash on hand to take advantage of hiring and growth opportunities or unforeseen setbacks. Their level of optimism is at 65 percent, down just slightly from 70 percent at the end of 2013.

Fortunately, 80 percent expect to be profitable in 2014 regardless of the economy’s growth rate, barring a major downturn.

“We’re still in glass half empty, glass half full territory. The problem is the glass needs to be full before we see real growth,” said SurePayroll CEO and President Michael Alter. “Small businesses have learned how to profit without hiring during the last two years, and that’s not going to change unless everything lines up just right. Demand has to rise, cash flow has to increase and then there have to be qualified candidates to hire. Small business owners just aren’t seeing that right now.”

Month over month, hiring was down 0.1 percent and paychecks were down 0.2 percent in January.

Hiring in the South and West was flat month over month, and down 0.2 percent in the Midwest and Northeast. The average paycheck was down across the country, dropping the most in the Midwest (-0.5 percent).

As the first economic indicator created by a payroll company, the SurePayroll Scorecard has provided a monthly look at national hiring and paycheck trends since October 2004. SurePayroll's Scorecard compiles data from small businesses nationwide, and exclusively reflects the trends affecting the nation's “micro businesses” — those with 1-10 employees. The average business reflected has six employees.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Accounting, Payroll, Small Business, Staffing