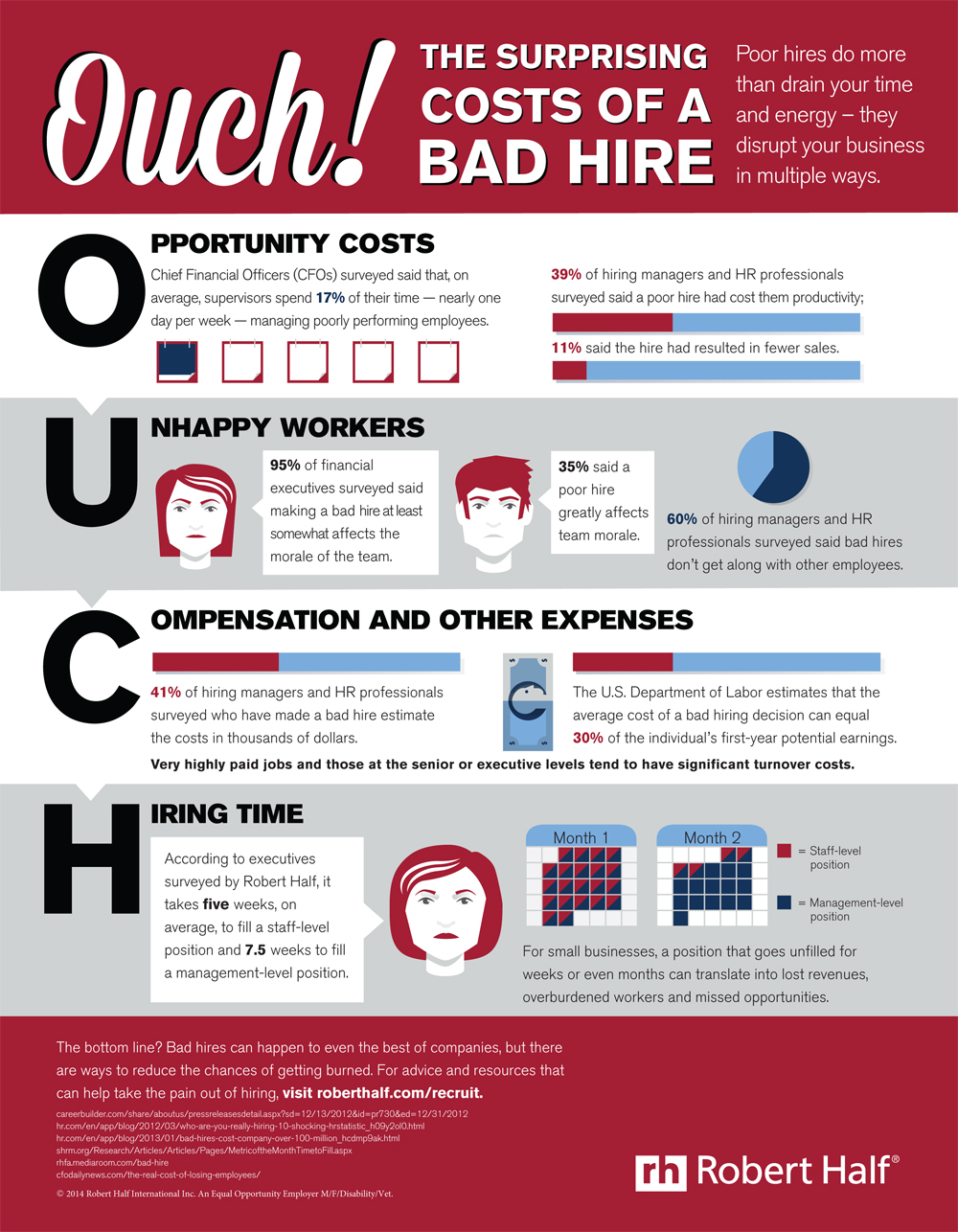

Making a bad hire can be very expensive to organizations. In fact, research suggests (www.blissassociates.com/html/articles/employee_turnover01.html) replacing an employee who doesn’t work out can cost at least 150 percent of that worker’s salary. Still, as expensive as that is, the financial hit isn’t the worst part.

In a recent Robert Half survey, 39 percent of chief financial officers said the greatest cost of a bad hire is lower morale among the remaining staff. Following closely behind was reduced productivity (34 percent). Only one in four respondents cited money as the most significant loss.

Here’s a closer look at how a bad hire can cost your organization, and what you can do to avoid making one.

The cost of a bad hire on morale and productivity

As the saying goes, “One bad apple can spoil the bunch.” There are several reasons new employees don’t work out:

- Their work habits clash with the office culture, which throws a wrench in the normally smooth operation of your accounting team.

- They don’t have all the skills you thought they had, which means assignments — preparing audit reports or financial statements, for example — take longer to complete and are not done as accurately as they should be.

- They have a weak work ethic. When other employees have to scramble to pick up the slack, they feel overloaded and resentful of the new hire.

Furthermore, your own productivity goes down — and stress goes up — because you have to devote time and energy to disciplining bad hires, correcting their mistakes and placating other team members. A separate survey from Robert Half found managers spend almost a full day each week managing underperformers. Because you’ve made a poor hiring decision, your other staff may question your judgment and leadership.

How to avoid hiring “bad apples”

Poor staffing decisions rarely happen by chance. They are usually the result of managers not investing the necessary time and effort into the hiring process. But due diligence is easier in theory than in practice.

Also, because there’s a shortage of skilled talent, it’s tempting to snatch up seemingly in-demand candidates before another firm does. Although you need to act with urgency in the hiring process, if you want to avoid the high cost of a bad hire, you can’t take shortcuts.

Here are some tips for making good personnel decisions:

- Start with a solid job posting. Collaborate with colleagues to create a clear job description, which will drive the job ad and, later, serve as the basis for the new hire’s performance review. Outline the technical skills, soft skills, education and certifications, years of experience, and specific industry knowledge you seek. Think hard about which particulars are required and which are preferred. You don’t want to discourage candidates who have excellent technical abilities but are not experts in your company’s business intelligence software, for example.

- Practice smart recruiting. In addition to posting on job boards, reach out to your staff, professional associations and local alumni organizations and ask whether they know of suitable candidates. A staffing agency can further accelerate recruiting and free up your time.

- Offer attractive compensation. Consult industry resources such as the Salary Guide from Robert Half and your network contacts to benchmark compensation trends. Then put together a highly attractive compensation package. Keep in mind, in today’s hiring environment, you’ll often need to offer salaries that go beyond being competitive to secure the best candidates.

- Check references. Ask finalists for a list of professionals who can attest to their abilities. Don’t skip this step, which can shed light on applicant’s employment history and suitability for the position, as well as how well they’ll mesh with your firm’s culture.

- Work with candidates on an interim basis first. An increasingly popular and cost-effective hiring strategy is the temporary-to-hire model. Bringing in interim accountants can lessen the load on your existing staff and allow you to assess a candidate’s skills and compatibility with your team in real time. If the candidate is a good fit for the position and your company, you can extend a full-time job offer.

When you make a poor staffing choice, you’re not the only one who pays the price; your budget, staff and new employee also suffer. The best way to avoid the high cost of bad hires is to take the necessary steps at the front end of the hiring process. Once they join your staff, it will be much harder and more expensive to repair the damage to your organization.

———–

Paul McDonald is senior executive director with Robert Half, the world’s first and largest specialized staffing firm. Over the course of his 30-year career with the company, he has spoken extensively on employment and management issues based on his work with thousands of companies and job seekers.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Accounting, Firm Management, Staffing