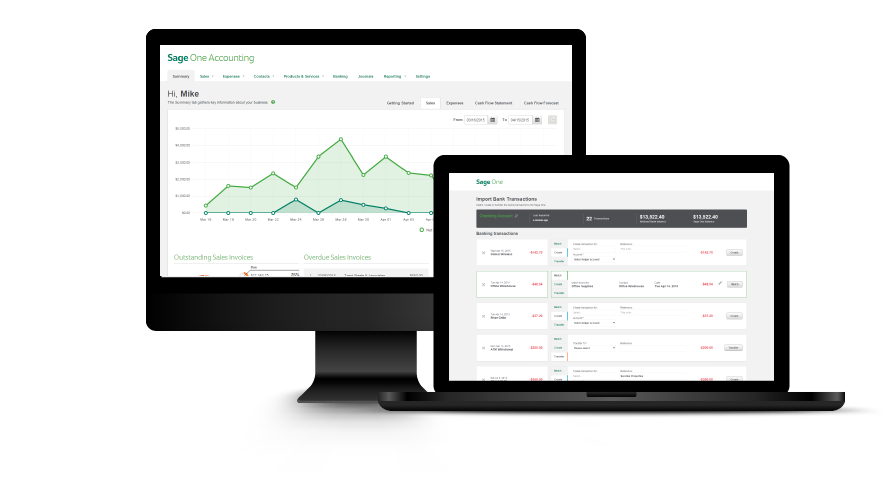

New features and a new pricing model are now available to small businesses who use Sage One Accounting, a cloud-based small business accounting, invoicing and management system from Sage North America.

Sage One Accounting is available in free and premium subscription versions, offering features for electronic invoicing, cash flow management, and financial analysis. Designed for new and growing small businesses, Sage One Accounting helps small business owners take care of their daily tasks quickly so they can get back to running their business.

In the 2015 State of the Startup Survey, Sage found that 36 percent of surveyed small business “nurturers” (third parties such as venture capitalists, angel investors, accountants, and attorneys) indicated they have a somewhat to extremely low trust of financial statements they receive from startups. At the same time, when startups were asked about how they handle accounting for their business, 21 percent do accounting manually on paper, while 27 percent use their own home-grown system.

“All small businesses need access to a simple and efficient way to manage their accounting and invoicing needs to ensure their finances are in order, while instilling confidence in their customers and partners,” said Mike Savory, Sage One product manager, Sage North America. “Sage continues to listen to the needs of small businesses, and we believe they will find Sage One Accounting ideal for organizing finances, preparing for tax time, and partnering with their accountant, all while putting themselves in a position for growth.”

Sage One Accounting allows small businesses to perform accounting tasks and cash flow analysis to make better strategic financial decisions for their business, including:

- Tracking income and expenses.

- Receiving online payments with Sage Payment Solutions and PayPal.

- Managing receivables and payables.

- Printing financial reports.

- Batching enter transactions.

- Managing and planning cash flow.

- Linking with bank and credit card accounts.

- Reviewing data by analysis codes.

- Accessing by mobile device.

The free subscription of Sage One Accounting provides small businesses with the tools necessary to perform accounting tasks, including the ability to send five invoices per month, link a bank account, and create unlimited quotes, expenses and bills. The Sage One Accounting premium subscription is available for $10 per month, with a $5 per month introductory rate, offering unlimited expenses, invoices and bills, and quotes and the ability to link to an unlimited number of bank accounts. This subscription also includes multiuser and multicurrency options.

Small businesses working with the Sage One Accounting premium subscription will be able to collaborate with their accountant using Sage One Accountant Edition. Sage One Accountant Edition allows accountants to connect with their clients’ data from anywhere, all in one place.

“Other solutions in the market can be overwhelming for small businesses,” said Shayna Chapman, CPA.CITP, CGMA, and owner, Shaynaco LLC. “I feel that Sage One Accounting will fill a gap for my clients that are currently using manual means for accounting without barriers to entry. My clients will have a better handle on their financials, and I can make better recommendations; everyone wins.”

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Accounting, Firm Management, Small Business