Revenue from sales and use tax is typically the main funding source for city, county, and state governments. Because of the importance of this funding stream, these entities are frequently aggressive when collecting. The good news is that for the small business owner with a single location, tracking and paying sales and use tax is fairly uncomplicated.

However, the stakes rise when that same business adds a second location, or a web store, or opens a location in a different state. Suddenly that small business owner is faced with a much more complicated sales tax tracking scenario.

It’s not just tracking additional jurisdictions that can become problematic. Sales and use taxes change much more frequently than other taxes such as income tax or property tax, so ensuring that a business is charging the correct amount of sales tax, and remitting that same tax to the proper taxing agencies on a timely basis, can be challenging without some help. While some business owners choose to use CPA firms to handle their sales and use tax calculations and payments, other may wish to handle tracking and payment in house.

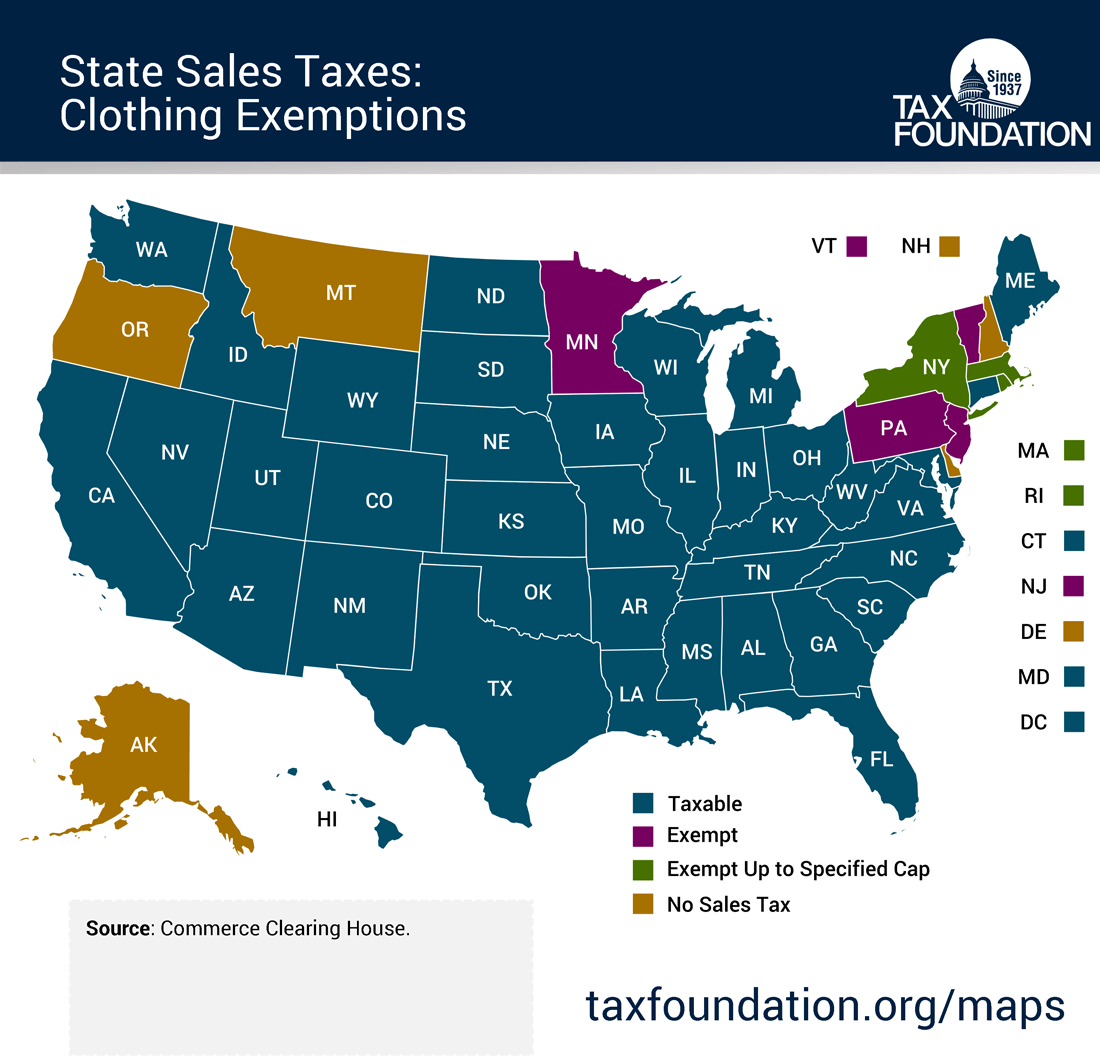

Businesses also have to be aware of temporary tax rates that cities, counties, and states frequently implement when looking to fund a community or state project. The popularity of tax holidays that are timed to coincide with back-to-school shopping have also become popular in recent years. Add to that the difficulty in tracking tax exemptions, and suddenly sales tax tracking and management has become a major endeavor.

Because of the increased complexity of tracking sales and use tax, an increasing number of businesses have faced fines and penalties for not collecting the proper tax amounts. These non-compliant businesses have two options; they can contact a tax professional who can assume responsibility for tracking and paying sales and use tax on their behalf. Or they can explore the various sales and use tax products that are available to aid them in tracking and calculating sales tax properly. Either solution will likely require a product such as the ones reviewed here.

The products in the review are divided into three distinct buckets:

- Rates & Forms Tools – which provide quick access to tax rates for thousands of tax jurisdictions. The Forms tool provides a comprehensive library of tax and related forms for users to access and complete.

- Sales Tax Preparation – is designed for those with less completed sales tax challenges. These products can help both business owners and accountants prepare and file returns and contain the ability to e-file returns and pay tax electronically.

- Integrated Sales Tax Rate Engines – are designed for businesses with more complex sales and use tax needs. These engines are designed to integrate with existing accounting software and work behind the scenes, ensuring that every customer entered into the system and every invoice produced will have the correct sales & use tax calculated.

Each of these buckets are designed to provide very specific functionality for specific markets, making it impossible to assign a star rating to the products. What we did is provide readers with a list of product strengths, potential weaknesses, and a summary of product features and functionality, along with pricing guidelines.

Whether you’re helping your client find a product that will allow them to track their own sales and use tax, or are searching for a product that will allow you to offer your clients this same service, these reviews can provide a brief overview of some of the products available.

The bottom line is that small, local businesses and well as multi-state businesses both need a way to track sales and use tax accurately and timely. These reviews can help identify the solution.

2015 Reviews of Sales & Tax Compliance Systems

-

Avalara AvaTax – Sales Tax – Cert Capture – Returns

-

Avalara TrustFile

-

BNA Sales & Use Tax Rates and Forms

-

CCH Sales Tax Office

-

CCH Sales Tax SaaS

-

CFS Software Sales and Use Tax

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Automation, Sales Tax, Software, State and Local Taxes