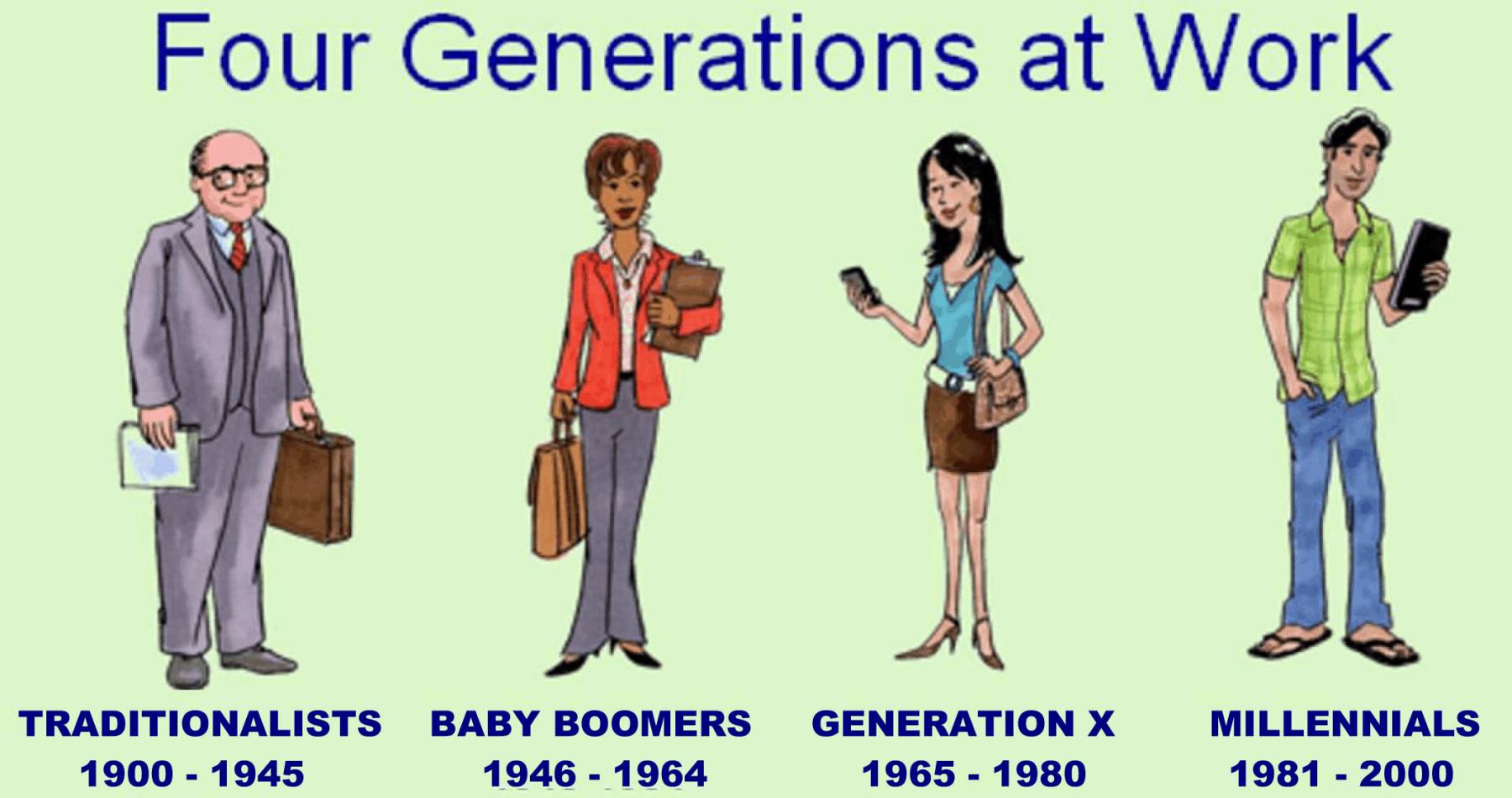

As the overall economy continues to expand and improve, in virtually every industry employers are finding it increasingly difficult to hire employees. The number of baby boomers reaching retirement age, estimated to be almost 10,000 each day, makes the labor shortage even more acute. In addition to the loss of their services, baby boomers who leave take with them institutional knowledge, operational know-how and informed best practices that may be difficult or even impossible to replace. Such losses are likely to continue for at least several more years if not longer.

Despite spending on average almost $4,000 to fill an open position, employers are finding that those tech-savvy millennials, Gen X, Y and Z new hires, often jump ship in a matter of months, if not sooner. Studies have confirmed that millennials change jobs on average every six (6) months or so, usually seeking higher salaries or more responsibility. They rarely, if ever, take a job intending to make it a career. More often, they use one job as the jumping off point for the next. They are always looking for that job with the perfect work/life balance.

In many cases these job-hopping Gen X’ers and millennials are not staying on the job for sufficient time to learn from the experienced older workers who depart. Having grown up with PCs, smart phones, e-mail and texting, they are more focused on electronic communication and social media than acquiring the needed practical job experience. As a consequence, much of the unique knowledge and business awareness possessed by the retiring employees will be lost.

Given the difficulty in finding suitable applicants to fill open positions, it should be no surprise that employers across most industries are seeking to attract and retain older workers. If they have not already considered this potential pool of experienced workers, perhaps they should. There is no question that, in general, the nature of most work today permits workers to be productive much longer than in the past.

An Older Workforce

According to Inc. Magazine, more than 76,000,000 Americans will soon reach the age of 60 or older, and many plan to continue working. In many cases out of necessity. The relaxing retirement that so many dreamed of has become unaffordable on the limited income from today’s pensions or recession-impacted 401K plans. Most workers are understandably concerned that they will outlive their retirement money. It is estimated that for an employee to be able to retire comfortably by the age of 67, they should have ten times their annual earnings in retirement funds.

Given life expectancies into the 80’s and beyond that have become the norm, outliving their funds is clearly a legitimate concern. In light of these realities, the greying of the workforce should come as no surprise. According to the Bureau of Labor and Statistics, 25% of all workers will be age 55 or older by 2020. In fact, today employment of persons 65 or older has more than doubled. We will soon, if not already, have multiple generations working alongside each other in most workplaces.

Employees are Like Fine Wine. They Get Better with Age.

There have been numerous studies and articles over the last several years describing the benefits that older workers bring to the workplace. All consistently agree on the virtues of employing “seasoned” employees. The benefits resulting from employing such persons described in these articles are numerous, to say the least. Many relate to the experience and dedication they bring to the job. Most have had a varied work history, utilizing a range of skills that the 20-somethings just do not have today. They obviously require less training for most jobs, and in fact can actually be mentors or trainers to less experienced employees. In addition, they are generally less concerned with the work/life balance and time off that most millennials seem to value most. They rarely take time off and almost always report to work on time. If some of the “seasoned” employees that are used as mentors are potential retirees who were convinced to stay longer, it has the added benefit of curtailing the loss of institutional knowledge.

One blogger on the issue, Lewis Lustman, a Los Angeles journalist, provided an excellent summary of the advantages to employing “seasoned talent”, as he describes older workers. He specifically noted that, among other things, older employees are:

- A steady and reliable source of skilled labor;

- Bring years and often decades of experience;

- Are more flexible in their work schedule;

- Are not job-hoppers;

- Are more focused on their tasks;

- May have some computer skills and are eager to learn;

- Are generally willing to mentor younger employees.

He also suggests that in terms of fringe benefit costs, older workers may have lesser health insurance requirements than younger employees with families. Many are on or eligible for Medicare.

Conclusion

Given the competitive labor market that we find ourselves in today, no company can afford to overlook potential employees that could help contribute to a successful operation, especially those that come ready to work. Sixty may truly be the next forty. Perhaps your company can benefit from this development. Why not take a chance!

———–

Richard D. Alaniz is a partner at Cruickshank & Alaniz, a labor and employment firm based in Houston. He has been at the forefront of labor and employment law for over thirty years, including stints with the U.S. Department of Labor and the National Labor Relations Board. Rick is a prolific writer on labor and employment law and conducts frequent seminars to client companies and trade associations across the country. Questions about this article, or requests to subscribe to receive Rick’s monthly articles, can be addressed to Rick at (281) 381-2219 or ralaniz@cruickshank.attorney.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs