Sponsored Content.

Intuit QuickBooks is a powerful platform designed to help accounting professionals and small businesses gain important insights into the performance of their businesses and help them succeed. Recognizing that small businesses and accountants interpret accounting concepts and terminology differently, Intuit has recently taken steps to evolve both the QuickBooks Online and QuickBooks Online Accountant experiences to better meet the specific needs of both.

For accounting professionals, recent QuickBooks Online Accountant enhancements include an updated Accountant Toolbox, enhanced Prep for Taxes functionality, and the Business Performance Dashboard. Intuit is also improving the experience for small business owners within QuickBooks Online by offering them a new user interface, simplified terminology and more intuitive workflows. These innovations, which will continue to evolve in the coming months, will help small businesses better understand cash flow, expense workflow, and the effect these and other indicators have on the health of their businesses. Simultaneously, the enhancements will also drive efficiencies for accounting professionals and allow them to focus on being a trusted advisor to their clients.

Accountant View and Business View

The first innovation is the new Business View. Though still in its infancy, the vision is for the Business View to display new terminology, navigation, guidance, and data visualizations that will help business owners get more work done with greater accuracy. The original view of QuickBooks, which is still available and expected to be built out even further for power users, is now called Accountant View.

“We conducted research with customers coming into QuickBooks Online and discovered that the time was right to stop fooling ourselves that one user interface was going to work for small businesses and accounting professionals,” says Richard Blitz, a group product manager with QuickBooks. “We were faced with ‘one size fits none,’ which was unsatisfactory for accountants because it didn’t offer the powerful features they needed, and challenging for small businesses, who needed something more intuitive so they could more easily — and correctly — complete their key workflows.”

Business View is also intended to help new users get started quickly. It avoids accounting language, reduces complexity in workflows and forms such as invoices, gives guardrails to help users get the accounting right without needing a textbook, and puts cash flow front and center, since that’s what most small business owners care about most.

For example, Blitz says something as intuitive to accountants as the word “expense” wasn’t clear to small businesses because it didn’t speak their language. Currently, the primary difference with Business View is a new cash flow chart on the dashboard and new terminology in the +New (create) menu. Instead of “Customers, Vendors, Employees, and Other,” Business View users will see “Money In, Money Out, and Other” as the headers.

“We’ll keep small businesses focused on their cash flow with the new Business View, since that’s the most important thing for them, but accounting and bookkeeping professionals who understand their clients’ books need a broader view, which they can still get with the Accountant View,” says Blitz.

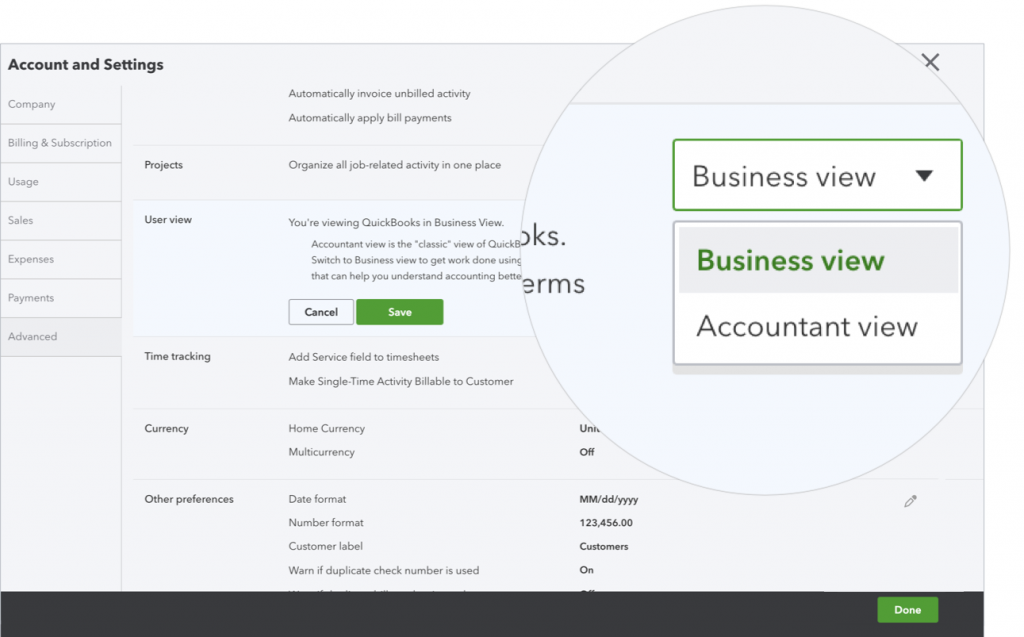

Accountants who prefer the previous interface for their clients can easily switch them back to the “classic” Accountant view. To learn more about how the two views work, check out this short video (https://bit.ly/2T4rQwC) by Intuit product specialist Woody Adams, which shows the new experience, and how to switch from Business View to Accountant View. You can also go to Account and Settings → Advanced → User View, then toggle to “Accountant View” and click Save. In addition, to help accountants and bookkeepers understand and communicate the differences, Intuit created a simple translation guide. Note that Intuit is still learning what will work best for users, and terminology may change.

Tagging

Tagging is also new to QuickBooks. With tagging, QuickBooks users will be able to search for data and report on it, without having to use the chart of accounts. Tagging is available in both Business View and Accountant View.

“Tagging is a super flexible way to allow small businesses to track what they need to know to actually run their businesses rather than focusing just on accounting,” says Blitz. “In our discovery, we found that customers wanted a way to capture different dimensions of things they care about for their businesses.”

Consider the owner of several yoga studios with multiple instructors, locations, and class levels. Instead of using the chart of accounts to track the most profitable classes by location and level, tagging enables the business owner to cut the data by any configuration with a simple click.

While QuickBooks users can start with “flat” tags that can be used as simple bookmarks, Blitz suggests as tagging becomes more intuitive a more powerful approach is to group them together so they can be compared with a click.

“Despite tagging and the new view for businesses, what hasn’t changed is how important it is to demonstrate your value to your clients,” he says. “It’s very important that accountants and bookkeepers work with their clients so they can understand how to use tagging and other features to take these insights to the next level.”

Initially, tagging will be available in bank feeds and on most money in and money out forms, with more to follow. In addition, tagging is not replacing classes/locations. In fact, accountants and bookkeepers will still be able to reserve the chart of accounts, classes, locations, and custom fields for tracking any business-critical information, while letting business owners track their front-of-house information their way using tags.

iOS experience

One more innovation is worth noting: a revamped QuickBooks Mobile app launched for iOS customers. Intuit previously launched a new Android app in December 2019. Now, with the iOS release, QuickBooks has a brand new look for the mobile app that revamps nearly everything about the app: new navigation, new global create, new zero states with updated messages and images, redesigned list pages to drive faster focus to important information, cleaned-up transaction forms and a revised dashboard.

Stay Tuned for More Updates

As always, Intuit will share the progress of these and other updates on www.firmofthefuture.com, with learned insights from accountants and business users. If you’d like to provide feedback on the innovations mentioned above, please take a moment to share your thoughts here.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs