On March 21, the IRS officially announced that the April 15 deadline for filing 2019 tax returns, and paying any tax liability, was extended to July 15. But that may not be the last move by Uncle Sam. Now the White House is reportedly contemplating a second extension.

Although talks within the Trump administration are still in the preliminary stage, NBC news has reported that the deadline could be postponed again to September 15—or even as late as December 15.

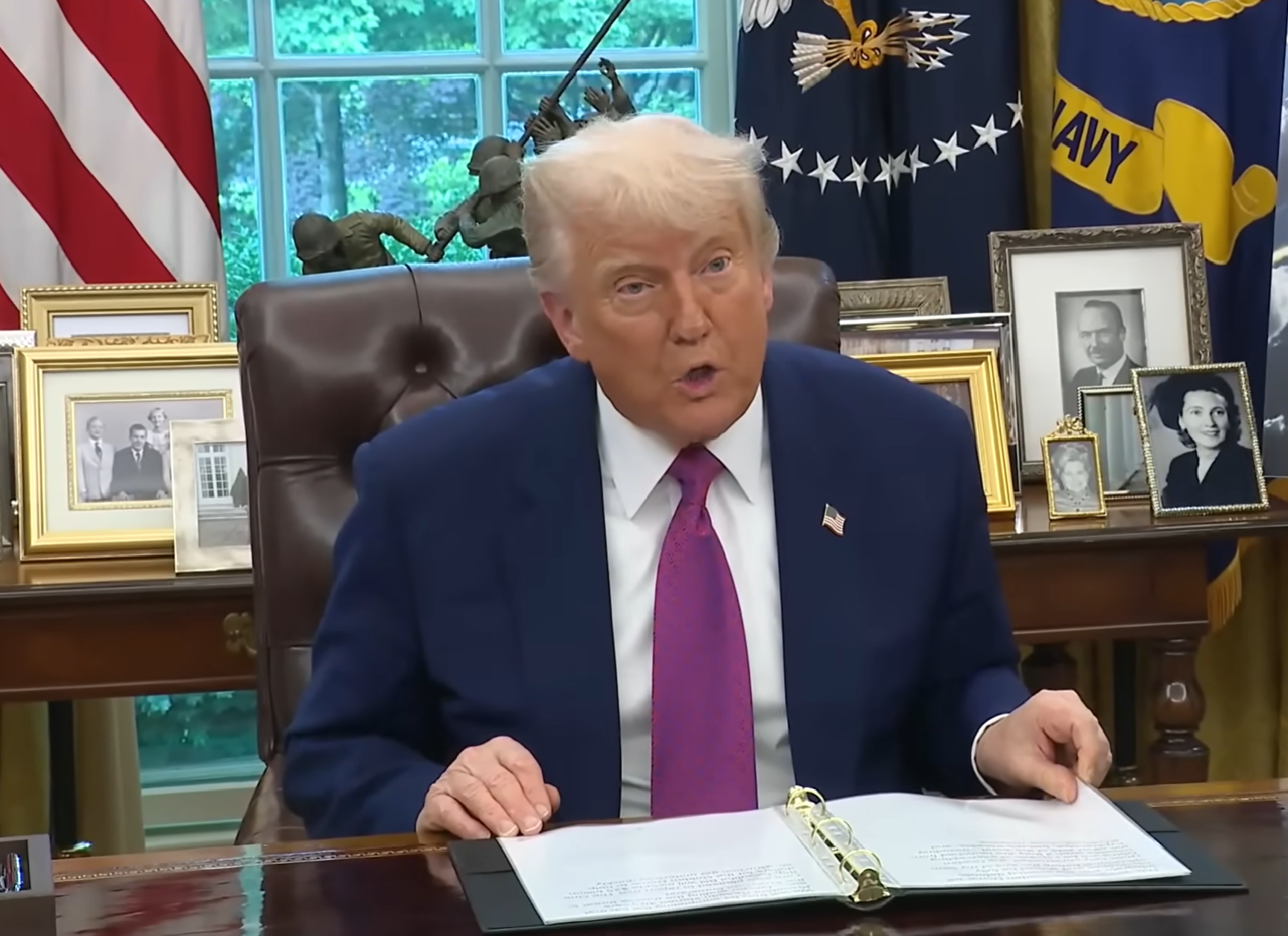

“As President Trump has said, we are going to ensure that we take care of all Americans so that we emerge from this challenge stronger and with a growing economy, which is why the White House is focused on pro-growth, middle-class tax and regulatory relief,” Judd Deere, White House deputy press secretary, told NBC.

“The President’s bold policies of low taxes, deregulation, reciprocal trade and energy independence took this economy to record-setting historic highs once, and they will do so again,” he added.

The White House is obviously concerned about the toll the COVID-19 pandemic is taking on the nation’s economy. Among other ideas being floated around the nation’s capital, such as another round of stimulus payments or an even bigger financial boost, it’s thought that pushing back the tax filing deadline to at least the autumn would provide some relief.

When the IRS initially delayed the tax filing deadline for individuals from April 15 to July 15, it also extended the time for paying the first quarterly installment of estimated tax of 2020. Subsequently, it also pushed back the due date for the second quarterly estimated tax payment, as well as tax payments required for estates and trusts, to July 15. It’s not clear if another extension would apply to these other tax payment requirements.

There are, however, some critics of the proposed plan. They point out that postponing these tax deadlines could result in a massive tax payment being due at one time. For instance if all the due dates are delayed to December 15, a taxpayer might be responsible for paying the 2019 tax bill plus three quarterly installments of estimated tax—with another estimated tax payment due just a month later on January 15. Also, don’t overlook state income tax requirements.

Human nature being what it is, taxpayers likely won’t be prepared for this type of scenario. Thus, another delay could actually cause more harm than good.

Alternatively, the tax deadlines could be staggered to avoid a huge one-time hit. At this point, it’s likely that other options will be considered. We will keep you posted on any significant developments.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Income Taxes