If you or your clients have fixed assets, they’ll need to properly managed. Since fixed assets are anything of value that is estimated to last for more than one year, they can include items such as laptop computers, printers, machinery, heavy equipment, tools, vehicles, and even real estate. You may have a single fixed asset or you might be responsible for thousands.

In any case, the assets need to be managed. Management can mean anything from calculating depreciation to keeping track of where those assets are. Fixed asset management also includes maintaining maintenance schedules, current condition, repairs, and depreciation schedules. If assets are used by others, you’ll also need to track where they are and when they should be returned.

Because fixed assets are long-term assets, there needs to be a way to properly manage them throughout their useful life until they’re retired or disposed of. In past years, fixed asset management consisted of depreciation schedules entered into spreadsheet software. Today, with the use of barcode technology and related software, it’s much easier to track the whereabouts of each asset at any time.

Of course, there are other reasons why using fixed asset software can be beneficial:

- In the past, fixed asset software was used primarily to track assets and manage depreciation schedules. In recent years, most applications have added the option to track assets such as tools and equipment that are used or assigned to multiple areas.

- Fixed asset software can also track things such as maintenance schedules, repairs, and warranties, so you’ll always know the true status of every asset you own.

- You’ll be able to finally toss all of those spreadsheets. While keeping a spreadsheet for depreciation purposes is common even today, you’ll be able to eliminate the need to use multiple spreadsheets to track where assets are, how much depreciation you’ll need to expense, and which employee is currently using which laptop computer.

- Reports will be more accurate. Imagine how easy it will be to just enter a few report parameters and have an accurate fixed asset report.

The products reviewed in this issue vary widely, with a focus on fixed asset applications that can be used as a stand-alone fixed assets management solution. While products such as Acumatica Fixed Assets and Sage Intacct Fixed Assets are robust, powerful fixed asset management applications, both are designed to be used solely within a financial suite and not as a stand-alone application, so programs such as those are not included in this year’s reviews. The products reviewed in this issue include:

- Bloomberg Fixed Assets

- CCH ProSystem fx Fixed Assets

- Intuit Pro Series Fixed Assets Manager

- Moneysoft Fixed Asset Pro

- Pro-Ware Asset Keeper

- Thomson Reuters Fixed Assets CS

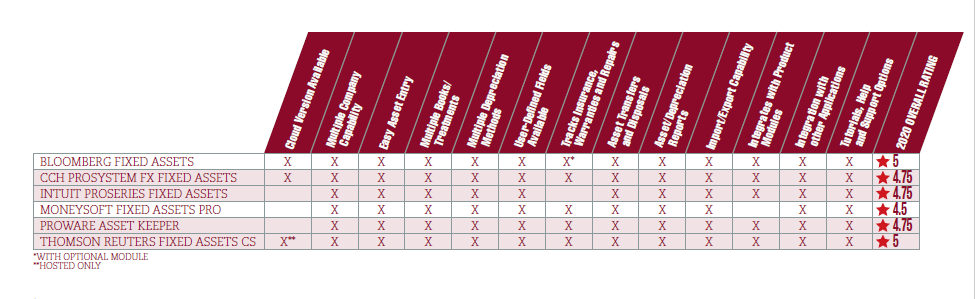

The below chart includes major features and functions is also available, highlighting the availability of features such as deployment method, multiple book support, multiple depreciation methods, and integration capability. Some of the applications are designed for businesses to manage their internal fixed assets while others are designed to track assets that are constantly in motion or are located outside the office. Many of the applications can also be used by CPA firms for tracking and managing their client’s fixed assets.

(Click to enlarge chart.)

Several of the applications we’ve reviewed also offer a free demo that you can test drive in order to get an idea of exactly what the application can do and if it includes the features that you’re looking for. We recommend that you do so.

It’s 2020. Time to ditch the spreadsheets and start managing your fixed assets the right way. Check out the reviews, download a few demos, and find the application that is right for you.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

![bigstock_Word_Cloud_Asset_Management_53085661_1_.590a554202838[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/2020/08/bigstock_Word_Cloud_Asset_Management_53085661_1_.590a554202838_1_.5f21b080dea7f.png)