Fixed Asset Pro

MoneySoft

From the 2020 reviews of Fixed Asset Management systems.

Fixed Asset Pro from MoneySoft is well-suited for small to mid-sized businesses that require a solid asset and depreciation management application. Fixed Asset Pro’s features include excellent importing and exporting options as well as the ability to handle an unlimited number of companies. Designed as a stand-alone application, Fixed Asset Pro is deployed as an onsite solution that should be installed on desktop or network computers.

Along with an unlimited number of companies, Fixed Asset Pro also supports an unlimited number of assets, and users are able to easily import asset data from third-party applications, with the help of the included import wizard.

Entering new assets is easy, as the main asset entry screen is easily navigated. Tabs are available to access other program options including the Multi-Book Asset Entry option and the File Cabinet, where information such as warranty and repair records and maintenance schedules can be stored. When entered, each asset is assigned a unique identifying number, although users have the option to assign a custom number as well.

Each asset record in Fixed Asset Pro can include a detailed description of the asset, the date the asset was placed into service, the useful life of the asset, the business and investment percentage of the asset, along with later entries such as salvage value of the asset, disposal date and price, and any Section 179 deductions taken. Users can also track information such as product serial numbers, current custody of the asset, the current condition, and any investment tax credits taken.

Fixed Asset Pro can support up to six sets of books including Financial, Federal Tax, State Tax, Alternative Minimum Tax (AMT), and Adjusted Current Earnings (ACE) with a user-defined book available as well. The application includes 36 MACRS methods including regular MACRS, alternative MACRS, and straight-line MACRS. In addition, 6 Pre-1981 GAAP methods are available as are 24 ACRS methods with amortization, and manual depreciation entry options are available in the application as well. One useful feature is the ability to enter each asset once, with all sets of books automatically updated. Users can easily process asset disposals throughout the year, as transfers and exchanges are supported in the application as well.

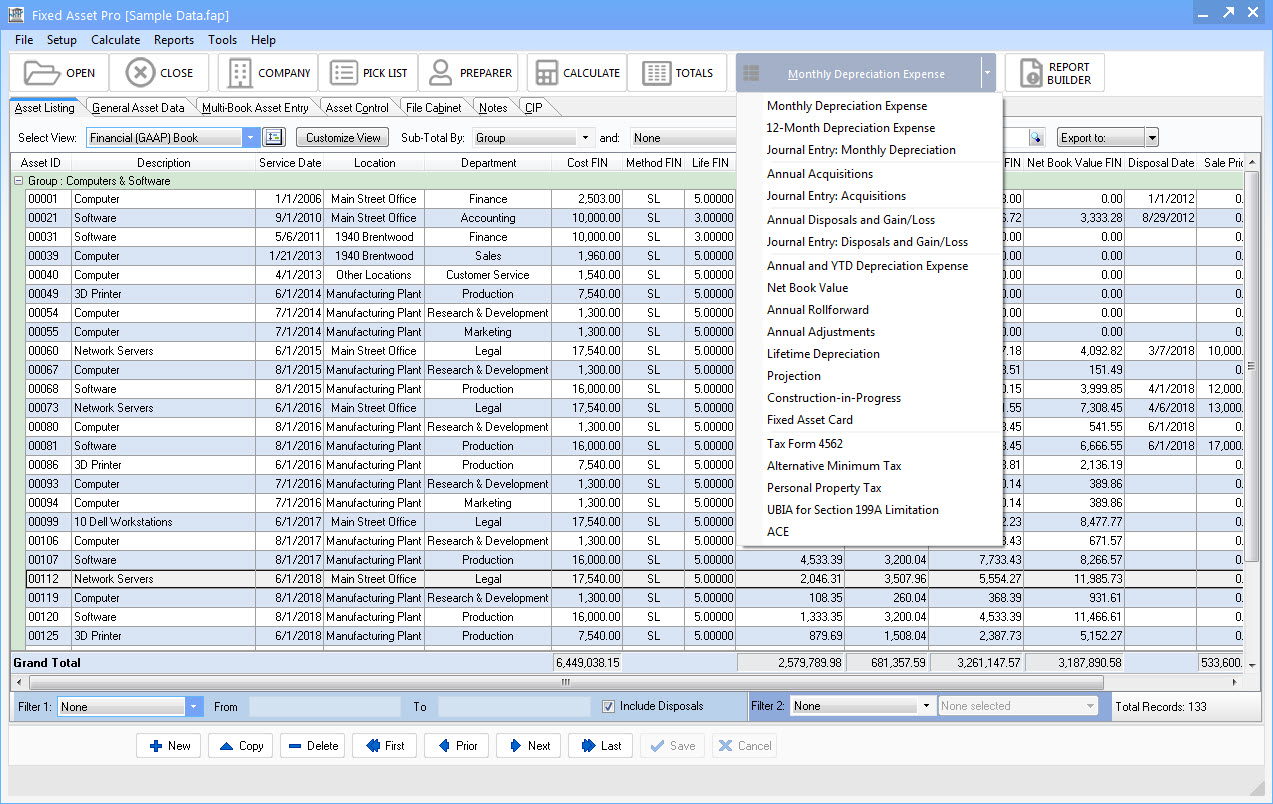

Fixed Asset Pro offers a solid selection of asset and depreciation reports including a summary report for each book. Other reports available include Monthly Depreciation, Asset Acquisitions, Asset Disposal with Gain/Loss, Year-to-Date Net Book Value, and a Tax Depreciation Form 4562 report. Reports can be created for multiple years, and users can choose from a variety of sorting and subtotaling options for any report. As a bonus, all reports include the Flex View grid, which creates a custom view for each report. There is also a report builder included in the application for creating custom reports and customizing existing reports, or users can export all Fixed Asset Pro reports to Microsoft Excel for additional customization. Reports can also be saved as an RTF or PDF file.

Fixed Asset Pro is designed to be used as a stand-alone application, and it includes excellent import and export capability using a variety of file formats including Microsoft Excel, Word, XML, RTF, CSV, TXT, PDF, Dbase, QuattroPro, SQL and Access.

MoneySoft technical support is available via telephone, email, and online chat, with the cost of support included in cost of the application. Users can also download a PDF of the MoneySoft user manual which offers guidance on product setup as well as step-by-step instructions. Additional help functionality is available throughout the application via the F1 key. Fixed Asset Pro also offers a variety of training options including online training which is completely customized for each customer, and introductory overviews to in-depth product instructions are available.

Fixed Asset Pro is currently available for $499.00 for a single user system, or users can opt to purchase a site license for $599.00. Those interested in Fixed Asset Pro can request a demo, access the product video, or purchase and download the application from the MoneySoft website.

2020 Overall Rating – 4.5 Stars

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs