eFileSalesTax.com

From the 2020 reviews of sales tax compliance systems.

eFileSalesTax.com is a web-based application that offers complete sales tax filing for four states: California, Colorado, Florida, and Illinois. Best suited for small to mid-sized businesses and firms that need to file sales tax returns for any or all of these four states, eFileSalesTax.com offers easy online access. There is no software to install, all that is required is an internet connection and a browser.

Firms or businesses will need to register online prior to using the application. There is no cost to register and a fee is not required until a return is filed. Once registered, users can access and file taxes for any of the four states included in the application, with eFileSalesTax.com supporting all state sales tax filing requirements, including any additional taxes that may be required.

Since eFileSalesTax is an online application, it always provides the most recent tax information. The application is hosted on secure servers that offer SSL encryption, intrusion detection systems, firewalls, and anti-virus software, keeping data secure at all times. eFileSalesTax also offers 99.9 percent uptime, so users should have access to system data at all times.

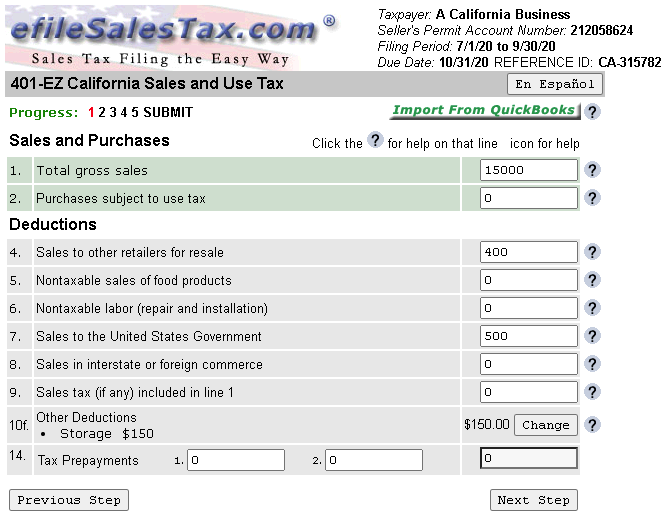

eFileSalesTax.com includes easy electronic filing for businesses in California, Colorado, Florida and Illinois.

eFileSalesTax.com offers QuickBooks users the ability to import customer and sales data directly into the application, with support personnel available to help with importing data from other applications as well. All tax rates are automatically included in the application, with users entering only sales and deduction information. All taxes due are automatically calculated by eFileSalesTax.com

The user interface in eFileSalesTax.com is intuitive, with even new users able to easily navigate through the application. Especially handy for firms handling returns for multiple clients is the ability to have all their clients under a single login, and full access to all historical filings for all clients. eFileSalesTax.com offers complete validation of each prepared return, with users able to e-file or print a paper return for both Illinois and California sales tax returns. Complete instructions are available for any forms. Both filing and tax remittance is available in eFileSalesTax.com, with users able to use ACH transfer or a credit card to remit payment.

eFileSalesTax.com supports all tax districts within each of the four states it covers. California forms supported include: 401-A, 401-EZ, 401-ASR, Schedules A, B, and C, and prepayment form 1150, and users have the choice to e-file or print a return form to file by mail. Florida forms supported include: DR-15, DR-15CS, DR-7, and DR-15SW Solid Waste Surcharge, with users able to file forms electronically directly with the Florida Department of Revenue. For Illinois, eFileSalesTax.com offers forms ST-1, ST-2, PST-2, ST-1x, and ST-2x and for Colorado, the form DR-0100 is supported. The Colorado system does not currently include an option for looking up tax rates or jurisdictions, so users will need to enter rates, sales, and deductions manually into the application in order to process Colorado returns.

All four of the states included in eFileSalesTax.com are maintained separately, although registered users will have access to any of the four states using the same login information provided. eFileSalesTax.com can be used by both businesses and accounting professionals, with the ability to designate the business type during the registration process.

eFileSalesTax.com includes help functionality, with users able to access help features from anywhere. The application also includes complete form instructions, and has an expanded FAQ section that is designed to answer common questions. Those interested in trying out the application can sign up for a free demo, with a complete user guide available to all users once registered and logged into the application. All support costs are included in the price of the application, with both telephone and email support options available.

Firms interested in eFileSalesTax.com can visit the website to register their firm. Pricing for California and Illinois are the same, with 1 filing running $7.95; 4 filings running $29.95; and 12 filings running $89.95. An unlimited filing option is also available for California for $229 per year, and for Illinois which runs $189 annually. Florida pricing is structured differently, with a $39 fee for a single company, while accounting firms that need to file for multiple companies will need to use the Pro version of the application, which starts at $129 per year. Those interested in Colorado filing will need to contact efileSalesTax.com for pricing information.

Strengths:

- Online application

- Rates, forms and schedules updated automatically

- E-filing supported for all states

Potential limitations:

- Offers sales tax processing for only four states (CA, FL, IL, CO)

- Colorado tax system is very limited

2020 Rating – 4.25 stars

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

![efilesale_10148255[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/2020/11/efilesale_10148255_1_.5faab0ec26fc0.png)