Tax technology and services provider Vertex, Inc., has released its annual report detailing sales tax rates and rules changes. The report uncovers emerging trends that may create unique challenges for businesses, specifically as jurisdictions look to make up for lost revenue caused by the ongoing COVID-19 pandemic.

Vertex consistently tracks sales tax rates and rules and produces detailed mid-year and end-of-year reports featuring tax data over a 10-year period. These reports are widely referenced by industry groups and indirect tax think tanks.

The 2020 end-of-year report includes the following jurisdictional highlights:

- 70% of new rates occurred at the district level;

- Although city rate changes returned to their normal pace of change after a spike in the second quarter, 65% of all rate changes were enacted at this level;

- The number of new taxing cities (69) and new district taxes (177) that materialized in 2020 mark one of the highest in each category during the past 10 years;

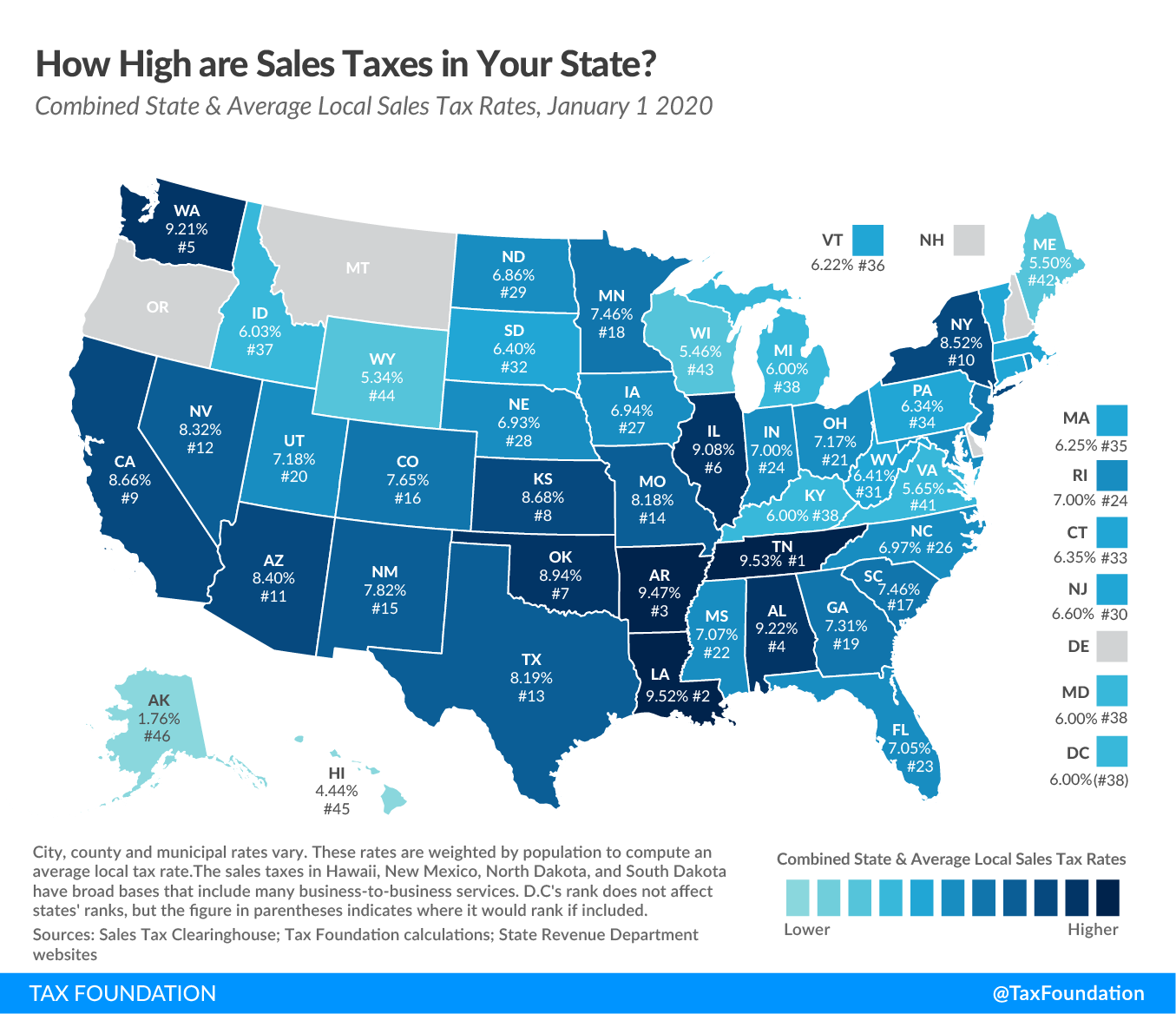

- Sterlington with the Sterlington Economic Development District No. 1, Ouachita Parish, LA now has the highest combined sales tax rate of 12.950; and

- The combined average U.S. sales tax rate (10.12%) across all jurisdictions also reached a 10-year high.

“Although the frenetic pace of rate-change activity we saw in early 2020, in particular with cities, slowed in the second half of the year, indirect tax teams still need to keep their eyes on several possible tax trends this year as all jurisdictions look to recover lost revenue and close COVID-related budget deficits,” said Vertex Vice President of Tax Research Bernadette Pinamont. “Given the number and size of state and local budget deficits, a ‘new normal’ for indirect tax policy and activity is almost certain to emerge.”

Click here to read more detailed trends and analysis from Pinamont. Download the full 2020 report here.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs