In this issue

August 23, 2017

10 Big Tax and Accounting Issues for Small Businesses

Entrepreneurs usually aren’t surprised by the amount of work it takes to get a business up and-running and become successful. But these same small business owners are often blindsided by the time and effort required for tax and accounting issues.

August 23, 2017

Home Office Deductions: The “Hard” Way Versus the “Easy” Way

As a general rule, you may write off the direct expenses of the home office (e.g., painting and carpeting a room) as well as a proportionate share of indirect expenses, such as mortgage interest and real estate taxes, utilities, insurance and repairs ...

August 22, 2017

One Simple Step Toward Better Strategic Business Partnerships

When you make a list of your firm’s strategic business partners, do your technology solution providers make the cut? If your answer is no, you’re likely approaching these relationships in a way that limits your opportunities to truly leverage ...

August 22, 2017

August 2017 Payroll Channel

FMLA provides up to 12 weeks of leave for family or medical purposes. In specific circumstances, employees can take up to 26 weeks of protected leave. Employees are able to take leave to bond with new children, care for ill family members, or take ...

August 22, 2017

How to Build a Tax Planning Practice

Two words, consistency and focus. We all talk about providing tax planning services, even our websites talk about tax planning and tax consulting services. The harsh reality is that most CPAs only dream of having the time to do tax planning.

August 21, 2017

How Client Experience Can Make Or Break A Firm

If firms are to maintain consistent, positive contact with clients and build strong relationships over time, they require technology designed to support client experience. Today, firms have the back-office (or “back stage”) work covered when you ...

August 21, 2017

The 2017 Under 40 Honorees: Breaking New Ground on All Levels

This year’s 40 Under 40 and 20 Under 40 honorees are visibly and incrementally changing the accounting profession through their exemplary leadership, their innovative thinking, their collaborative efforts guaranteed to provide unity to the ...

August 21, 2017

Elevating Roles in the Face of Automation

It is nearly impossible to exist in our profession without hearing about artificial intelligence (AI), automation, and job loss. You may already see it in your firm when software assembles and delivers tax returns or a trial balance is imported into ...

August 21, 2017

Franchisees Welcome Bill to Reverse Joint Employer Rule

Franchise owners, particularly in the restaurant industry, are applauding the introduction of the Save Local Businesses Act in the U.S. Congress, legislation that would reverse expanded joint employer standards set by the National Labor ...

August 21, 2017

August 2017 Tax Channel

Although taxpayers can claim valuable income tax write-offs for gifts of property to charity, they should not get greedy. If a taxpayer doesn’t have the proper records to back up the claims, most or all of the deduction may be denied.

August 21, 2017

PBC Lists – Prepared By Client Lists Now Automated

Over the past years, we have discussed paperless techniques, 1040 workpaper products, optimizations of processes, streamlining workflows, the use of portals, encrypting email, as well as other tools and techniques to make our work easier, faster and ...

August 21, 2017

A CPA’s Guide to the New EEO-1 Report, and Why It Matters

Employers of all sizes rely on accounting professionals to manage and report on their financial performance. With ever-shifting regulations and compliance demands, the traditional role of accounting professionals is evolving.

August 21, 2017

6 Ways for Managers to Improve Communication

Your accounting team works hard, and everyone stays in sync most of the time. But every once in a while you wonder why certain tasks aren’t done well or why an employee seems disgruntled. The problem could be you.

August 21, 2017

August 2017 Small Business Channel

The costliness of errors in valuation is one reason accountants and others performing valuations spend hours to earn professional accreditations, and it is one reason professional associations develop standards for business valuations.

August 21, 2017

When Starting Your Firm, Consider Your Future

Early on, Kelly discovered ProSeries comes with a great deal more than a recognizable name. She also gained one of the largest communities of tax professionals she can turn to for help and a passionate Intuit team committed to helping her.

August 21, 2017

Phishing Scams: Don’t Take the Bait

The scammers have “gone phishing.” This is the crime of using emails, websites and social media to steal your confidential information off your computer. The devious cyber crooks may convince you to install malicious software by having you click on a ...

August 21, 2017

August 2017 Firm Management Channel

A study by the Peterson Institute for International Economics found that firms with women in the C-suite were more profitable. Meanwhile, the number of women-owned businesses grew 45 percent from 2007 to 2016 compared to just a 9 percent growth in the ...

August 18, 2017

Apps We Love August 2017: Document Sharing

File sharing and collaboration are no longer for the tech crowd, but are essential tools of client service and teamwork. File sharing apps not only allow users to stay focused on the task at hand, and the right document version, they can also ...

August 18, 2017

AICPA News – August 2017

Recent news and alerts from the American Institute of Certified Public Accountants.

August 18, 2017

How to Settle Tax Debts With the IRS

Are any of your clients up to their ears in debt to the IRS? Tell them to listen carefully: You don’t have to flee the country or pull off a bank heist to get out from under. There are a couple of ways to resolve a tax debt in a reasonable manner ...

August 18, 2017

2017 Reviews of Professional Tax Preparation Software

Tax compliance systems are a necessity for the busy tax professional that annually has to sift through the latest laws, what may become law, or what is no longer relevant in order to accurately prepare tax forms for their clients.

August 18, 2017

New Tools Help Tax Practices Thrive

This competition and need for increased productivity has driven technology innovation in the last few years, from tax document automation, to increased integration options, and mobile expense tracking apps that are focused on keeping solid records for ...

August 17, 2017

Employers Concerned Over Heightened Immigration Enforcement

Issues surrounding immigration have been a focal point for employers since the 1986 passage of the Immigration Reform and Control Act (IRCA). The effects of that law and its requirements have made the hiring process a source of major concern for many ...

August 16, 2017

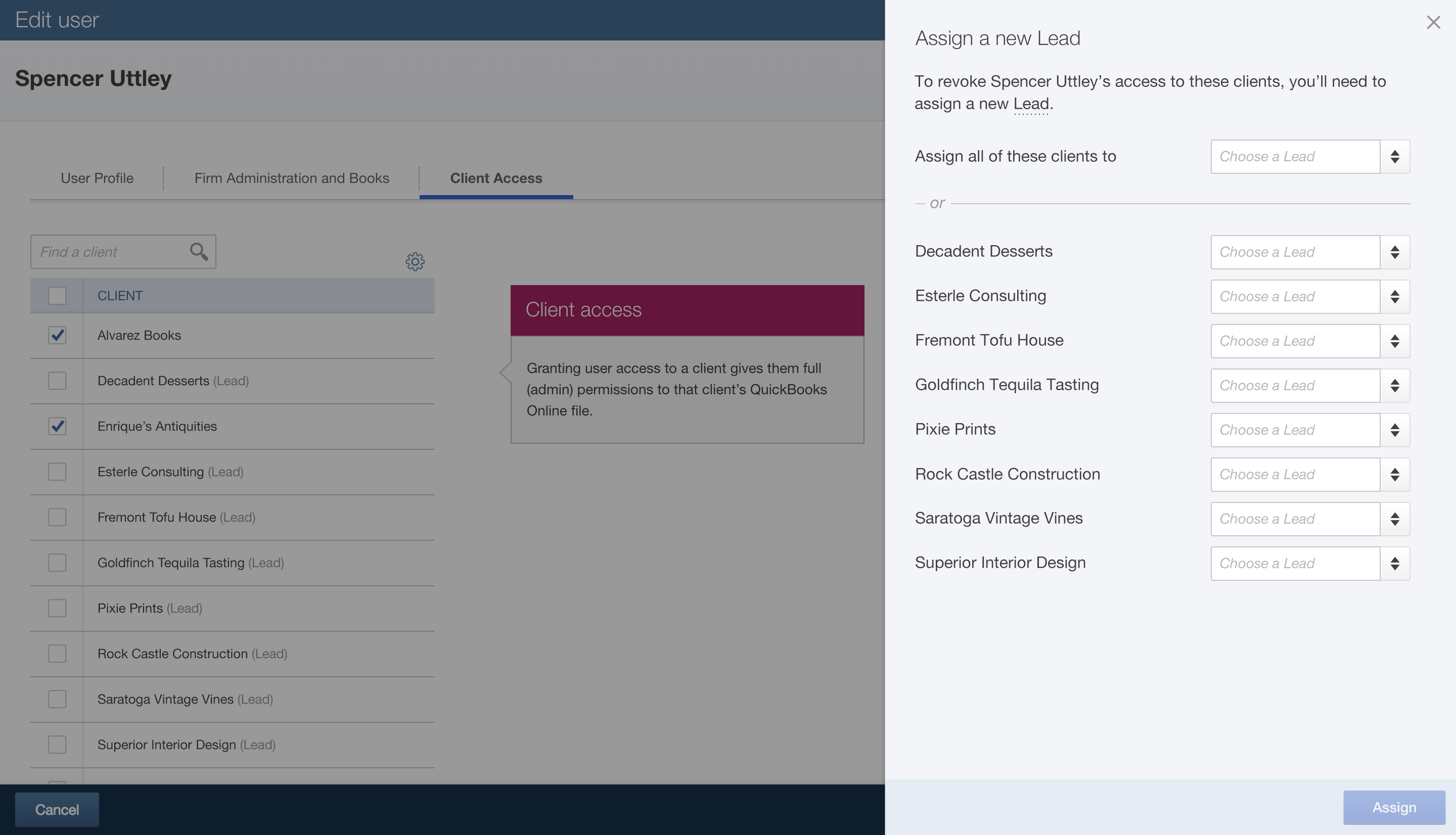

Streamlining the Client-Firm Relationship

Intuit rolls out new improvements to Lead Accountant, Audit Log and Custom Reports designed to improve firm functionality and client connection

August 11, 2017

4 Tips to Boost Efficiency in Finance Teams

For business leaders, increasing profits holds a permanent spot at the top of the priority list. And with a constant focus on the bottom line, there’s no room for flawed revenue and expense tracking. Sure, you may have accurate records and a finance ...

August 8, 2017

There’s Always a Diamond

You can tell from the air if a diamond is well cared for. The infield and outfield grass is green, the baselines are clearly laid out with straight edges and filled with that red/brown sand/clay mix, the pitcher’s mound and the batter’s box are ...

July 20, 2017

Document Management Software Tools: The 5 Must Haves in a Down Economy

Avoid freeware at all costs—no pun intended. Document management software cost per month from the reputable vendors costs less than what you’d spend in one evening at a mid-scale restaurant–$50 dollars per month per user license.