800-388-3038

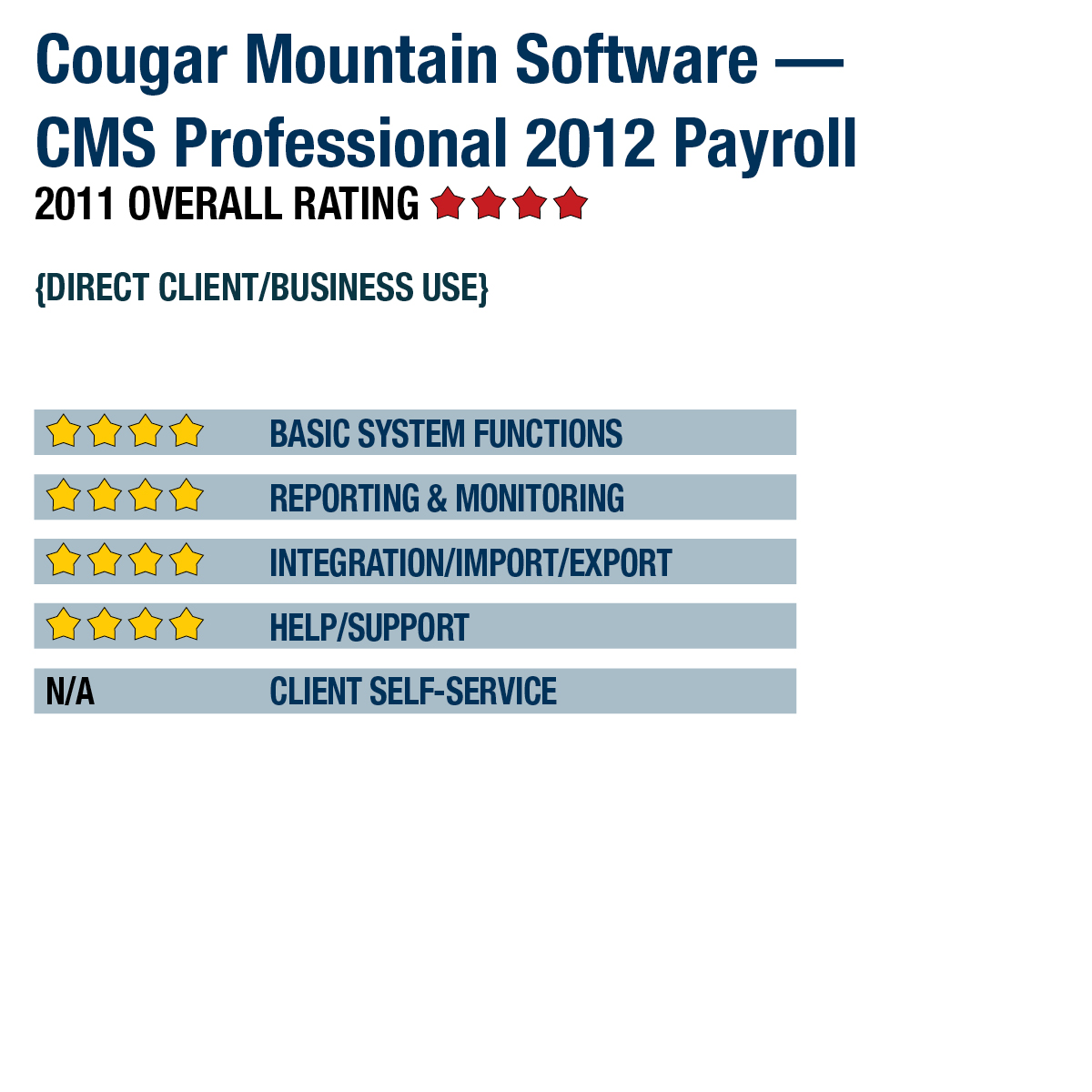

2011 Overall Rating 4

Best Fit

Users who want an on-premises application for processing large payrolls and those who use other Cougar Mountain Software offerings. It’s also a good fit for those who want to prepare and transmit their own payroll tax filings or outsource to a third party (Aatrix).

Strengths

- Supports unlimited number of businesses with multiple department codes, pay frequencies & job costing data, as well as custom fields.

- Tight integration into the other Cougar Mountain Software modules; however, integration with other packages is not natively supported.

- Custom reporting & branding of reports with add-on module.

- Supporting documents can be attached to the master records, i.e. PR employees, from within the application.

Potential Limitations

- Internet-based employee & company portals not supported.

SUMMARY & PRICING

Although Cougar Mountain Software licenses its software to a number of wholesale and nonprofit businesses, CMS Professional Payroll provides functionality for any business type. Cougar Mountain Software prides itself on the service and support offered to its customers as well as the tight vertical integration of its products. Payroll can be purchased with CMS Professional or as a stand-alone product. Single-user licenses start at $699 with four-user and unlimited user licensing starting at $899 and $1,149, respectively. All licenses also come with the ability to upgrade to Cougar Mountain Software’s Software Assurance program. Service fees for any Aatrix subscription services are not included with the above pricing and are billed separately.

Product Delivery Methods

_X_ On-Premises

___ SaaS

___ Hosted by Vendor

Basic System Functions 4

Reporting & Monitoring 4

Integration/Import/Export 4

Help/Support 4

Client Self-Service Features N/A

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs