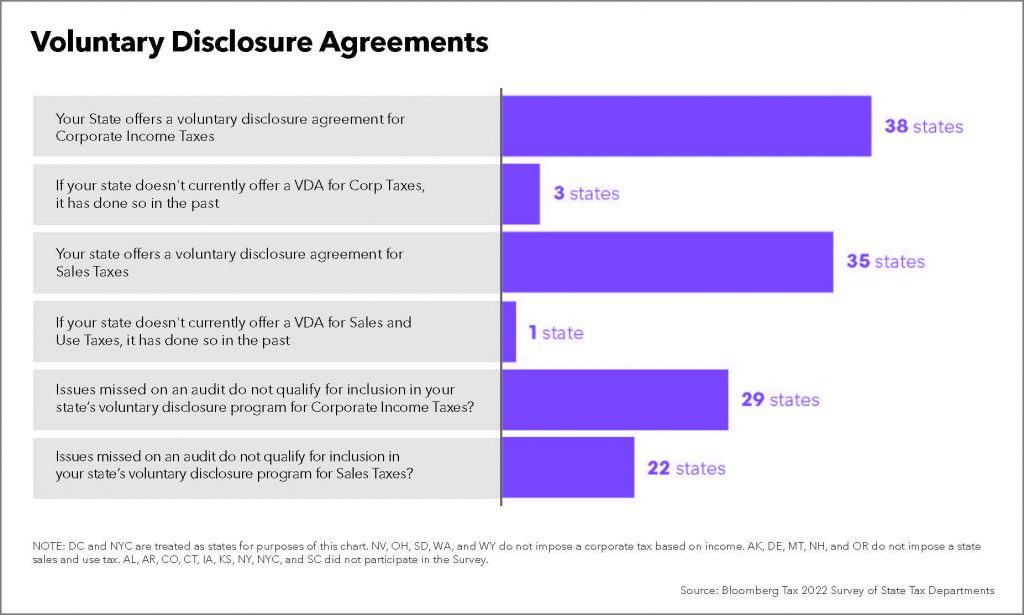

While almost all states offer a Voluntary Disclosure Agreement (VDA) program, issues that qualify for inclusion in these programs vary widely, according to Bloomberg Tax & Accounting’s 22nd annual Survey of State Tax Departments. State tax professionals interested in learning more about this year’s survey results and key trends can attend a complimentary Bloomberg Tax & Accounting webinar on Thursday, July 21 at 11:00 a.m. ET. To register for the event, or to download an executive summary of the survey results, visit http://onb-tax.com/BOFY50JRBZj.

This is the first time Bloomberg Tax & Accounting has asked about VDA programs. The survey finds only six states noted issues missed on a corporate income tax audit qualify for inclusion in these programs. Twenty-three states also indicated that receipt of a nexus survey will disqualify a state from participating in their state’s VDA program.

The 2022 Survey of State Tax Departments includes a wide range of corporate income and sales tax issues from senior state tax department officials from 41 states and Washington, D.C., clarifying how their jurisdictions approach gray areas of corporate income tax and sales and use tax laws, in addition to the laws regarding the taxation of pass-through entities. The survey also examines response to federal tax changes and state tax apportionment and sourcing.

“Every year we seek guidance from the states to help the tax practitioners navigate constant change in laws and regulations and discern their best options in gray areas,” said Heather Rothman, vice president of analysis & content, Bloomberg Tax & Accounting. “This year, we were excited to dig into voluntary disclosure agreements and taxes impacting pass-through entities.”

“I’m impressed by the quality and quantity of information complied into the Survey of State Tax Departments,” said Sylvia Dion, Founder & Managing Tax Partner at PrietoDion Consulting Partners, LLC. “When performing tax research, I can’t tell you the number of times I say to myself ‘What does the Bloomberg Tax Survey show?’ and reach for the survey.”

Other key takeaways from the survey include:

- Twenty-two states, up from 15 last year, said they impose an entity-level tax on pass-through entities. However, these states were split on whether the entity must pay their entity-level tax: seven states say their pass-through entity tax is mandatory and 15 states say their tax is optional.

- In their responses, states gave critical information on how their economic nexus thresholds are calculated. While most states use sales made in a calendar year to determine whether a seller has established economic nexus, 4 states say they use sales made in the previous four calendar quarters. Additionally, almost every state responded that they include sales of tax-exempt items in calculating their economic nexus thresholds, but only about half the states include sales for resale in their calculations.

- As companies adjust to a more remote workforce, nexus created by teleworking employees continues to create complexity for companies trying to determine where they have tax filing and payment obligations. Thirty-three states indicated that one to six employees who perform non-solicitation activities would create nexus for an out-of-state corporation if the employee is telecommuting from within their state.

- The states have continued to refine their responses to the CARES Act. All but three states responded that they conform to section 1106(i) of the CARES Act which provides that PPP loan forgiveness will not be included as taxable income. Conversely, only seven states said that they conform to I.R.C. § 172 as amended by the CARES Act, which modifies the net operating loss deduction.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs