By Rachel Blakely-Gray.

The new W-4 form for 2023 is now available. Unlike the big W-4 form shakeup of 2020, there aren’t significant changes to the new form. But that doesn’t mean you shouldn’t familiarize yourself with it.

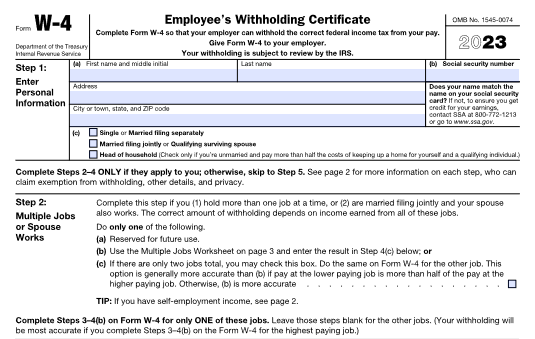

You may not file Form W-4 with the IRS, but your payroll depends on it. Employers use Form W-4 to determine how much to withhold from an employee’s gross wages for federal income tax.

[This article first appeared on the Patriot Software blog.]

Don’t get caught out of the loop. Read on to learn about 2023 changes to the new W-4 form and what you need to know about 2020 and later versions of Form W-4.

New W-4 form 2023: Changes

So, what’s new with the 2023 W-4 form? Not a whole heck of a lot. But, there are a few changes you should know about:

- The IRS removed references to their tax withholding estimator

- There’s now additional text on Step 2(c) to clarify who should use the checkbox for two jobs

- The amounts on the Deductions Worksheet are updated for 2023

If you know Form W-4 like the back of your hand, knowing these 2023 changes should be enough to close out this article and go about your day. Otherwise, you may have questions about the new W-4 (and no, we’re not just talking about the 2023 version).

2020 and later versions of Form W-4: Q&A

In 2020, the IRS released the long-awaited new federal W-4 form, shaking up how employers handle income tax withholding. Because the IRS only made the new form mandatory for new hires and employees making Form W-4 changes, some employers might need to familiarize themselves with it.

Other employers are a little too familiar with the new IRS W-4 form and the old version. It can be difficult juggling both 2019 and earlier Forms W-4 with 2020 and later forms. To combat this, the IRS released a new, optional computational bridge for 2021.

The “new” Form W-4, Employee’s Withholding Certificate, is an updated version of the previous Form W-4, Employee’s Withholding Allowance Certificate. The IRS launched this form in 2020, removing withholding allowances. The new IRS W-4 complements the changes to the tax law that took effect in 2018. This new design aims to simplify the process of filling out Form W-4 for employees and improve tax withholding accuracy.

Continue reading at the Patriot Software payroll blog.

https://www.patriotsoftware.com/blog/payroll/new-w-4-form-irs-changes/

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Payroll, Payroll Taxes