From the July 2012 Issue.

Maintaining a healthy balance between career and family is important for long-term success in both areas. While we can’t eliminate the need to access data outside the office, this month’s mobile applications ensure that you have the data at your fingertips so that you can provide excellent customer service and accept credit cards in payment for services rendered when away from your office. These applications include:

- QuickBooks Mobile

- CCH Tax News Highlights

- Intuit Tax Online (formerly Proline Tax Online)

- Square Card Reader

QuickBooks Mobile

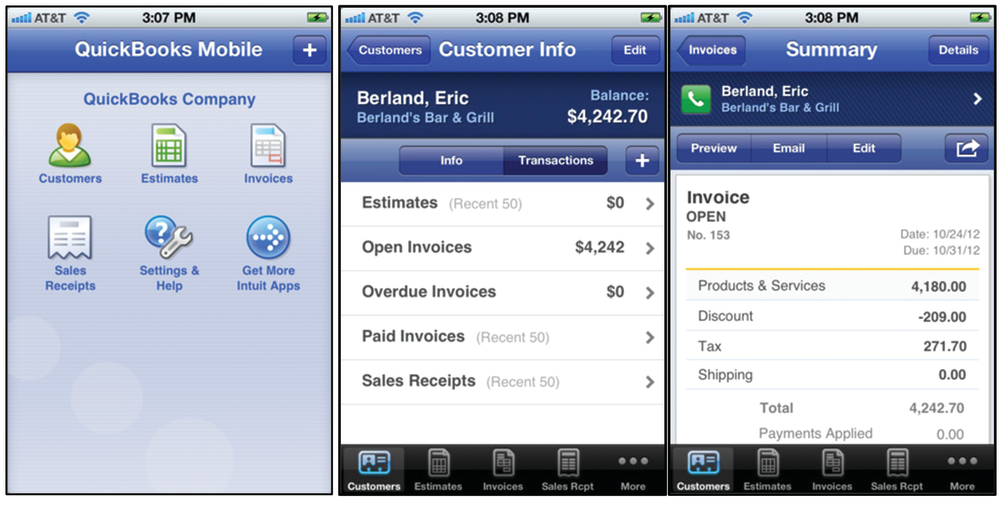

QuickBooks Mobile is an app for iOS and Android phones which makes customer data in QuickBooks available from anywhere. Users can access either QuickBooks Online data (no additional charge) or 2011 and 2012 Windows desktop versions of QuickBooks with an option subscription to QuickBooks Connect. The app is a companion to a compatible QuickBooks subscription (not a replacement), and the mobile software provides very limited capabilities for completing customer activities from a mobile device. There is no attempt to incorporate other functions such as bill payment, online banking, or general ledger functions. Users and clients might do well to think of this app as a QuickBooks mobile customer management app, which more accurately states the limited capabilities of this tool.

Although the application is not a replacement for a traditional web-based or on-premises business management software application like QuickBooks Online or QuickBooks Pro, the ability to access customer information and create estimates and invoices from mobile devices with automatic synchronization into QuickBooks is compelling for many businesses.

CCH Tax News Highlights and CCH Mobile

CCH’s Mobile apps, CCH Mobile (for IntelliConnect subscribers) and CCH Tax News Highlights (free for anyone) are available for mobile devices running the iOS, Android, and BlackBerry operating systems.

The CCH Tax News Highlights (free) app provides users with five stories on the day’s federal and state tax headlines affecting practitioners, as chosen by the CCH/IntelliConnect editorial staff. The Highlights app does not allow for any customization, so every user receives the same headlines, regardless of their interests or their geographic location. This application is available for devices running all major mobile operating systems (iOS, Android, and BlackBerry).

CCH Mobile is an application for iOS and BlackBerry devices which provides IntelliConnect subscribers with mobile access to customized content from CCH’s tax research platform. Unlike the Tax News Highlights app, which provides the same stories for all users, CCH Mobile provides access to content based on user preferences through Tax Tracker News. Users can also access common databases and tools from their IntelliConnect subscription, including the Internal Revenue Code and Regulations, Tax Tools and Calculators, and SmartCharts. The application has recently been enhanced to provide better functionality within Intelliconnect on the Apple iPad platform, and some users report that they are using their iPads with SmartCharts for client discussions away from the office. Although an Android version of this app is not currently available (at press time), CCH has a history of adding support for additional platforms when customer and market demands require it. Given the increasing market share of Android smartphones and tablets, one would expect that CCH might expand support for this app to this leading platform at some point in the future.

Intuit Tax Online

Intuit Tax Online is a browser-based Software as a Service (SaaS) application which allows users to prepare tax returns on a personal computer running any compatible full-function web browser. This web-based application can be run on Windows, MacOS, Linux, or ChromeOS, and provides tax preparation functionality similar to that in the Intuit ProSeries Professional tax application. This application is particularly attractive to those who need to prepare ten or fewer tax returns, as there is no software to install, and users can obtain a practitioner-grade application without the fixed costs of many of the traditional pay per return plans.

The Intuit Tax Online mobile application is a tool which allows practitioners to access client data, e-filing status, and PDF copies of returns on their SmartPhone or tablet running iOS. Users can use the client information from the tax application to make telephone calls or send SMS messages to clients, as well as obtain directions from their current physical location (as sensed by the mobile device) to the client’s physical address using the Apple iOS mapping functions.

Intuit has made steady progress on the online tax application as well as the mobile app over the last few years. These investments have increased the capabilities of the product to the point where it appears to be a formidable competitor to traditional workflow tax software like Drake, TaxWise, and TaxSlayer. The mobile app provides remote access to data for those with a mobile lifestyle or for practitioners who have limited hours outside of tax season, and is a significant selling point for Intuit’s web-based platform.

Square Card Reader

The Square Card Reader app works along with a hardware credit card reader which plugs into the headphone jack of most smartphones and tablets. Although users may not want to leave the reader plugged in when using the smartphone as a traditional phone handset, the card reader is one of the smaller devices at 1” x 1” x ½”, and would not be an undue burden when carrying a phone in a purse or briefcase. Mobile payment services like Square are being used by field service professionals like plumbers and lawn maintenance services, and are a good option for accountants to collect fees from customers who may have limited cash flow but plentiful availability on their credit cards. A competing merchant services company, Sage Payment Services, reported significant sales increases in the annual Girl Scout Cookie sales when troops allowed purchasers to pay via credit card using Sage’s similar mobile payment platform.

Pricing for mobile payment services can be a factor in deciding which one to use, and although Square does not currently charge a fixed monthly base fee for use of its service, the Company takes 2.75% of any collections as its charge for operating the service. The net payment is deposited in the firm’s checking account the next day. The service is compatible with most major credit cards, including MasterCard, Visa, American Express, and Discover. While this marginal rate is relatively high when compared to traditional merchant accounts, the lack of a fixed monthly fee may be appealing to users who plan to use the service as a convenience to clients with variable cash flow who have fallen behind in paying their accounting and bookkeeping charges.

Users can sign up for a free account and receive the card reader hardware plugin with no commitment required by creating an account at www.square.com.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Accounting, Software, Taxes