By Ronald Ulrich. [From the ADP Spark Blog.]

The SECURE 2.0 Act was designed to make it easier and more affordable for small businesses to offer employer-sponsored retirement plans. Learn about tax credits that can help offset the costs of a new plan.

New provisions from the SECURE 2.0 Act are now underway, aiming to increase retirement readiness for all. The legislation extends valuable benefits to both employers and employees to make it more attractive to offer retirement plans, and potentially improve retirement outcomes.

One new benefit? Increased tax credits to small businesses to encourage plan sponsorship.

Expanded credit for retirement administrative costs

Previously, employers with less than 100 employees were eligible for a three-year, start-up tax credit of up to 50% of administrative costs, with an annual limit of $5,000. The new law increased this credit to 100% of qualified start-up costs for new plans sponsored by employers with up to 50 employees.

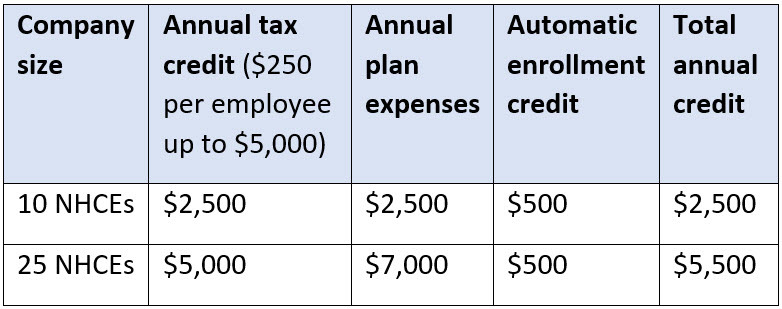

In order to qualify, a business must have at least one employee who is a non-highly compensated employee (NHCE). A NHCE is a person who made less than $135,000 in the prior year (2022) with the business and is not the business owner. The credit is based on the greater of $500 OR $250 per NHCE (capped at $5,000), applied to 100% of the costs incurred.

That could mean a total of $15,000 in tax credits by year three. But businesses could potentially earn $16,500 over three years if they add automatic enrollment, which offers a credit of $500/year for three years.

Businesses must have one NHCE to qualify for the tax credit.

If you started a plan within the past three years, you may qualify for part of the credit. Eligible businesses with 51 to 100 employees are still subject to the original SECURE Act start-up tax credit — 50% of administrative costs, capped annually at $5,000 per employer for three years. For companies with more than 100 employees, the tax credit does not apply.

Employer contribution

For businesses sponsoring a new plan, the new legislation also offers a tax credit for employer matching or profit-sharing contributions for the first five years of the plan. The credit is for businesses with up to 100 employees, but the credit is reduced by 2% per employee over 50 employees earning less than 100,000/year. The maximum credit is $1000 per year for each of those employees.

The credit potentially covers:

- 100% of employer contributions for the first two years after the plan is created

- 75% in year three

- 50% in year four

- 25% in year five

For employers using the tax credit, a tax deduction won’t typically apply. It’s always best to review scenarios unique to your plan with your accountant.

Building a more SECURE future

SECURE 2.0 is paving the way for more small businesses to offer a retirement plan. As the 90+ provisions continue to roll out, it’s critical for employers to strategize how they can maximize the new benefits, maintain compliance and do their part to empower employees to achieve retirement readiness.

====

Ronald Ulrich is vice president of product consulting and compliance at ADP.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Benefits, Income Taxes, Payroll