From the November 2012 Issue.

Every year, tax and accounting professionals and their clients are faced with the task of year-end wage and information reporting. W-2 and 1099 forms must be filed no later than January 31, so that recipients can receive them in time for their own income tax reporting.

This leaves a short window from the end of the year for those professionals that have numerous forms to file. This in itself can appear daunting for firms that are faced with the uncertainty of major changes or for businesses that manage the process themselves.

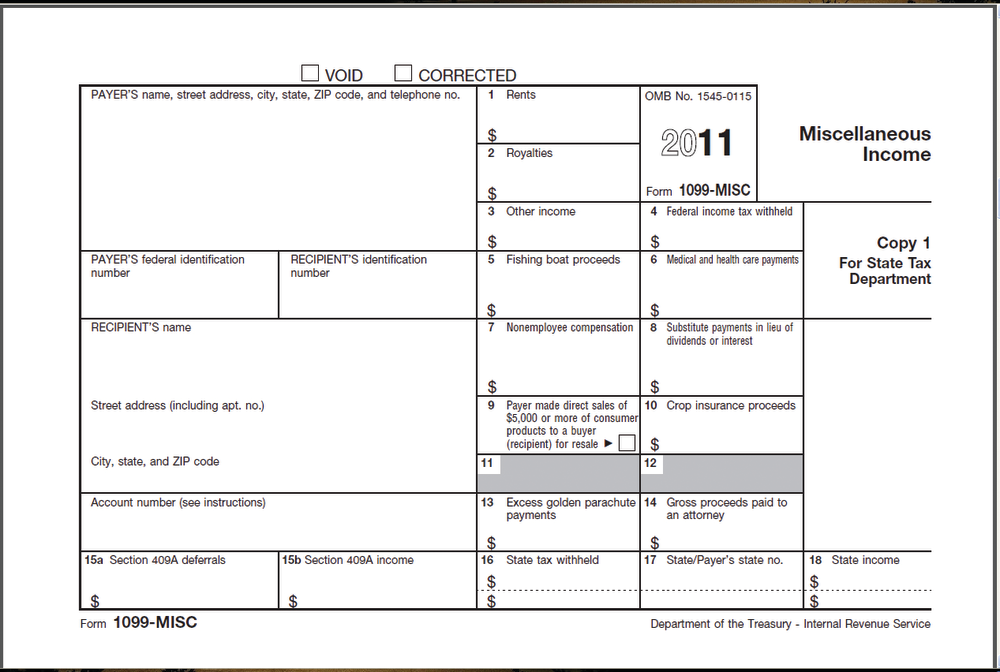

Add to the mix recurring changes to W-2/1099 requirements, and the entire process can become quite cumbersome. Businesses must file a 1099-MISC for every person they have paid $600 or more during the year. This includes services, prizes and awards, medical and healthcare payments and other income payments.

In addition, employers that have more than 250 workers have to report the value of healthcare benefits on an employee’s behalf. This amount appears on the W-2 form in Box 12, using code DD. While some employers elected to report this on 2011 W-2s, it is mandated for 2012 W-2s.

Changes to the 1099-B form reflect the new reporting mandates that include reporting the date a stock was purchased, the cost basis, whether the gain or loss was short- or long-term and wash sale status. These reporting requirements affect stocks purchased on or after January 1, 2011, mutual funds purchased on or after January 1, 2012, and bonds, options and private placements bought on or after January 1, 2013.

This means that tax and accounting professionals working with brokerage firms will need to ensure their clients are reporting the necessary information to its recipients and the IRS.

These changes as well as rules that are already in place mean that practices will need to prepare and submit a variety of forms for each of their clients and recipients. Fortunately, many of the companies that make W-2/1099 preparation software have resolved to make the process as simple as possible for users.

Common features include built-in electronic filing capabilities and service bureau print and mail options. Through these services, vendors outsource the printing and mailing of completed forms to recipients.

Many W-2/1099 preparation software also offer data import and rollover options, making it easier to complete forms if there were very little changes in clients and recipients from the previous tax year, or if the payroll and contact information already exists within another program.

The individual needs of each firm and their clients will vary greatly. It’s important to review any program before you select it to ensure it has the capabilities you and your clients need to manage the year-end wage and information reporting process.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Financial Reporting, IRS