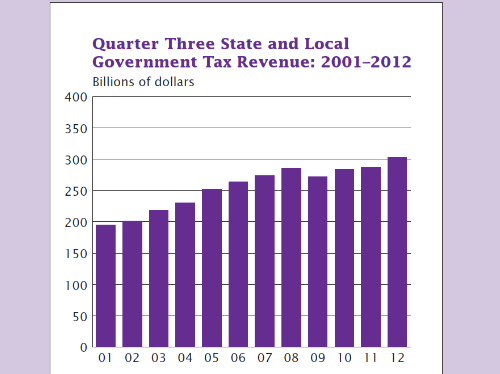

Third quarter 2012 state and local tax revenues were up 5.3 percent over last year, according to the latest report by the United States Cenus Bureau. This marks “the 12th consecutive quarter of positive year-over-year growth,” according to the Summary of State and Local Tax Revenue.

Total tax revenue for the third quarter of 2012 totaled #302.9 billion, compared to $287.7 billion in the third quarter of 2011. The largest tax categories which are preperty, individual, corporate and sales taxes, all showed gorwth over the period.

By category, state and local property taxes were up the most, by $92.5 billion, an increase of 8.0 percent over Q3 2011. General sales tax revenues saw the second highest growth, to $71 billion, up by about 6.1 percent. State and local individual income tax revenues were up 4.5 percent to $68.8 billion, and corporate income tax revenues were up 4 percent to $9.9 billion for the third quarter.

Overall, state individual income taxes accounted for 35.1 percent of total state tax revenues, while sales and gross receipts taxes accounted for 32 percent, and other taxes measured 32.9 percent of state tax revenues.

Severance taxes were the largest source of state government tax revenues in North Dakota and Alaska during Q3 2012.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: State and Local Taxes, Taxes