Bloomberg Tax & Accounting released its 2024 Projected U.S. Tax Rates, which indicates inflation adjusted amounts in the tax code will increase 5.4% from 2023. While this is a slight decrease from the 7.1% increase in 2023, it is nearly double the 2022 increase of 3%. The full report is available at: http://onb-tax.com/9MPI50PLeeM.

[See projected tax bracket tables below.]

Bloomberg Tax’s annual Projected U.S. Tax Rates Report provides early, accurate notice of the potential tax savings that could be realized due to increases in deduction limitations, upward adjustments to tax brackets, and increases to numerous other key thresholds.

The report accounts for changes made under the Inflation Reduction Act and the SECURE 2.0 Act that affect tax planning for corporate taxpayers in certain industries. They include an increase in the wage limitation amount for the additional §45E credit for small employer pension plan startup costs from $100,000 to $140,000.

Additional changes include an increase in the §4611(c) hazardous substance superfund financing rate and an increase in the §179D deduction for energy efficient commercial building property if new wage and apprenticeship requirements are met.

This year’s report projects that several key deductions for taxpayers will see notable year-over-year increases, with the foreign earned income exclusion increasing from $120,000 to $126,500, and the annual exclusion for gifts increasing from $17,000 to $18,000, thereby allowing taxpayers to increase their gifts without tax implications.

“For the second year in a row, high U.S. inflation has contributed to a significant increase in inflation-adjusted amounts in the tax code,” said Heather Rothman, Vice President, Analysis & Content, Bloomberg Tax & Accounting. “Once again, our annual report provides actionable projections for tax professionals and taxpayers to begin planning for the upcoming year ahead of the official IRS announcement.”

Other key adjustments, with comparisons of the 2023 amounts and 2024 projections, include:

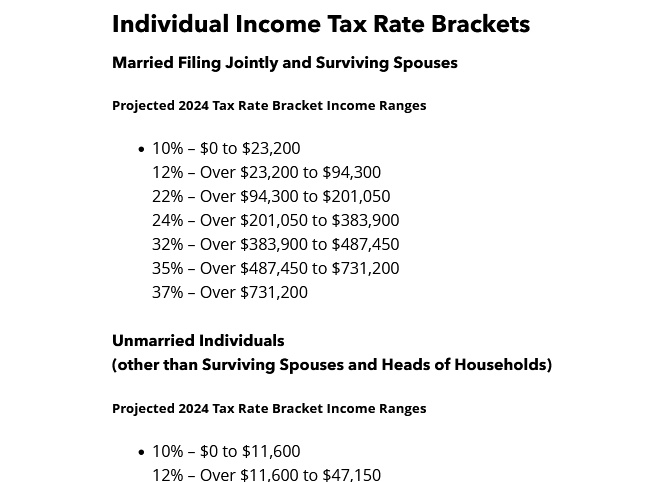

Individual Income Tax Rate Brackets

Married Filing Jointly and Surviving Spouses

Projected 2024 Tax Rate Bracket Income Ranges

- 10% – $0 to $23,200

12% – Over $23,200 to $94,300

22% – Over $94,300 to $201,050

24% – Over $201,050 to $383,900

32% – Over $383,900 to $487,450

35% – Over $487,450 to $731,200

37% – Over $731,200

Unmarried Individuals

(other than Surviving Spouses and Heads of Households)

Projected 2024 Tax Rate Bracket Income Ranges

- 10% – $0 to $11,600

12% – Over $11,600 to $47,150

22% – Over $47,150 to $100,525

24% – Over $100,525 to $191,950

32% – Over $191,950 to $243,725

35% – Over $243,725 to $609,350

37% – Over $609,350

Standard Deduction

Projected 2024 Standard Deduction by Filing Status

- Married Filing Jointly/Surviving Spouses – $29,900

- Heads of Household – $21,900

- All Other Taxpayers – $14,600

Alternative Minimum Tax (AMT)

Projected 2024 AMT Exemption Amount by Filing Status

- Married Filing Jointly/Surviving Spouses – $133,300

- Unmarried Individuals (other than Surviving Spouses) – $85,700

- Married Filing Separately – $66,650

- Estates and Trusts – $29,900

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Accounting, Income Taxes, Taxes