The IRS is slashing the costs for paid tax return preparers to renew their preparer tax identification numbers (PTINs) in 2024 by nearly 36%, after a court ruled earlier this year that the agency had previously overcharged tax professionals to obtain a valid PTIN.

According to interim final regulations released by the IRS on Sept. 29, the application and renewal fee will be $11 per user, plus an $8.75 fee paid to a third-party contractor, for a total of $19.75—down from $30.75 for PTIN renewals in 2023.

Any tax professional who prepares or helps prepare a federal tax return for compensation must have a valid PTIN from the IRS before preparing returns, and they need to include the PTIN as the identifying number on any return filed with the IRS.

A federal district court, however, ruled in Steele v. United States earlier this year that the IRS charged excessive fees from 2011 to 2017 for tax preparers to apply for or renew their PTINs and ordered the IRS to refund any fees that exceeded the agency’s expenses.

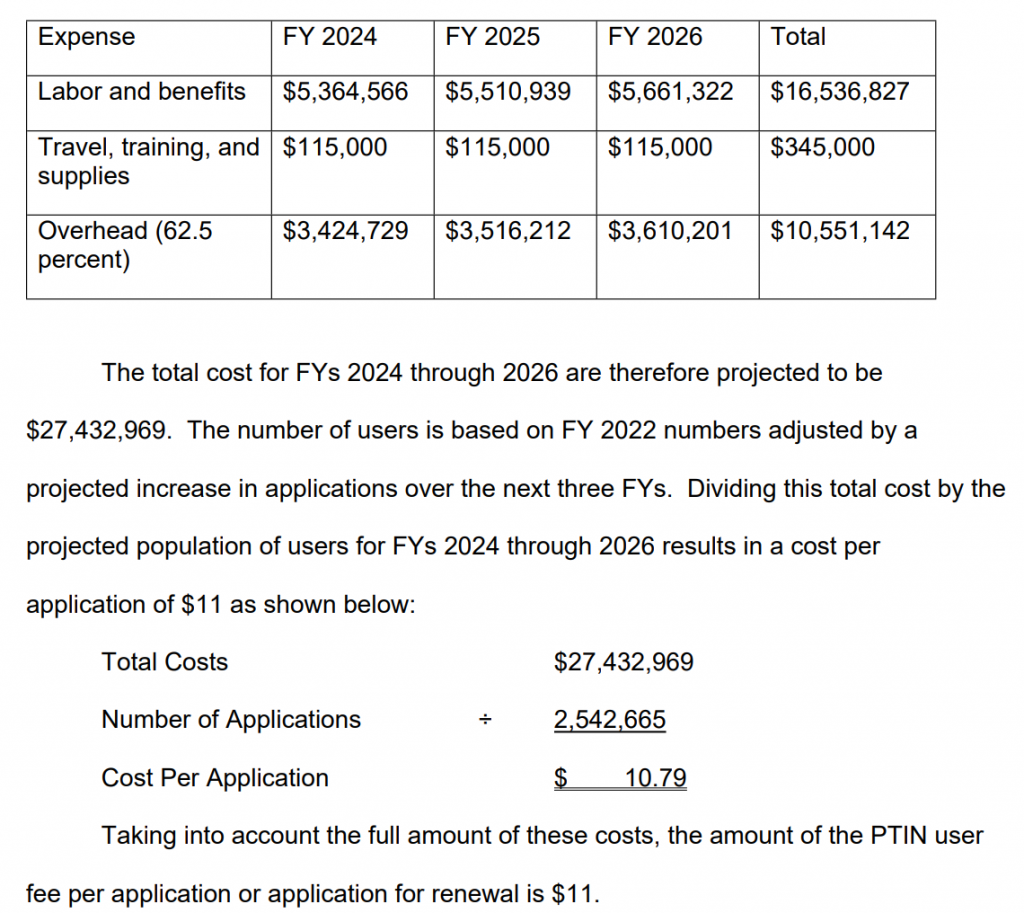

The IRS decided on the $11 fee by estimating that the cost of providing PTINs for fiscal year 2024 through fiscal year 2026 was $27,432,969, including labor and benefits; travel, training, and supplies; and overhead. With the number of applicants over those three years estimated at 2,542,665, the cost per application was determined to be $10.79.

The third-party contractor was chosen through a competitive bidding process, according to the IRS. The $8.75 fee covers the contractor’s activities “for the issuance, renewal, and maintenance of PTINs, such as processing applications and operating a call center,” the agency said. However, the $8.75 contractor fee may change in 2026 when the current contract expires and will be recomputed, according to the IRS.

The IRS will likely provide instructions on how tax preparers can renew their PTINs for 2024 later this month.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs