By Andrew Argue, CPA.

People are nervous. College graduates with accounting degrees, CPA exam takers, new entrants to the accounting workforce—all these metrics and our experience make us feel there’s a lack of interest in our industry. You can sense the collective anxiety brewing: Is our industry running low on accounting talent?

It’s not just the macro stats causing concern. If you’re in the trenches—be it as a partner, manager or recruiter—you know that finding qualified staff is like chasing a mirage. You’re searching for that rare blend of expertise, technical skills and cultural fit, but your quest often ends in disappointment. When big-picture data echoes these daily frustrations, it’s easy to jump to the conclusion that we have a talent gap.

However, let me offer another perspective.

We often talk about the staffing shortage. And we do need enough people to get work done, to be productive. But what does “productivity” actually mean? Labor productivity measures economic output against labor input. Essentially, how much value does one accountant create?

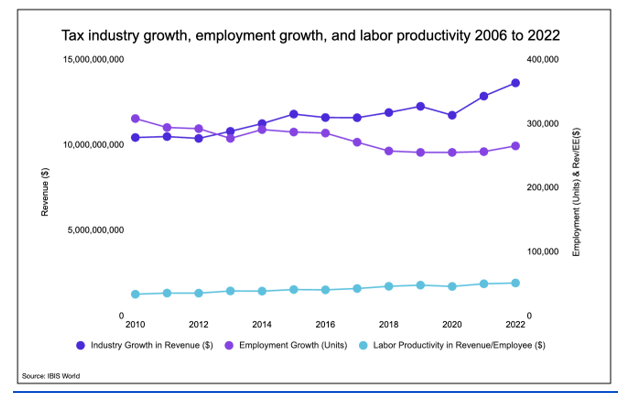

Let’s ponder that for a moment. Imagine isolating just the tax industry’s revenue for 2022 ($13.6B), and then divide that by the total workforce (265,460). The result is a labor productivity figure ($51,398). The industry’s worth, divided by its collective human capital. What you’ll find is quite telling. Over the past few years, industry revenue has been growing at a pace that eclipses the growth in workforce numbers.

COVID-19 admittedly sent some professionals packing, but the growth rate in revenue has consistently outpaced the number of new accountants even pre-pandemic. Here lies what many consider irrefutable proof. The common refrain: “We need more people or else!”

Next, we get the laundry list of solutions. Increase college enrollments. Get more people to take—and pass—the CPA exam. Perhaps even ditch the 150-hour requirement. All valid ideas, but are they the right ideas for today?

If today’s tax accountant brings in an average of $51,398 in revenue, what will that number look like a decade from now? Fifty years hence? Contrary to the panic, I posit that we’re approaching a future teeming with accountants—so many, in fact, that we’ll soon wonder how to fill our newfound leisure hours. With AI and automation eliminating drudgery, the question turns from “Do we have enough accountants?” to “What new value can we deliver with how much time we now have?”

To illuminate my point, let me recount two anecdotes from recent conversations with industry insiders.

First, the CIO of a top 10 accounting firm, spooked by the release of sophisticated technology like ChatGPT in late 2023 and spurred by rising public scrutiny, decided to impose a firmwide ban on these new tools. Ostensibly, it’s a safety-first move. But what has really happened? An atmosphere has developed where everyone is, metaphorically, cheating on their homework.

And that leads me to the second story: An individual within a firm surreptitiously uses AI technologies, unbeknownst to both employer and clients. The result? A 50-60% reduction in work time and a 20-30% increase in output. This person appears to be a rock star, yet the firm still believes the person is drowning in work. The lack of transparency has led to a skewed perception.

Consider this: Not long ago, producing a stellar work paper would consume 80 hours. Now, armed with cutting-edge tools, the same output is generated in under three hours. These tools aren’t just for niche tasks; they’re expanding capabilities at a speed that can only be described as meteoric.

While I don’t have the luxury of detailing this today, I predict the imminent arrival of tools that will emulate the experience of working with staff, seniors, managers—basically, any complex knowledge worker. And it won’t be limited to just one of them. You’ll be able to collaborate with an effectively unlimited number of these digital entities to accomplish tasks.

So is the number of human accountants rising at the rate we’d like? Perhaps not. But the rate at which tasks are being completed via automation and tech is accelerating exponentially. Consequently, the individual firepower within the industry is ramping up at a pace far exceeding what a 10% increase in human workforce could achieve.

In the grand scheme of things, the question isn’t whether we need more accountants. It’s how can existing professionals harness burgeoning technology to redefine their roles and deliver unprecedented value.

So what will the accountants of the future be doing when we have tools like ChatGPT or a hypothetical superpowered successor at our disposal? These tools can speak, interpret the world and understand everything across the firm and client’s operations, then execute tasks or entire jobs at the level of a human. If you’re skeptical that this future is imminent, let me plant this seed: I’m convinced it’s just a few years away.

In that future, we won’t be scratching our heads over how to attract more talent into accounting. Instead, we’ll be wondering how many people we actually need. Imagine technologies that amplify a person’s capabilities by factors of five, 10, 20 or even more. While some remain skeptical, clinging to the notion that these tools will forever be limited to isolated tasks, I believe we’re on the verge of a monumental paradigm shift.

So, if you’re like me and see these technologies as potent enough to rival, or even surpass, human accountants at various levels, what should be your next steps?

Pardon, Not Punish

The first action is simple: Stop penalizing curiosity and innovation within the ranks. Just as professors futilely ban tools like ChatGPT from being used on assignments, many firms are similarly taking a Luddite approach. Staff are using these tools anyway, funding them out of pocket, and they’re doing so for a reason. The resultant security risks can’t be ignored—client-sensitive data is being processed on personal computers.

Think about it. It’s as if we’ve told employees to traverse the country on horseback—envisioning them battling the elements, Oregon Trail-style—while they are, in fact, zipping along in a Tesla, taking leisurely pit stops. We believe they’re sweating away, but in reality, they’re “cheating on their homework” by employing technology far superior to traditional methods.

So pardon your innovative staff. Embrace the tools that amplify human ability. Let’s prepare for an accounting future where the only limitations are those of our own imaginations.

Redefine Problem-Solving

The time has come to integrate these people, and their ingenuity, into our firms’ strategies. Doing so not only offers an immediate solution to perceived staffing shortages, but it also opens up new horizons for problem-solving. As the CEO of Corvee, I’ve witnessed firsthand how our products have saved taxpayers more than $1.5 billion, and that’s barely scratching the surface. We need to reimagine what we can offer clients, leveraging these potent tools to push boundaries further than ever before.

The point is not that we haven’t been doing excellent work; it’s that the advent of such technologies gives us the capability to ascend to levels of effectiveness and efficiency previously thought to be the stuff of science fiction. And many of these tools are not coming soon—they are here now, and their power grows with each passing quarter.

While we can’t predict the future with certainty, we can certainly prepare for it. The scenario where staff are working substantially less but producing significantly more isn’t a distant utopia; it’s achievable today. The difference is that our current ratio of work-to-productivity will pale in comparison to what lies ahead. Imagine your team working 50-70% less but churning out results that are 200-400% more effective. This is possible when each team member becomes a “manager” of powerful technologies, functioning like they’re heading large teams of accountants. These changes are already happening in the military where one soldier will soon be managing 100 AI drones. It’s a different kind of work.

Support the Accountants of the Future

I predict we’ll soon transition from lamenting a shortage of accountants to wondering if we have too many—less because of actual oversupply and more because not everyone will be able to adapt. There’ll be two types of people that succeed in this environment.

The first group will be those with a wealth of experience and knowledge, who will act as the last line of human verification for the output generated by these technologies. They’ll be the ones signing off on key positions in audit opinions, tax returns and financials.

The second group will be the tech-savvy, from rookies to veterans, who know how to harness these digital tools as though they had a virtual team of hundreds at their disposal. These are the people who will excel in a radically changed work environment, one so different that we may need to rethink academic and certification rigor altogether. Perhaps universities should become exponentially tougher, and the CPA exam should be a colossal challenge, albeit one where using advanced tools is not only allowed but expected.

Adapt to the Inevitable

As we navigate these tumultuous waters, it’s crucial to be future-curious but present-focused. Let’s pardon those who’ve been “cheating” by using these tools; they’re the pioneers we should be learning from. Let’s normalize the use of these technologies within our firms, perhaps through lunch-and-learns or internal seminars to get everyone on the same page.

And let’s collectively change our mindset from one of fear—“the robots are coming for our jobs”—to one of possibility. While there may be fewer accountants, those who adapt will not merely survive; they’ll define the industry in ways that are as yet unimaginable. We stand on the cusp of the most exhilarating phase in the history of accountancy, a renaissance powered by exponential technologies. If you think that sounds dramatic, just wait a few years—you’ll see.

==========

Andrew Argue, CPA, is the CEO and co-founder of Corvee and Instead where he works to help tax and accounting firms provide more value to clients through tax advisory services leveraging technology.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Accounting, Firm Management