Tea merchants and small to medium businesses in the U.S. continue to struggle to navigate with tax complexity and tax rate changes on the eve of the 250th anniversary of the Boston Tea Party. In fact, eight in 10 tea merchants (82%) feel anxiety related to staying on top of their tax obligations. In the U.S., there are more than 900 sales tax rules on tea products. These are the results of a new survey by Avalara, Inc., a provider of cloud-based tax compliance automation for businesses.

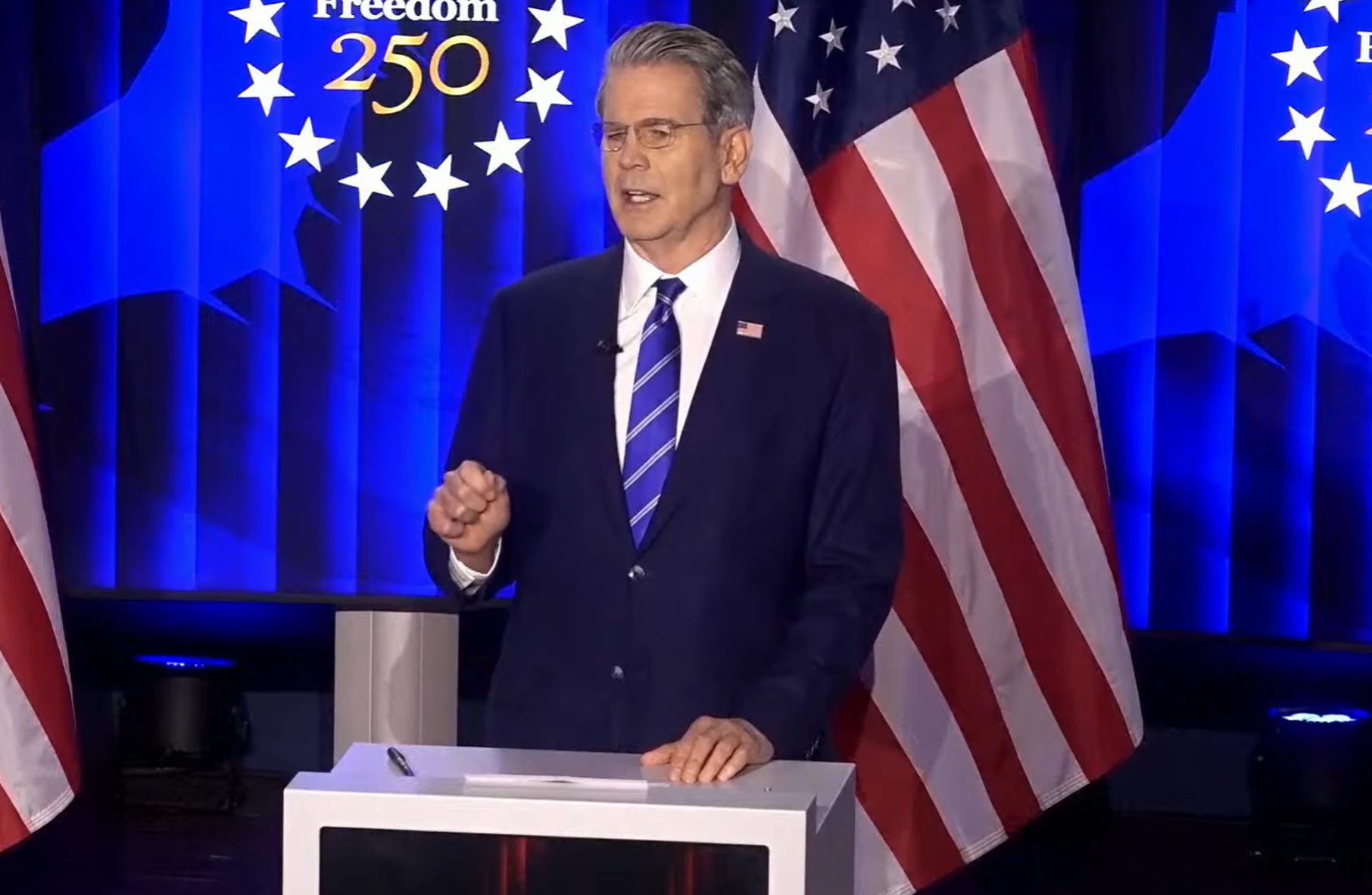

“The Boston Tea Party was our nation’s first public disagreement over tax complexity – which is far from over,” said Scott Peterson, VP of U.S. Tax Policy at Avalara. “Fast forward 250 years and U.S. businesses that are selling goods across states today must comply with tax laws set by legislators they cannot elect – which presents an ongoing challenge as these businesses struggle to comply with constantly changing tax rules across the U.S.”

The survey also found that three-quarters of modern tea merchants (76%) have faced penalties or fines for tax errors — costing an average of $2,000 annually — as nearly all sellers (94%) are unaware of the number of different tax rates on tea products.

The majority of tea merchants (83%) believe that tax complexity is now out of control and eight in 10 (80%) say it is one of the biggest burdens on their companies. The average tea seller spends more than nine hours a month on tax compliance and 71% of merchants say tax complexity has prevented them from expanding into new markets both domestically or internationally. For example, a U.S. business selling tea products to customers in the European Union (EU) will need to comply with different rates of tax for green and herbal tea (3.2% and 9%, respectively).

As a result, 76% of tea merchants would urge the government to consider ways to reduce sales tax complexity with 42% considering lobbying decision makers and half (50%) even contemplating a legal challenge. As an alternative, 90% would look to reduce the burden of complexity with automation or AI.

American tea merchants are not the only ones struggling to keep across their obligations. In fact, 4 in 5 (83%) tea merchants in the United Kingdom (UK) have faced penalties or fines due to unintentional non-compliance with U.S. sales tax obligations. While the majority, (53%) agree that it is more difficult to sell tea in the U.S. given tax complexities when compared to selling elsewhere

Sales tax complexity costs businesses and creates anxiety

U.S. tea merchants are not alone in feeling anxious about the country’s tax complexity as Avalara’s survey also revealed that 69% of small to medium businesses found that sales tax complexity looms large with far-reaching impacts for their bottomline. Findings include:

- 40% have faced penalties or fines for non-compliance in the past – the average fine costing $1,600

- 70% say tax complexity is one of the biggest burdens on their companies

- The average business spends 10 hours a month on compliance

- 62% of businesses say tax complexity has prevented them from expanding into new markets

- 80% of businesses would urge the government to consider ways to reduce sales tax complexity

- 88% of businesses would use automation or AI to reduce the burden of complexity

“Managing tax obligations for our company means that across the U.S. alone, we must be in compliance with different rules and regulations for the thousands of revenue jurisdictions within states, cities, and counties, said William J. Mullaney, senior indirect tax manager for the Analytical Instruments Group at Thermo Fisher Scientific. “Leveraging automation technology like Avalara saves a company like Thermo Fisher Scientific time and money because it implements the correct tax for the difficult situations we manage across states, especially when we handle tens of thousands of exemption certificates each year. Avalara not only improves the ability to do my job but makes the job of everyone around my organization better.”

Fortunately, U.S. businesses have an alternative to manually keeping up-to-date with tax in this country. With automation software, businesses gain a modern digital solution that monitors for tax changes and automatically updates rates based on geolocation, item taxability, new legislation, tax regulations.

The following tax changes have been monitored and tracked this year alone by Avalara:

- More than 8,700 sales and use tax rate changes across the U.S. thus far in 2023, that is nearly 30 a day

- The top five states for sales and use tax complexity based on the number of sales and use tax rate changes in 2023 are: 1) Alabama with 3,734 changes, 2) Kansas with 2,292 changes, 3) Virginia with 743 changes, 4) Missouri with 350 changes; and 5) New Mexico with199 changes

- 16 states have not yet changed any sales and use tax rates in 2023

- Food is the category with the number of changes to sales tax rates, with 4,967 changes already made in 2023

To see more takeaways from Avalara’s 250th Boston Tea Party survey, please click here.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs