Accounting January 20, 2026 Sponsored

Cultivating the Next Generation of Accounting Professionals: Inside the Intuit ProAdvisor Student Mentorship Program

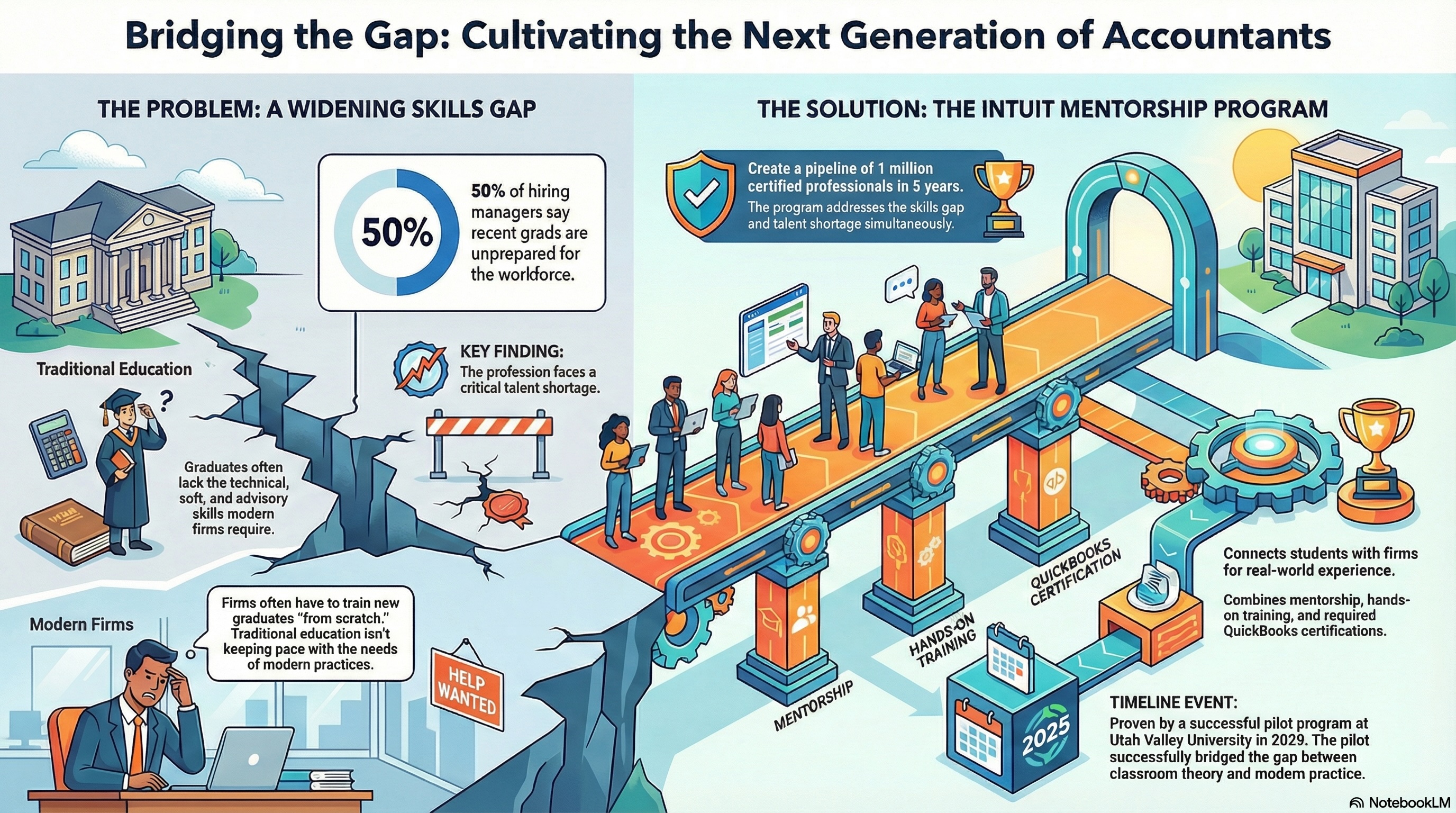

Sponsored: The accounting profession is facing a dual challenge that threatens the longevity and efficiency of firms: A talent shortage and a widening skills gap.