In this issue

Accounting August 21, 2022

A User’s Guide to Encryption Part One: Encryption of Data at Rest

When working papers and confidential information were stored on paper, it was enough to physically secure the paper records you had so others couldn’t view them. Just as our society is adapting its laws, regulations, and definitions of terms like ...

September 1, 2018

Client Accounting Services – What Is It, Really?

Leaders in CPA firms across the country agree that Client Accounting Services (CAS) is an emerging, growing and profitable opportunity. In fact, it is one of the fastest growing new revenue segments of many Top 100 Firms, but it is relevant and ...

August 29, 2018

Why Your Firm’s Business Development Efforts Fail

Every firm needs to attract new clients and most firms in the country tend to have one partner who seems to have a natural gift of bringing in new clients. That person is your rainmaker. Everyone else at the firm maintains a client relationship and ...

August 23, 2018

The Intriguing World of IRS Interest Abatement

Unlike certain penalties, such as the Failure to File or Failure to Pay penalties, which can be abated due to reasonable cause, interest cannot be reduced or abated for reasonable cause. The abatement of interest is never permitted merely due to ...

August 23, 2018

How to Leverage Corporate Culture for a Competitive Advantage

If someone asked, would you be able to describe your accounting firm’s corporate culture? This concept is the topic of many a workplace report, but what does it mean?

August 23, 2018

Why and How: Blockchain

Blockchain seems to be everywhere in the press and conferences related to accounting. There is clear merit to this coverage and blockchain is a technology with long-term importance. Applications have only been developed in a few pilot projects ...

August 22, 2018

Transferring Wisdom for Continued Success in Your Firm

Attend any conference or peruse any publication in the accounting profession and you’re sure to hear talk about the impact of artificial intelligence (AI), machine learning and other emerging technologies. These advancements present a tremendous ...

August 22, 2018

How to Conduct an Effective Job Interview

One of the most important steps in conducting effective interviews is the preparation before the interview is even conducted. Interviews can be a time intensive process for businesses. If the wrong person is hired, then additional interviews ...

August 21, 2018

4 Tips for Small Businesses to Survive an Economic Downturn

As we all know, however, the economy is cyclical. And while it’s important to capitalize when times are good, smart business owners also make sure they’re prepared in case things start moving in a different direction.

August 21, 2018

How to Handle Sales Tax for Small Businesses

First and foremost, you’ll need to get a sales tax permit — it’s against the law to collect sales tax without one. Getting a sales tax permit is just one of the many things you have to do when you start a business. To get one, complete your ...

August 21, 2018

2018 Review of Professional Tax Preparation Systems

2018 will definitely be an interesting year for tax professionals, with the most significant tax changes in more than 30 years due to take place. These changes are widespread, taking place for both individual tax filers, as well as corporations.

August 21, 2018

How to Manage the Risks of Serving Cannabis Clients

Experts predict that America’s cannabis industry will continue to grow over the next four years. The legal cannabis market was worth an estimated $7.2 billion in 2016 and is projected to grow. Medical marijuana sales are projected to grow ...

August 21, 2018

Major Acquisitions Shape Accounting Technology Market

Summer is often thought of as the marriage season, so what better time to review some of the recent marriages impacting the technology sector of the accounting profession?

August 21, 2018 Sponsored

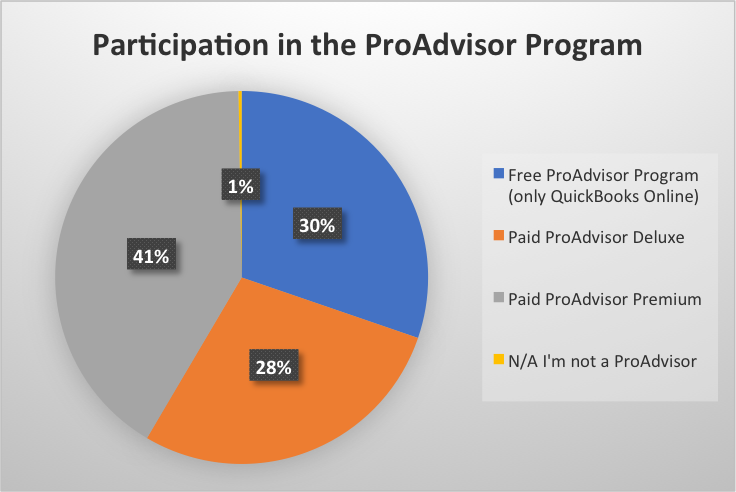

2018 Intuit Rate Survey Uncovers New Trends in Billing and More

Value pricing is based on the maximum amount a given client is willing to pay for a service, typically set before the work begins. Conversely, value billing is usually marking up – or more frequently marking down – the invoice to the client after the ...

August 20, 2018

Helping Business Clients Stay Compliant

Owning your own business means staying current on new laws, requirements and filings. That’s a lot to tackle, and in many cases your clients rely on you to keep them compliant. Do your clients even know they need to maintain their corporation or LLC ...

August 20, 2018

Workers Need to Double Check Payroll Withholding

Generally, employees can satisfy their annual tax obligations by having enough tax withheld from their paychecks during the course of the year. However, if you fail to pay enough tax, including both withholding and any quarterly installments, the IRS ...

August 20, 2018

3 Ways to Stop Competing on Pay for Top Talent

One of the top challenges business executives face today is finding and retaining the best and brightest employees in their industry.

August 20, 2018

August 2018 Accounting & Audit Channel

Four Ways to Evolve Your Auditing Firm Today By Matt Towers, Product Manager, Thomson Reuters Tax & Accounting By now, most of us have been exposed to some sort of doom and gloom message about automated systems and ‘robots’ taking over the future of the tax and accounting profession. Google “jobs most likely to be...…

August 20, 2018

August 2018 Tax & Compliance Channel

Bill Would Allow IRS to License and Regulate Tax Preparers By Isaac M. O’Bannon, Managing Editor Senator Rob Portman (R-Ohio) has introduced a new bill in the Senate that would give the Internal Revenue Service the authority to regulate income tax return preparers. The bill is cosponsored by Senator Ben Cardin (D-Missouri). The IRS attempted...…

August 20, 2018

Apps We Love: Food Delivery Apps

In case you haven’t noticed, getting fed by phone is very commonplace these days. Whether you’re calling in for lunch at the office, getting home at the end of the day and feeling too exhausted to cook, requesting food for a party, making sure your ...

August 17, 2018

August 2018 Payroll Channel

Big Changes for the New W-4 Form By James Paille, Thomson Reuters The pre-draft 2019 W-4 has been released, and it’s a major change from previous versions of the W-4. The new W-4 doesn’t have a way to number allowances — instead, four new boxes that instruct the taxpayer to predict income and deductions replace...…

Firm Management August 17, 2018

How to Smoke the Competition When Marketing to Cannabis Clients

As with any new industry upstart, accountants have an opportunity to increase revenue within this niche by providing tax, accounting, audit, and business services, like bookkeeping, internal controls, workflow, payroll, and cloud-based solutions.

August 16, 2018

August 2018 Small Business Channel

Entrepreneurs Optimistic About Business Outlook By Isaac M. O’Bannon, Managing Editor Business owners have a generally positive business outlook, feel good about their ability to find new customers, and are relatively optimistic about the state of the U.S. economy. That’s according to data from the first Paychex Business Sentiment Report, which polled 500 randomly...…

August 15, 2018

The Entrepreneurial CPA Millennial

It is time for you and your firm to start understanding the millennial mindset, address these issues, and engage top talent of your choice. In order to do so, step one, is to understand the mindset of these millennials, which is different than your own.

August 14, 2018

How to Brand Your Firm With Personality

These days, clients will turn off the second they feel you’re trying to sell them something and you are not being authentic. The growth of native advertising and influencer marketing attest to the fact that people don’t respond favorably to a more ...

Firm Management August 9, 2018

How to Speak to Your Accounting Firm Clients About Cannabis

How do you explain your cannabis clients to your non-cannabis clients? Good question, but we should start with two assumptions that need to be made. One, you are working with State licensed companies. Two, your client’s starting point of view on ...

August 6, 2018

How Accountants Can Get Started Serving Cannabis Clients

Cannabis is a very close knit community where everyone seems to know everyone. Breaking into the industry is not as easy as you may think. First of all you have to have some sort of angle. For instance, mine is that I have found a way around IRC §280e ...

July 27, 2018

A Tax Accountant’s Analysis of the Cannabis Industry

In 28 States and the District of Columbia, cannabis is legal in one way or another. The problem is when you are dealing with the Federal Government. Cannabis is an illegal Schedule I Narcotic. That being said, when it comes to cannabis, legal ...

July 3, 2018

3 Signs You Should Stay at Your Job – And 3 Signs You Should Go

Growing up I was taught by my parents to get a job and keep a job. Period. It was ingrained in me that once I graduated college, I needed to land at a good company and stay there. The big reward would be retirement at 40 years with a fancy company pen ...