In this issue

August 25, 2020

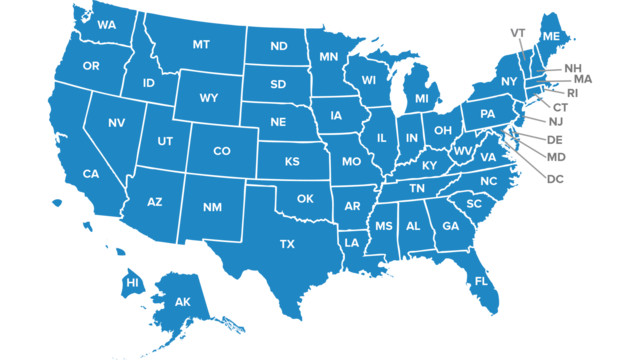

As States Look to Bounce Back, Tax Leaders Need to Engage with Lawmakers

Transaction tax changes are on pace to reach the second highest total in the past 11 years. 150 city sales tax rate adjustments have occurred to date this year—with all but 10 being rate hikes—and those numbers aren’t likely to slow down.

August 17, 2020

2020 Review of Tax Prep Document Automation Systems

The tax document automation products reviewed in this issue vary, with some better suited to larger firms, while others work better for smaller firms processing fewer returns.

August 14, 2020

TCJA / Transition Tax Audit Campaigns and the Amplification of State Income Tax Complexity

Taxpayers with Transition Tax or TCJA audit adjustments should know that the completion of the federal audit could trigger reporting requirements and additional examination at the state level. The multi-state reporting of the resulting ...

![bigstock_Word_Cloud_Asset_Management_53085661_1_.590a554202838[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/2020/08/bigstock_Word_Cloud_Asset_Management_53085661_1_.590a554202838_1_.5f21b080dea7f.png)

August 14, 2020

2020 Review of Fixed Asset Management Systems

If you or your clients have fixed assets, they’ll need to properly managed. Since fixed assets are anything of value that is estimated to last for more than one year, they can include items such as laptop computers, printers, machinery, heavy equipment, tools, vehicles, and even real estate. You may have a single fixed asset...…

![11811656013738103981_11118416[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/2020/08/11811656013738103981_11118416_1_.5f248454ba2d5.png)

August 14, 2020

A Primer on IRS Continuous Wage Garnishments

Having a wage garnishment order issued is frightening. Trying to navigate through the process alone can be intimidating to the point where the taxpayer just gives up and accepts their fate.

August 7, 2020

NASBA: Is It Time for a COVID-19 CPE Break?

If you've attended an accounting conference in person, you know that there is much more to a conference than sitting in a seat, listening to speakers, and logging your CPE hours. Accounting conference events are about networking, meeting peers, sharing...

August 13, 2020

How to Conduct a Business Insight Review

When businesses are connected to a tax and accounting professional, they are more financially stable, more creditworthy, and twice as likely to succeed than businesses that attempt to navigate the waters on their own.

August 12, 2020

Apps We Love August 2020: At-Home Education Apps

Schools across the country are requiring students to learn from home. And while the schools are providing educational material to correlate with material that would have been taught in classrooms, there is a disparity in the teaching methods and the ...

August 12, 2020

Health-Related Benefits Under the CARES Act

For services provided on or after Jan. 1, 2020, and for plan years beginning on or before Dec. 31, 2021, high-deductible healthcare plans (HDHPs) with HSAs provide coverage for telehealth or other remote care services without a deductible or having to ...

August 9, 2020

Do You Have a Clear Vision for Tax Document Automation?

From the August 2020 Issue. In the June 2020 issue, my column Do You Have a Clear Tax Vision? addressed tax software innovations in around a dozen categories. Many of you have just finished the unusual tax season of 2020 with the COVID-19 pandemic extended personal tax deadline of July 15 just behind us. You...…

August 6, 2020

AICPA News: August 2020

AICPA News is a roundup of recent announcements from the AICPA.

August 5, 2020 Sponsored

Streamlined Invoicing and Tasks Among New Features in QuickBooks Online Advanced

Workflow automation allows mid-market businesses, which Intuit defines as businesses that have 10 to 99 employees and $500,000 to $20M in annual revenue, to streamline time-consuming, repetitive tasks, while maintaining accuracy and increasing ...

August 4, 2020

Creating a Data Culture

CPA firms possess an incredible amount of data, and the tools allowing them to use that data are increasingly available. However, firms need a plan for using those tools to provide value to clients and create value for themselves.

August 3, 2020

2020 Innovation Award Winners Announced

Now in their 17th year, the CPA Practice Advisor Tax and Accounting Technology Innovation Awards highlight technologies that are shaping the profession and small businesses through increased collaboration and productivity.

July 31, 2020

Communication Methods in Our New Work Environment

The whirlwind that is 2020 has changed the nature of accountancy in ways that nobody could’ve predicted a few short months ago. From a delayed tax deadline to a back-and-forth dance of opening and closing businesses, it’s still ...

July 30, 2020

Age and Other Post-Pandemic Discrimination Claims

Anticipating the potential for claims of discrimination to arise, and being fully prepared to provide the objective bases for a failure to recall an employee, or for termination is perhaps the most effective means of defending against any such claims.

![NewGroupPhoto_1_.5efb8ca75da28[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/2020/07/NewGroupPhoto_1_.5efb8ca75da28_1_.5f0ca6bbc0c24.png)

July 28, 2020

Who Really Won in the Supreme Court Rulings on Trump’s Tax Returns?

The Court said in both cases that Trump isn’t granted immunity from such investigations just because he occupies the office of POTUS. Thus, at first glance, the president “lost” this legal battle, but the actual truth is more complex. The main sticking po

July 28, 2020

Report Shows Trends for Accounting Advisory Services

The survey data indicates that being able to offer expert insights when it comes to finances will give firms the upper hand when it comes to implementing value pricing as it enables them to provide a better customer experience.

July 27, 2020

CARES Act Causing Business Valuation Concerns for Divorces, Estate Plans and Partnerships

Business valuations are forward-looking and there are multiple approaches to them. An income approach to valuation applies an opportunity cost of capital to an expected future benefit stream, such as cash flows or net income ...