In this issue

February 18, 2017

Will the Big Four Change Hiring Practices in the Coming Years?

The Big Four firms are not quite at the stage of having computers replace people. The challenge they have now is hiring a balance of people who can do the interpreting and people who will make sure the computers are set up to interrogate properly.

February 17, 2017

Marketing and Social Media Tips for CPAs With eCommerce Clients

Does your firm have a lot of clients who specialize in ecommerce? If so, this article is for you.

February 17, 2017

Apps We Love – Anti-Anxiety/Stress Management

Well it’s that time of year again. I remember my first busy season at Deloitte and how shocked I was to go outside after work on April 15 and see daylight – after so many long days, I had forgotten what that felt like! You get used to it, but if the ...

February 17, 2017

The Road From Lacerte® to CCH Axcess™: “Cloud is a Magic Word”

Frank Stitely takes his tax practice seriously. As one of two partners at Stitely & Karstetter, a CPA firm based in Chantilly, Virginia outside of Washington DC, he has his eye on the future as he looks for ways to attract younger clients and utilize the

February 17, 2017

Quick Tips for Surviving Cash Shortfalls

Got Cash? Here are a few quick strategies to jump start cash flow when the going gets tough.

February 17, 2017

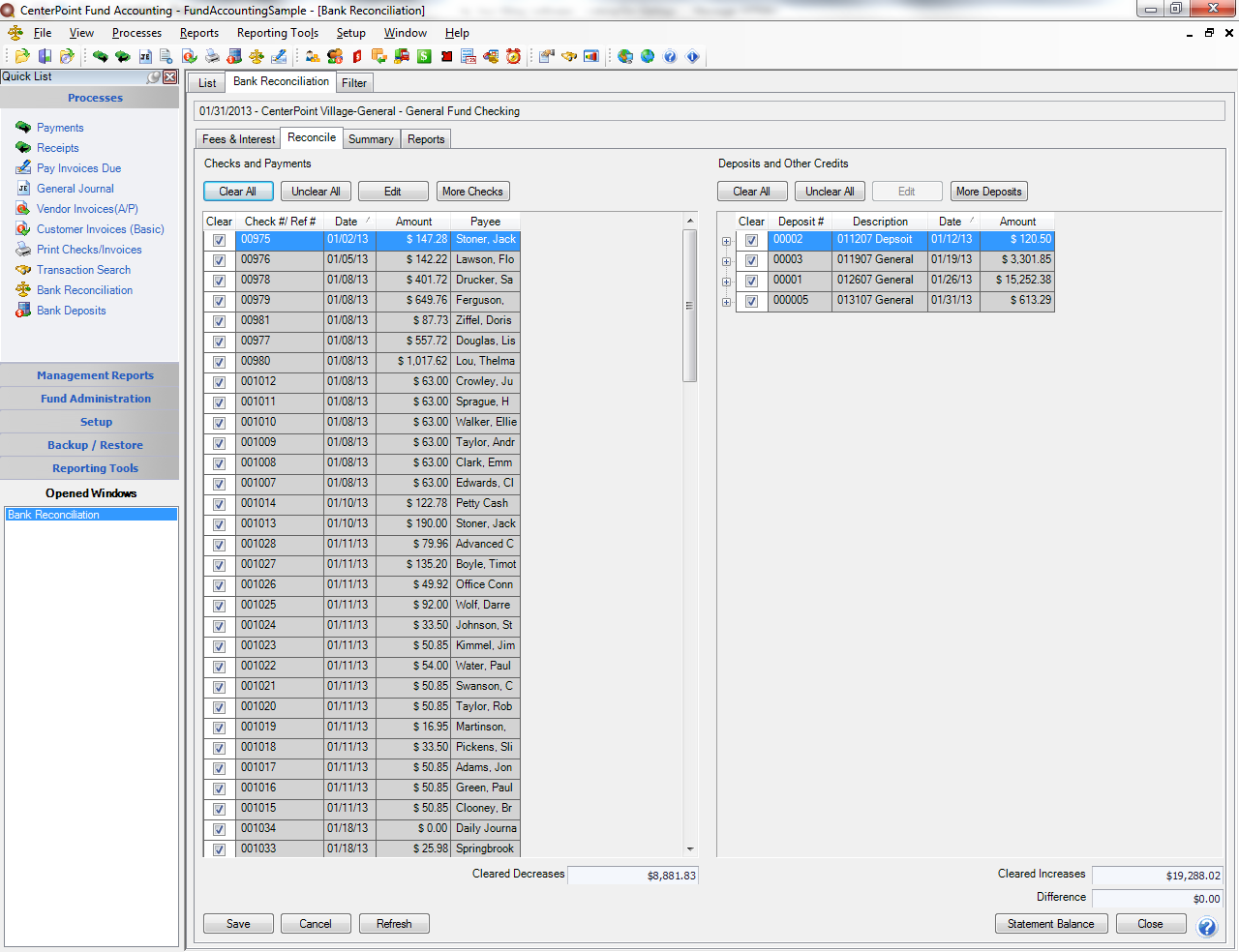

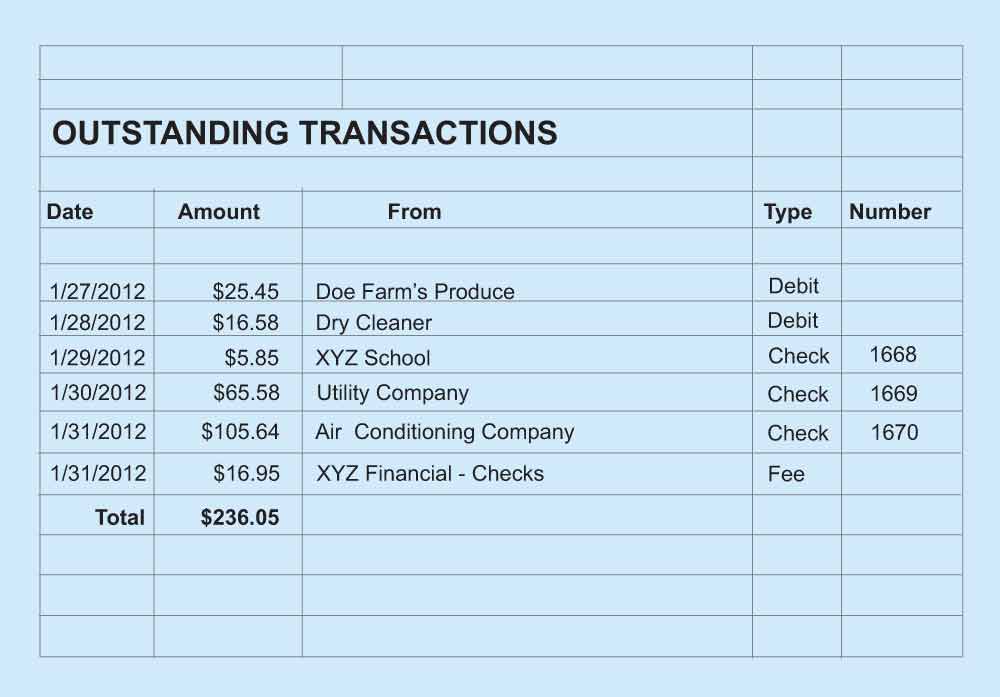

Bank Reconciliations At a Glance and Tips for Success

One of the biggest challenges of reconciling a bank account, particularly one with lots of transactions, is combating the “blur.” As you compare the many numbers and columns on your statement to the reconciliation window, it won’t take much for your ...

February 17, 2017

Cash Management: Internal Controls Checklist

Per the U.S. Chamber of Commerce, about 75% of employees are stealing from their employer. Research has shown that the most common item stolen was cash, with the average amount stolen amounting to $20,000. Here is a checklist of internal controls your ...

February 17, 2017

2017 Reviews of Cash Management Systems

The accounting professional often views cash management as another piece of the accounting puzzle that can often be handled more effectively by these same professionals. This has never been truer, as more accountants begin to offer cash management ...

February 17, 2017

How Sales Tax Impacts Cash Management

Even profitable companies can have problems with cash flow. Although some stem from external sources and are beyond control, many can be addressed by making adjustments to internal processes. The way companies handle sales tax can impact cash ...

February 17, 2017

Best Practices for Managing Cash

The word cash is starting to get a funny ring to it, isn’t it? Like “davenport”, “slicker” or “billfold”. Coin and paper currency are fading into the background of modern finance and appear only most frequently in movies about heists or shady ...

February 17, 2017

5 Steps & 5 Online Resources to Produce Accurate Cash Flow Projections

We’ve all heard the statement, “Cash is King.” Unfortunately, many business owners focus exclusively on Profit and Loss, often to their detriment. Income is not cash, and the money in your bank account pays your employees, purchases your inventory ...

February 17, 2017

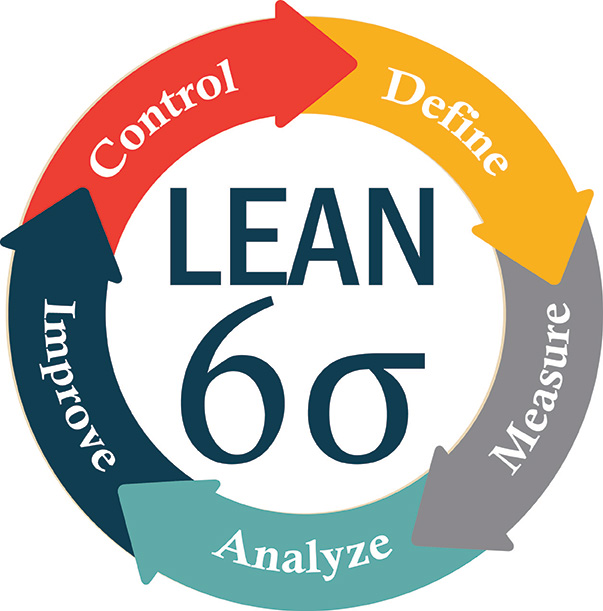

Why Lean?

You never know where inspiration will strike. I was on an early morning drive to the airport several years ago, driving a cold and dark state route as I made my way to the freeway. In my little part of the world, we tend to listen to more country ...

February 17, 2017

Increase Accountability in 2017

One reason our goals fall by the wayside is that we often just think about them. We internalize what we want to accomplish but don’t write it down or share it with anyone. This keeps things simple, but it also increases the chance of failure.

February 17, 2017

Get Ready for New Changes to Sales and Use Taxes in 2017

In 2017, when it comes to sales tax, states are taking stances on everything from soda to streaming content, tobacco to tampons. The New Year will also bring renewed efforts by states to implement internet sales taxes and continue the legal battle to ...

February 17, 2017

Cash is King: Tools to Improve Cashflow

The fundamentals are the same as they have always been: ample margin, adequate top line sales, minimize expenses, collect cash quickly, and if you choose, make the best of OPM (other people’s money) by creative bill payment, financing and special ...

February 17, 2017

17 Professional Development Ideas for 2017

It’s no secret that a robust professional development program is beneficial for accounting professionals, but managers also reap rewards when they invest in employees. Your workers become more knowledgeable, which means they’re able to contribute ...

February 17, 2017

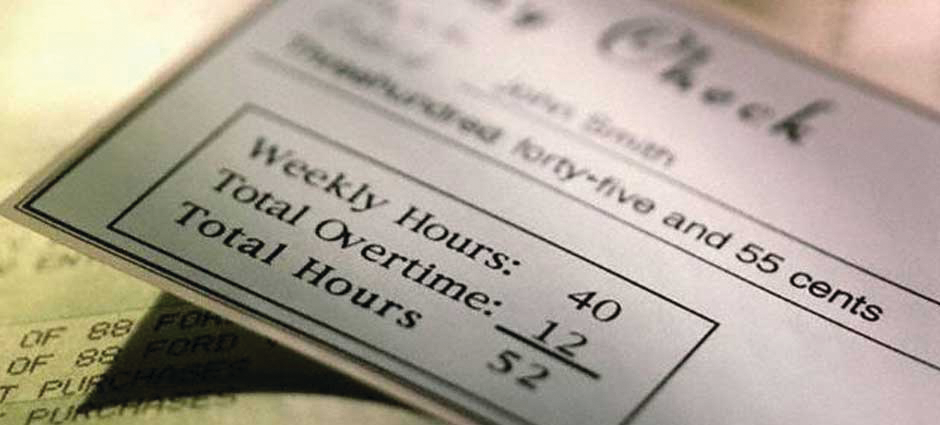

4 Tips on the Hold of the Final Overtime Pay Rules

As a trusted advisor to your clients, you’ve probably gotten your share of questions about the new Fair Labor Standards Act (FLSA) overtime regulations or “Final Rule” and the latest court ruling blocking the Final Rule from taking effect.

February 17, 2017

A New Year, New Payroll

Right now, accountants are meeting with clients to prepare taxes. This is a great time for accountants and payroll professionals to assess 2016 and make plans to ensure compliance moving into 2017. With the impending changes and uncertainty ...

February 17, 2017

February 2017: What Are Your Clients Asking This Month?

When you can anticipate the questions your clients will ask, it’s likely your meetings will go smoothly. We asked Linda Freeman, tax partner at MarksNelson, about the types of questions clients are asking as they meet with their accountants to review ...

February 17, 2017

February 2017 Audit Channel: At My Office

How do you start your day? I start my day off with some exercise, often some running, have my breakfast - a bowl of oatmeal or cereal - and then head into office. I arrive at the office between 6:30 and 7:00 a.m.

February 17, 2017

Latest Tax & Compliance News – February 2017

The Top Five Business Tax Issues of 2017: “The tax action list for business leaders in 2017 is relatively short, but it is critical for organizational success,” says Jeffrey C. LeSage, Vice Chairman-Tax at KPMG LLP. Here are LeSage’s five action items for business leaders in 2017. http://cpapracticeadvisor.com/news/12298743 Report Looks at eCommerce Corporate Income Tax Issues:...…

February 17, 2017

Latest Small Business News – February 2017

Small Business Owners Expect Growth in 2017: A large percentage of American small business owners are optimistic for growth in 2017 with some important investments in their businesses, including hiring, according to a recent survey of more than 1,200 small business owners. Interestingly, the optimism among small business owners significantly outpaces that of the general public....…

February 17, 2017

Latest Payroll News – February 2017

Payroll in 2017: What to Expect: As we prepare for a new administration, let’s take a look at what we know, what will change and what 2017 may bring. www.cpapracticeadvisor.com/12295253 5 Manager Mistakes that Can Cause Labor Lawsuits: Employee lawsuits are exploding nationwide in the past few years, and manager mistakes are the cause of...…

February 17, 2017

Latest Firm Management News – February 2017

Firm Management Channel How Small Accounting Firms Find Big Advantages in the Cloud: It’s a trend to watch for in 2017, as cloud services enable CPAs to be strategic partners that can offer more in-depth and timely financial advice to help their small and medium size business (SMB) clients succeed. www.cpapracticeadvisor.com/12294496 3 Steps to Ensure...…

February 17, 2017

Latest A&A News – February 2017

FASB to Host Roundtable Meetings on Disclosure Framework: The Financial Accounting Standards Board (FASB) will host two public roundtable meetings to discuss proposals related to its Disclosure Framework project. The meetings will be held on Friday, March 17, 2017, at the FASB offices located at 401 Merritt 7 in Norwalk, Connecticut. www.cpapracticeadvisor.com/12295256 AICPA Issues New Revenue Recognition...…

February 15, 2017

How to Create an Environment for Diverse Leadership to Thrive

Women in accounting have come a long way. Christine Ross, the first female CPA in the U.S., received her certification in 1899 --- but only after an 18-month delay by state regents because of her gender. While today we’re sitting at around ...

February 14, 2017

Petty Cash Tips & Tricks

The best way to determine the proper amount of petty cash is to look historically at what your business spends cash on and how often you have "emergency" needs. Most small businesses do well with around two hundred dollars as a good ...

February 14, 2017

Bank Reconciliation Made Fun With Xero

The foundation of the financial web, a network of organizations sharing financial data, is bank statement feeds. Small business owners, working in the cloud, now expect their bank transactions to arrive automatically loaded in their accounting ...